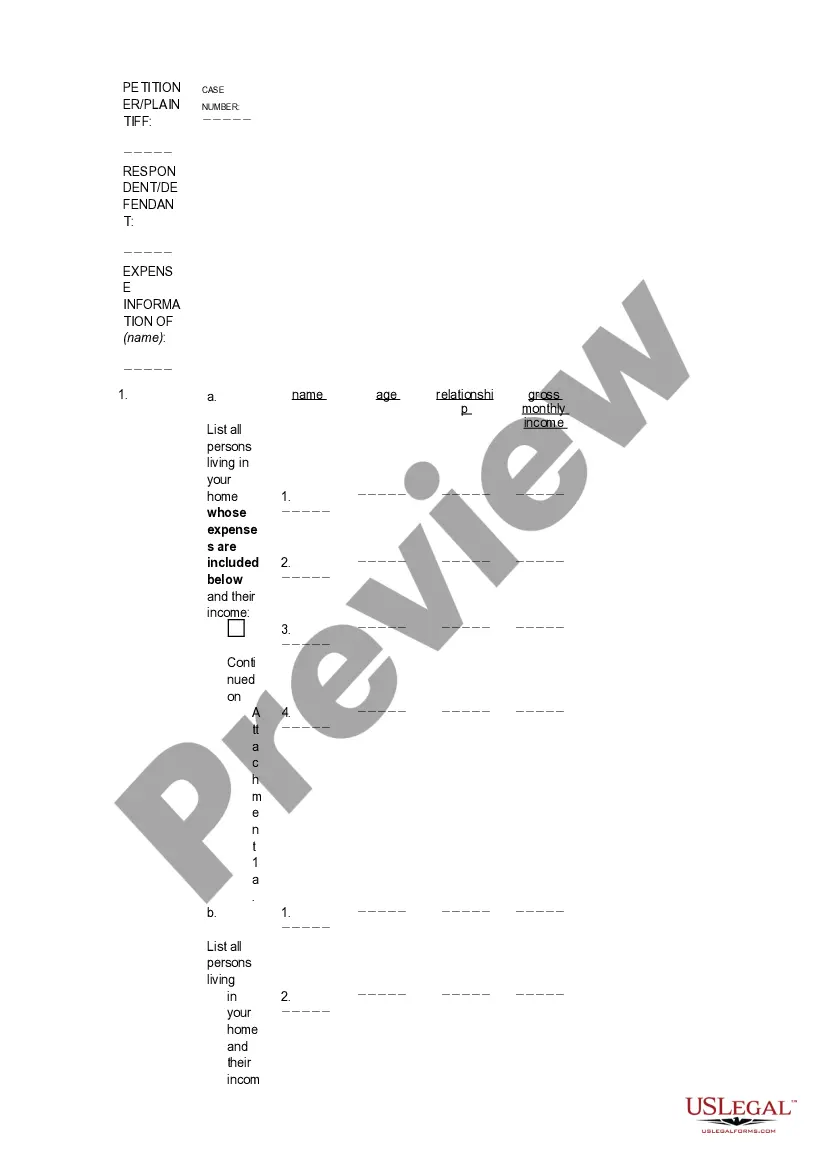

Queens New York Business Deductions Checklist is a comprehensive guide that outlines the various tax deductions available to businesses operating in Queens Borough, New York. This checklist helps businesses keep track of their eligible expenses and ensures that they take advantage of all the deductions they are entitled to, ultimately reducing their tax liabilities. By utilizing this checklist, businesses can maximize their tax savings and improve their overall financial health. Here are some relevant keywords related to the Queens New York Business Deductions Checklist: 1. Queens Borough: Refers to the geographical area of Queens in New York City, specifically targeting businesses operating within this borough. 2. Business Deductions: Pertains to expenses that can be subtracted from a business's taxable income, thus lowering their overall tax obligations. 3. Tax Savings: Indicates the reduction of tax liabilities by leveraging eligible deductions, which can free up additional funds for reinvestment or business growth. 4. Expense Tracking: Involves the process of monitoring and recording the business's expenditures to ensure accurate and organized deductions. 5. Tax Liabilities: Refers to the amount of taxes a business is obligated to pay based on their income, profits, and other applicable factors. 6. Financial Health: Describes the overall financial well-being of a business, indicating stability, profitability, and efficient management of resources. Different types or sections of the Queens New York Business Deductions Checklist may include: 1. General Business Expenses: This section includes deductible expenses that are common to all businesses, such as office rent, utilities, insurance premiums, and marketing expenses. 2. Employee-related Deductions: Focuses on deductions related to employee wages, benefits, and payroll taxes, including salaries, healthcare contributions, retirement plans, and employer-paid taxes. 3. Business Travel and Entertainment: Covers deductions for travel expenses, lodging, meals, and client entertainment incurred while traveling for business purposes. 4. Home Office Deductions: Provides guidelines for eligible deductions related to a home office, including a portion of rent or mortgage interest, utilities, and maintenance costs. 5. Equipment and Asset Depreciation: Involves deductions for the depreciation of business assets such as machinery, vehicles, furniture, and computer equipment. 6. Professional Services: Lists deductible expenses related to professional services like legal and accounting fees, tax preparation services, and consultancy fees. 7. Inventory and Cost of Goods Sold: Offers information on deductions for inventory purchases, cost of goods sold, and methods for valuing inventory. By referencing the Queens New York Business Deductions Checklist and ensuring compliance with tax laws, businesses operating in Queens Borough can effectively manage their finances, reduce tax burdens, and optimize their overall profitability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Lista de verificación de deducciones comerciales - Business Deductions Checklist

Description

How to fill out Queens New York Lista De Verificación De Deducciones Comerciales?

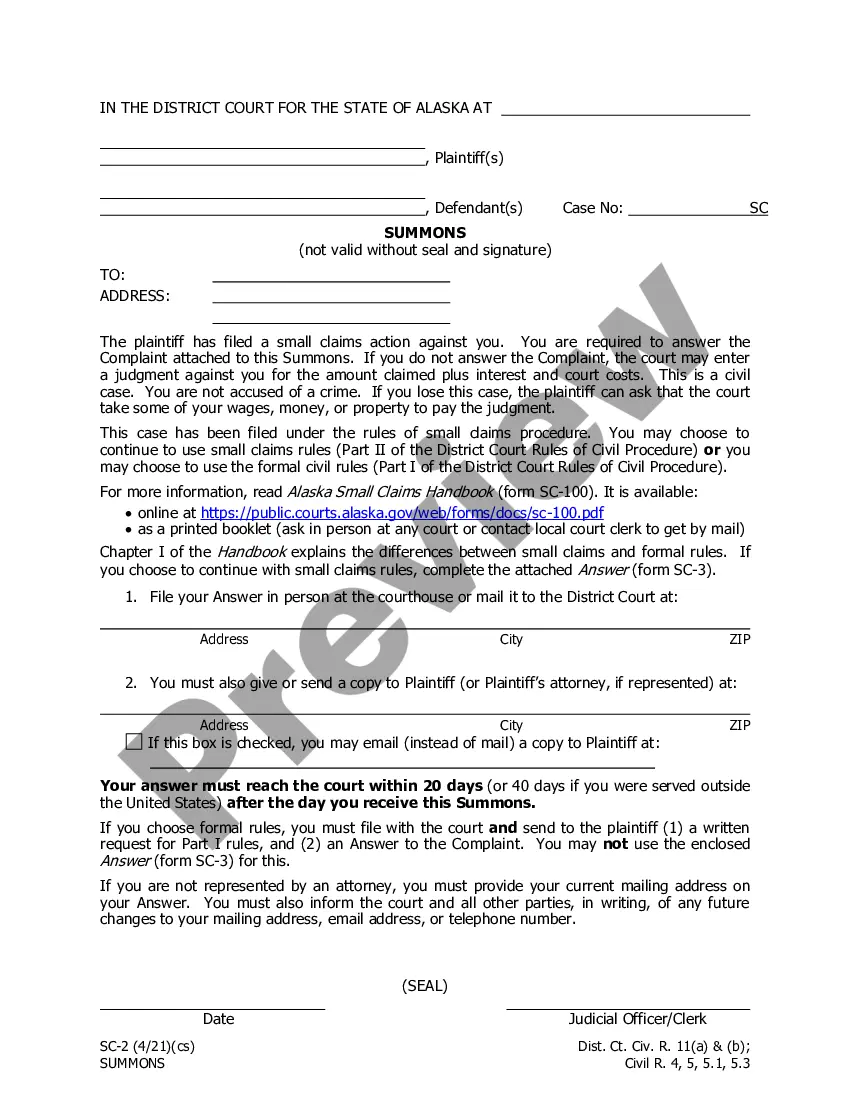

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Queens Business Deductions Checklist, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Queens Business Deductions Checklist from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Queens Business Deductions Checklist:

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!