Allegheny Pennsylvania Business Deductions Checklist serves as a comprehensive guide for business owners and entrepreneurs operating within Allegheny County. This checklist outlines the essential deductions that businesses can claim to minimize their tax liability and maximize their overall profitability. By utilizing this checklist, businesses can ensure that they are taking advantage of all available deductions and credits. Here are some of the key types of Allegheny Pennsylvania Business Deductions Checklists: 1. General Business Expenses: This checklist covers the everyday operational expenses that businesses typically incur, including rent, utilities, office supplies, insurance premiums, employee wages, advertising costs, and professional service fees. 2. Depreciation and Amortization: This checklist assists businesses in claiming deductions for the depreciation of assets, such as equipment, vehicles, and office furnishings, over their useful lifespan. It also includes deductions related to amortization of intangible assets, such as patents and copyrights. 3. Home Office Deductions: For businesses operating from a home-based office, this checklist outlines deductions that can be claimed for a portion of rent or mortgage interest, utilities, home insurance, and property taxes. It also covers expenses related to the maintenance and repair of the home office area. 4. Travel and Entertainment Expenses: This checklist encompasses deductions related to business travel, including airfare, accommodation, meals, and transportation expenses. It also covers entertainment expenses directly related to conducting business, such as client meals or event tickets. 5. Employee Benefit Deductions: This checklist assists businesses in claiming deductions for employee benefits such as health insurance premiums, retirement plan contributions, and other fringe benefits offered to employees. 6. Charitable Contributions: For businesses involved in philanthropic activities, this checklist itemizes deductions for charitable contributions made to eligible organizations within Allegheny County. 7. Research and Development Deductions: This checklist is designed for businesses engaged in research and development activities, outlining potential tax deductions for expenses related to scientific research, experimental activities, and technological advancements. 8. Section 179 Expenses: This checklist covers deductions related to the immediate expensing of certain business assets, allowing businesses to deduct the entire cost of qualified equipment or property in the year it was purchased. It is worth noting that these checklists are not exhaustive and may vary based on individual business circumstances. Consulting with a qualified tax professional or accessing official resources provided by Allegheny Pennsylvania's taxing authorities is highly recommended ensuring accurate and up-to-date deductions are claimed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Lista de verificación de deducciones comerciales - Business Deductions Checklist

Description

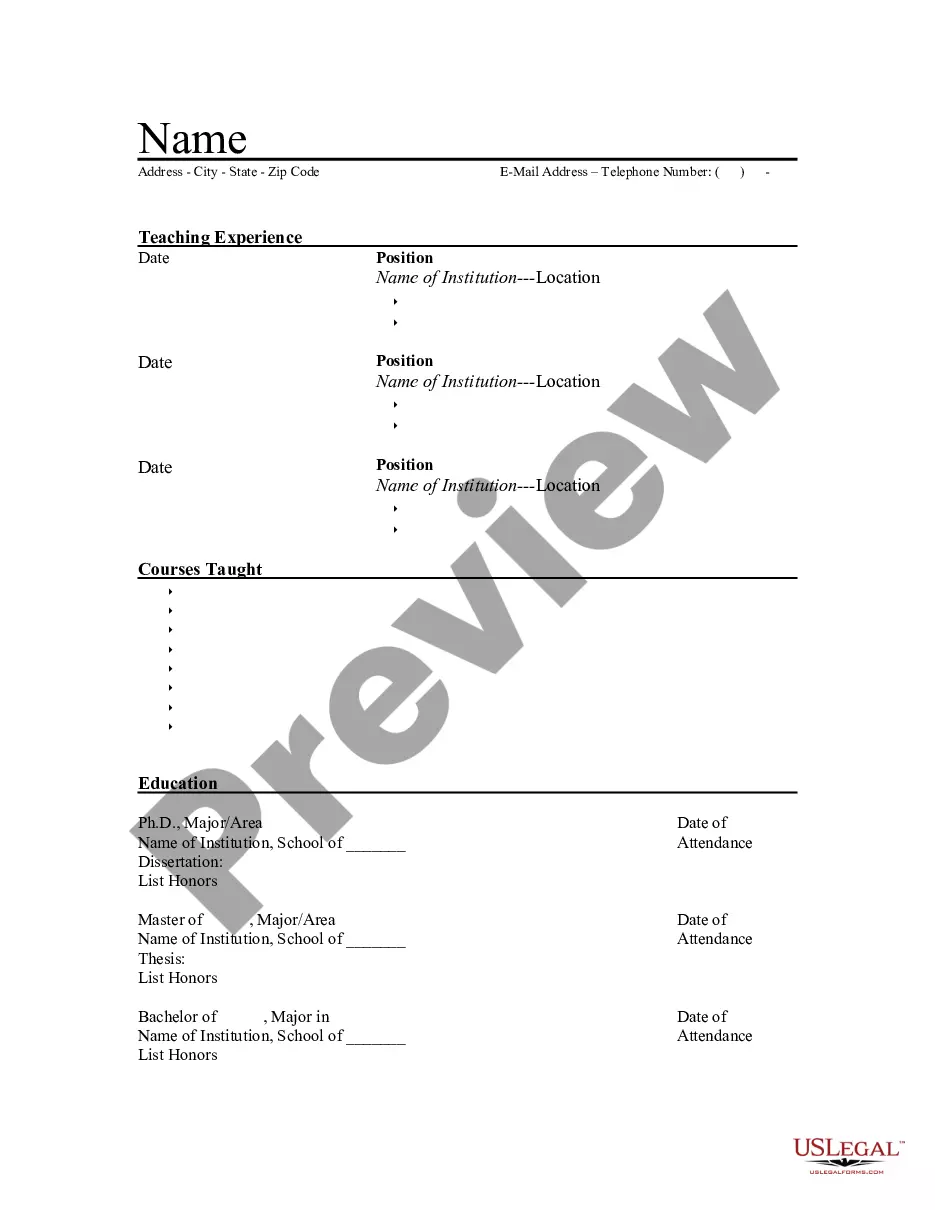

How to fill out Allegheny Pennsylvania Lista De Verificación De Deducciones Comerciales?

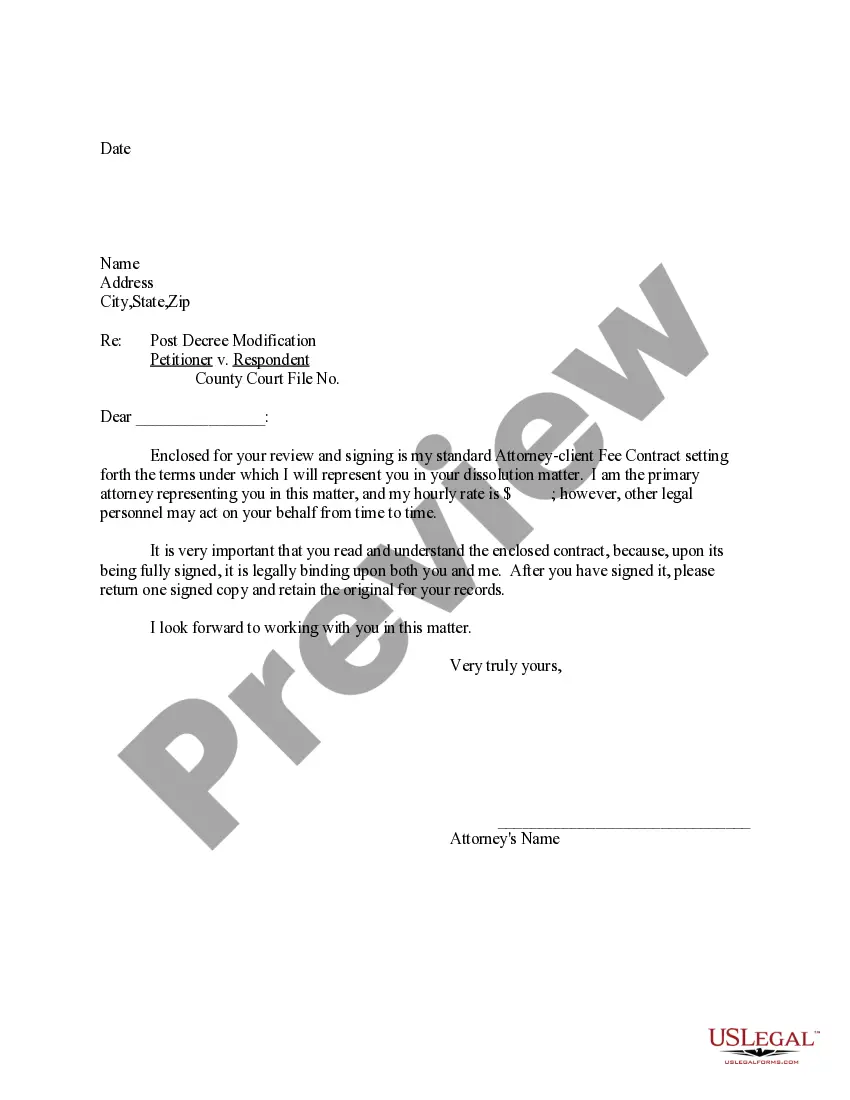

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business objective utilized in your county, including the Allegheny Business Deductions Checklist.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Allegheny Business Deductions Checklist will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Allegheny Business Deductions Checklist:

- Ensure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Allegheny Business Deductions Checklist on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!