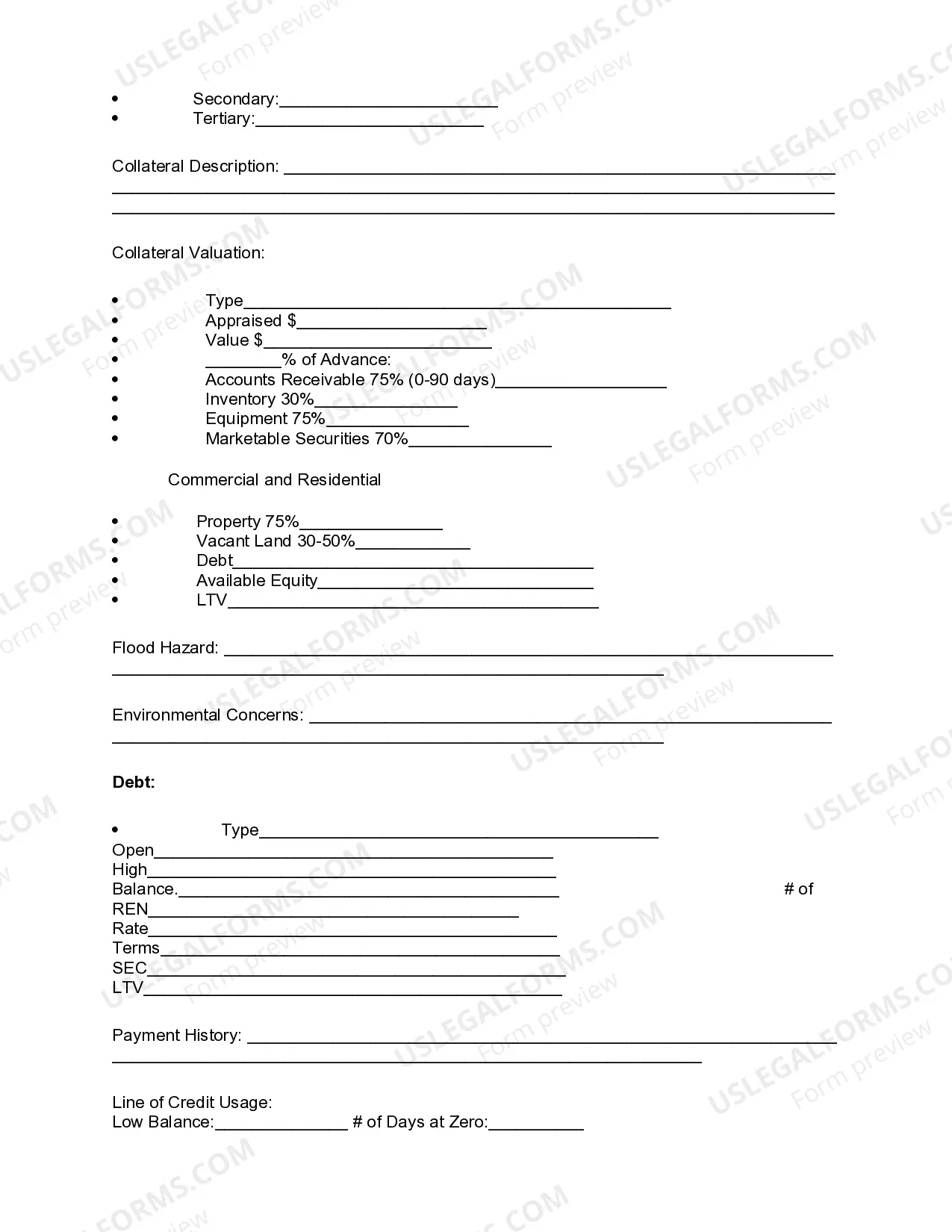

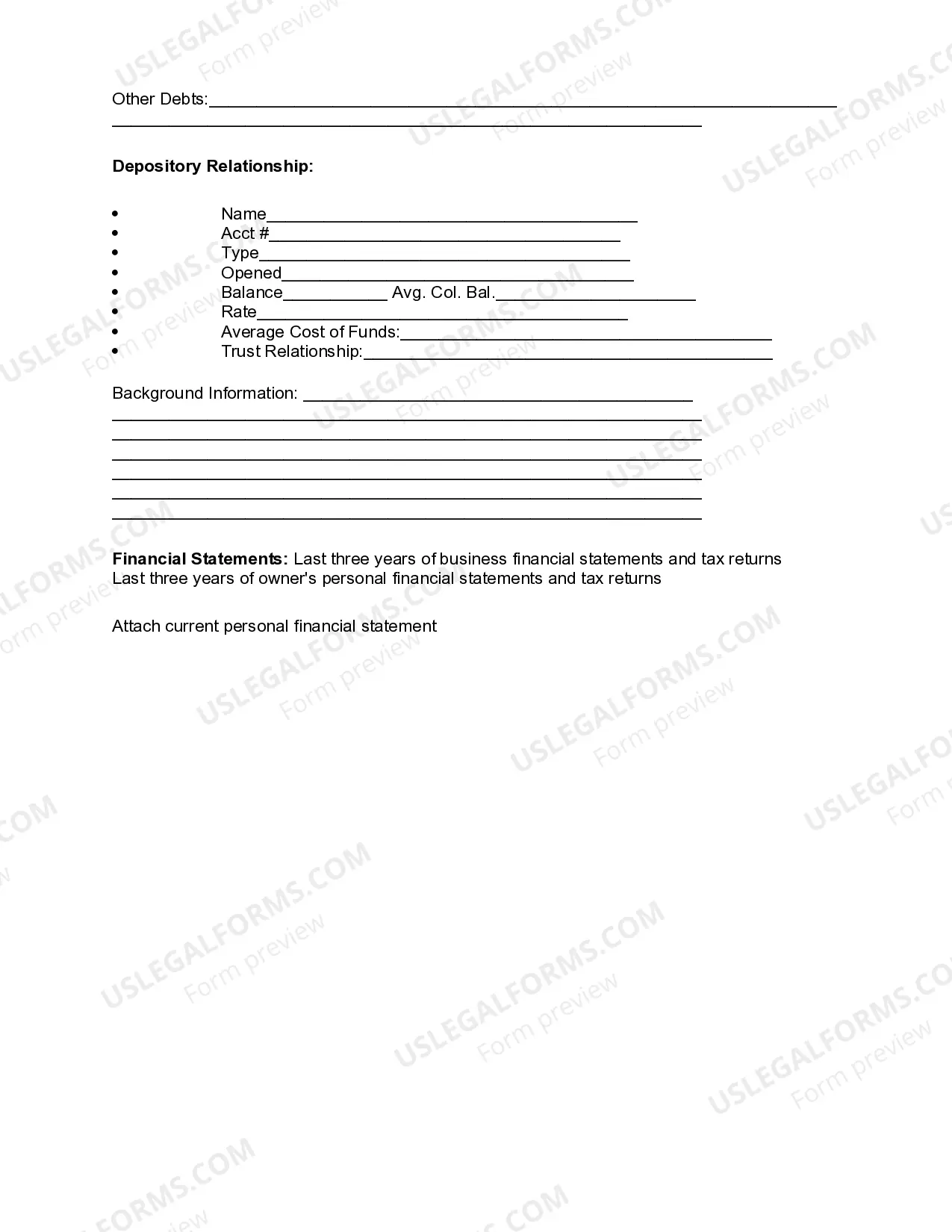

Title: Understanding Hillsborough Florida Review of Loan Application: A Comprehensive Guide Introduction: The process of loan application in Hillsborough, Florida can be complex and daunting. This article will serve as a detailed overview of Hillsborough Florida Review of Loan Application, helping you navigate through its various aspects. We will discuss the importance of this review, its specific requirements, and highlight different types of loans reviewed in Hillsborough, Florida. Keywords: Hillsborough Florida, Review of Loan Application, loan application process, loan types, loan requirements, loan eligibility 1. Importance of Hillsborough Florida Review of Loan Application: When applying for a loan in Hillsborough, Florida, the review process plays a crucial role in determining the outcome of your application. A thorough review ensures compliance with local regulations, determines loan eligibility, and assesses the borrower's financial position. Keywords: loan review process, loan application outcome, compliance, loan eligibility, borrower's financial assessment 2. Requirements for Hillsborough Florida Review of Loan Application: To initiate the review process, certain requirements need to be fulfilled by the borrower. These requirements may include documentation, credit score, income verification, property appraisal, and more. Meeting these criteria will significantly impact the loan application's success rate. Keywords: loan application requirements, documentation, credit score, income verification, property appraisal, loan success rate 3. Different Types of Hillsborough Florida Loan Applications: a. Mortgage Loan Application: Hillsborough, Florida review of mortgage loan applications is a common type. This process analyzes various factors such as credit history, income, debt-to-income ratio, property appraisal, and compliance with mortgage regulations. Keywords: mortgage loan application, credit history, income, debt-to-income ratio, property appraisal, mortgage regulations b. Personal Loan Application: Reviewing personal loan applications involves assessing the borrower's credit score, income sources, employment history, and overall financial stability to ensure repayment capacity. Keywords: personal loan application, credit score, income sources, employment history, financial stability, repayment capacity c. Business Loan Application: For businesses in Hillsborough, Florida, the review process for loan applications evaluates the company's financial statements, business plans, credit history, collateral, and industry analysis to determine the feasibility of the loan. Keywords: business loan application, financial statements, business plans, credit history, collateral, industry analysis, loan feasibility Conclusion: Navigating the Hillsborough Florida Review of Loan Application requires a comprehensive understanding of its requirements, processes, and specific loan types. By fulfilling the necessary criteria and providing accurate documentation, borrowers can increase their chances of a successful loan application in Hillsborough, Florida. Keywords: loan application process, loan types, loan requirements, loan eligibility, Hillsborough Florida loan application

Hillsborough Florida Review of Loan Application

Description

How to fill out Hillsborough Florida Review Of Loan Application?

If you need to find a trustworthy legal document provider to get the Hillsborough Review of Loan Application, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support make it easy to find and execute various documents.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to look for or browse Hillsborough Review of Loan Application, either by a keyword or by the state/county the form is intended for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Hillsborough Review of Loan Application template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less pricey and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate agreement, or execute the Hillsborough Review of Loan Application - all from the comfort of your sofa.

Join US Legal Forms now!