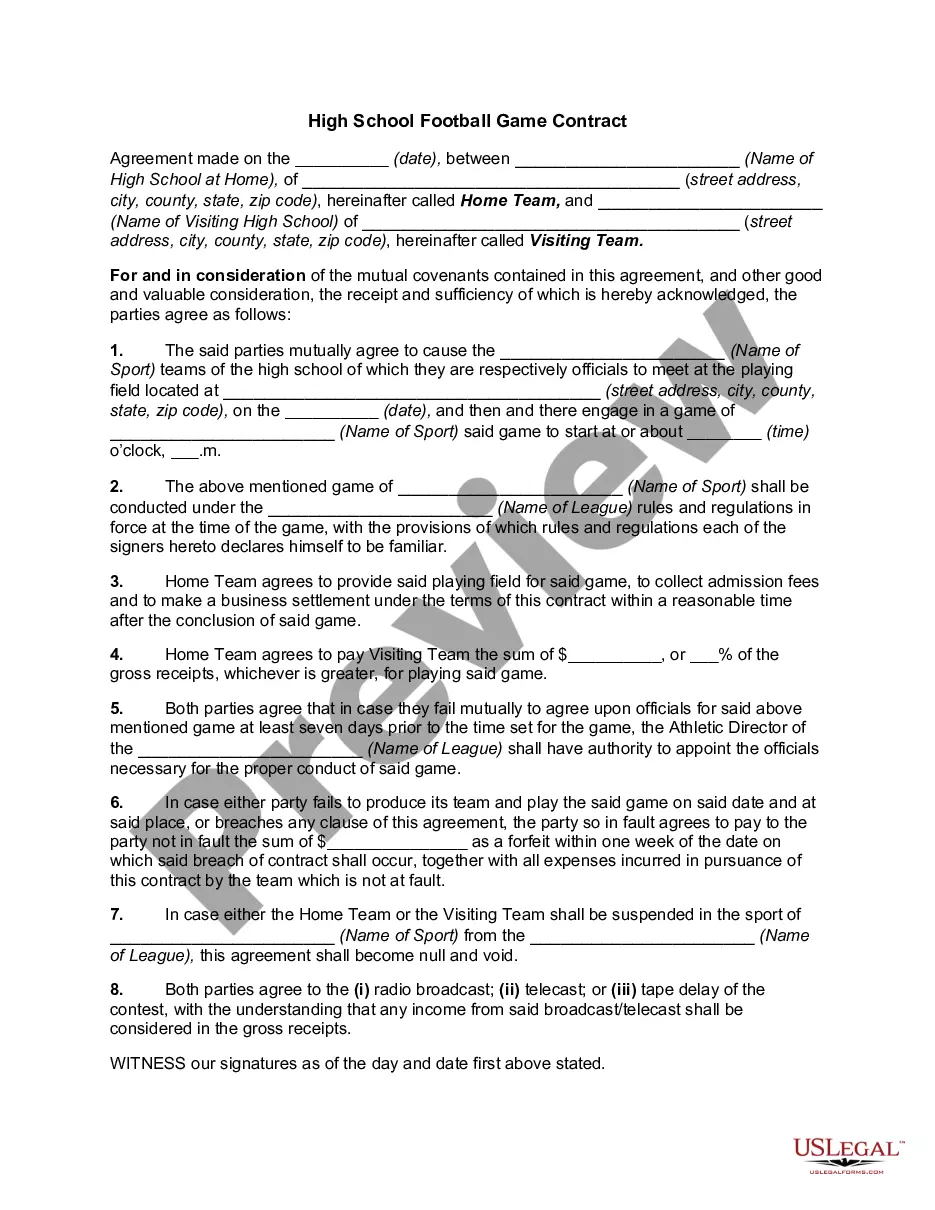

Hillsborough Florida Business Deductions Checklist is a comprehensive tool designed to help businesses in Hillsborough County maximize their tax savings by identifying eligible deductions. This checklist is specifically tailored to meet the requirements of businesses operating in Hillsborough County, Florida. By utilizing this resource, businesses can ensure that they take advantage of all available deductions and credits, ultimately reducing their tax liability and increasing their bottom line. The Hillsborough Florida Business Deductions Checklist covers various categories and types of deductions that are unique to businesses in the area. Some key areas covered in this checklist include: 1. Operating Expenses: This section lists common business operating expenses that may be eligible for deductions, such as rent, utilities, insurance premiums, office supplies, advertising costs, and professional fees. 2. Employee-related Expenses: Businesses can offset their tax liability by deducting expenses related to employees, including wages, bonuses, benefits, training costs, payroll taxes, and contributions to retirement plans. 3. Business Travel: Deductions related to business travel, including transportation expenses, lodging, meals, and entertainment costs while on business trips, are included in this section. 4. Depreciation and Capital Expenses: Businesses can claim a deduction for the depreciation of certain assets used in their operations, such as machinery, equipment, vehicles, and buildings. This section helps businesses identify eligible assets and calculate their depreciation deductions. 5. Home Office Expenses: For businesses with a home office, this section outlines the criteria for qualifying for a home office deduction. It covers eligible expenses, including a portion of mortgage or rent, utilities, insurance, and repairs. 6. Professional Services: Businesses that hire accountants, attorneys, consultants, or other professionals can deduct their fees as business expenses. This section guides businesses in identifying and claiming these deductions. 7. Tax Credits: The checklist also highlights various tax credits available to businesses in Hillsborough County. These credits may include research and development credits, energy-saving incentives, and job creation incentives. It is worth noting that there might be different versions or variations of the Hillsborough Florida Business Deductions Checklist that cater to specific types of businesses or industries within the county. For example, there could be separate checklists for retail businesses, construction companies, technology startups, healthcare providers, or restaurants. These specialized checklists would address industry-specific deductions and requirements to ensure businesses do not miss out on deductions relevant to their field. Overall, the Hillsborough Florida Business Deductions Checklist is an invaluable resource for businesses in Hillsborough County, Florida, providing a detailed breakdown of deductions, credits, and expenses that can significantly impact their tax liabilities. By utilizing this checklist, businesses can effectively navigate the tax landscape and maximize their savings, enabling them to reinvest in their growth and success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Lista de verificación de deducciones comerciales - Business Deductions Checklist

Description

How to fill out Hillsborough Florida Lista De Verificación De Deducciones Comerciales?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business objective utilized in your region, including the Hillsborough Business Deductions Checklist.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Hillsborough Business Deductions Checklist will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Hillsborough Business Deductions Checklist:

- Make sure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Hillsborough Business Deductions Checklist on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!