The Montgomery Maryland Business Deductions Checklist is a comprehensive guide that provides businesses in Montgomery County, Maryland, with a detailed breakdown of expenses that can be deducted from their taxable income. This checklist is designed to ensure that businesses take full advantage of all available deductions, minimizing their tax liability and optimizing their financial management. Keywords: Montgomery Maryland, Business Deductions Checklist, deductions, taxable income, expenses, tax liability, financial management. Types of Montgomery Maryland Business Deductions Checklists: 1. General Business Deductions Checklist: This checklist covers common expenses that are applicable to most businesses, such as office supplies, marketing expenses, utilities, rent or lease payments, employee wages, professional fees, insurance premiums, and travel expenses. It provides a comprehensive overview of deductions that businesses can claim. 2. Industry-Specific Deductions Checklist: In addition to the general deductions' checklist, Montgomery Maryland also offers industry-specific checklists tailored to various sectors such as healthcare, retail, manufacturing, or professional services. These checklists focus on deductions that are specific to each industry, ensuring that businesses claim all relevant expenses related to their field. 3. Home-Based Business Deductions Checklist: For businesses operating out of a home office, the home-based business deductions' checklist provides guidance on expenses like mortgage interest or rent, utilities, home maintenance, and insurance that can be deducted. It helps home-based businesses take advantage of certain tax benefits available to them. 4. Startup Business Deductions Checklist: This checklist caters specifically to new businesses in their initial phase. It outlines deductible expenses unique to startups, including costs related to research and development, incorporation fees, legal and accounting services, marketing and advertising, and equipment purchases. The checklist serves as a valuable tool for startups to optimize their deductions from the outset. 5. Self-Employed/Sole Proprietorship Deductions Checklist: This checklist is tailored for self-employed individuals and sole proprietors who report their business income and deductions on their personal tax returns. It highlights deductions applicable to self-employment taxes, health insurance premiums, retirement contributions, vehicle expenses, and home office deductions, among others. By utilizing the appropriate Montgomery Maryland Business Deductions Checklist based on their business type or situation, businesses can ensure that they identify and claim all eligible deductions accurately. This not only helps in reducing tax liability but also maximizes the financial resources available for growth and investment in Montgomery County, Maryland.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Lista de verificación de deducciones comerciales - Business Deductions Checklist

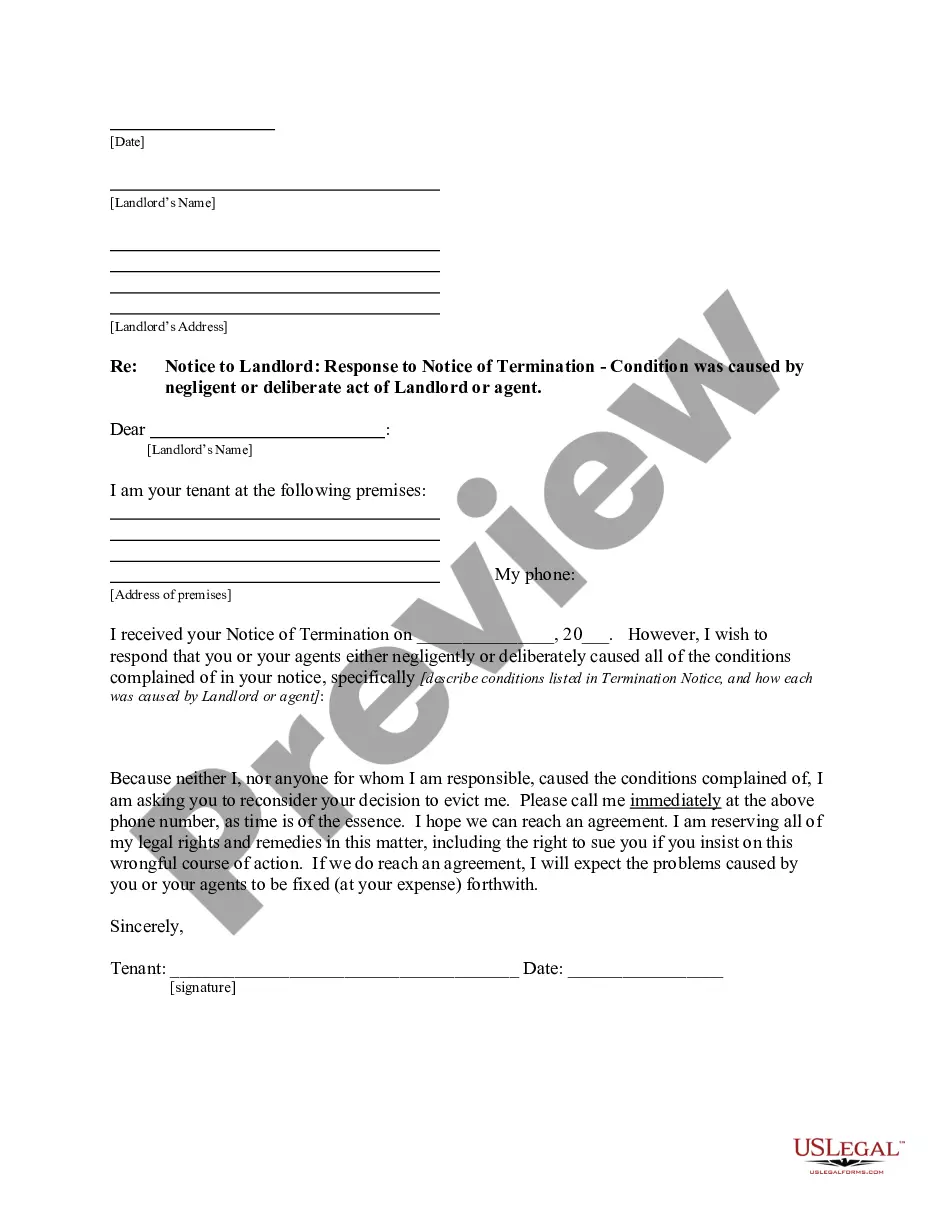

Description

How to fill out Montgomery Maryland Lista De Verificación De Deducciones Comerciales?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business objective utilized in your region, including the Montgomery Business Deductions Checklist.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Montgomery Business Deductions Checklist will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the Montgomery Business Deductions Checklist:

- Ensure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Montgomery Business Deductions Checklist on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!