A Flexible Benefits Plan benefits is a plan that allows employees to select from a pool of choices, some or all of which may be tax-advantaged. Potential choices include cash, retirement plan contributions, vacation days, and insurance. It is also called a cafeteria plan.

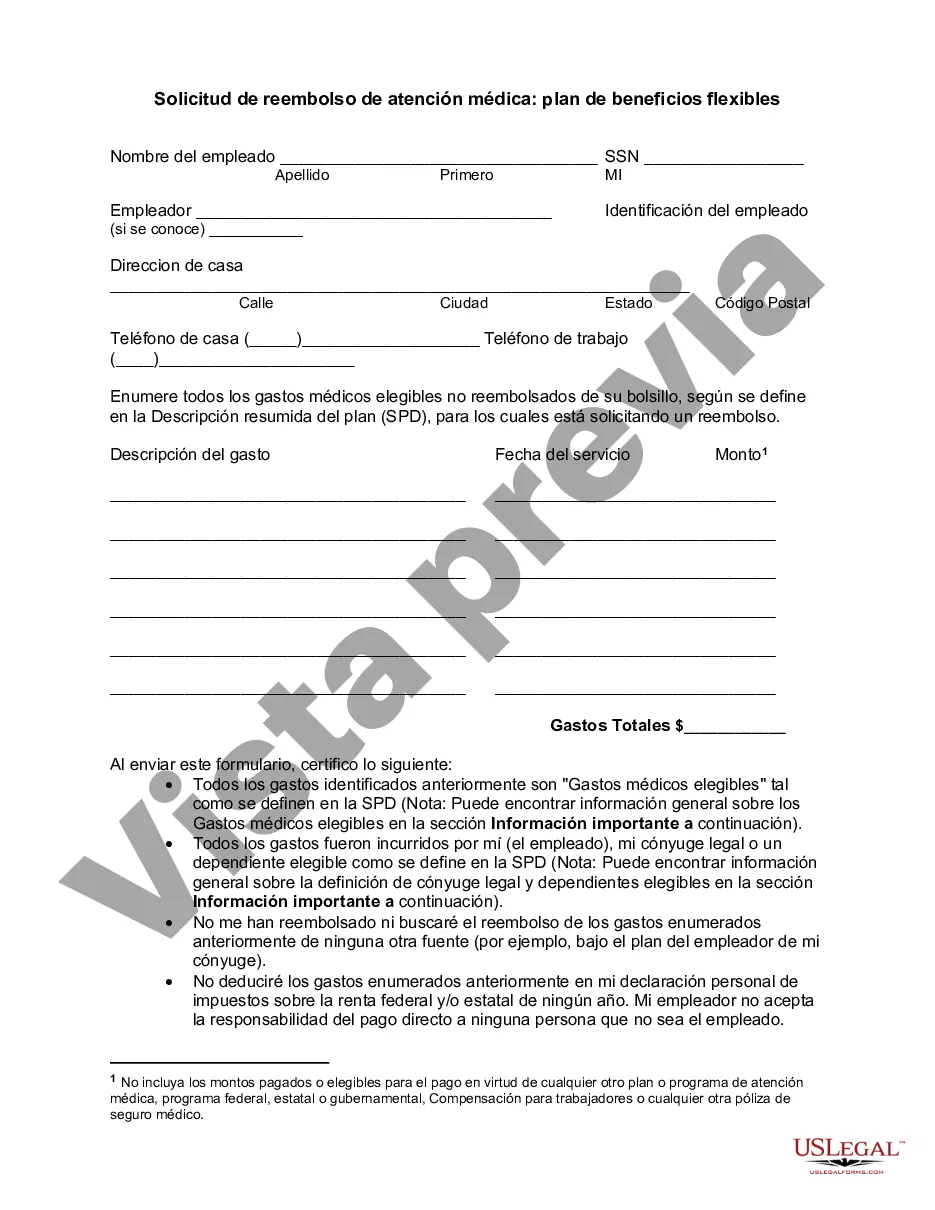

Cook Illinois Medical Care Reimbursement Request — Flexible Benefits Plan is a comprehensive plan that allows eligible employees of Cook Illinois Corporation to receive reimbursement for medical care expenses. This plan is designed to provide flexible options for employees to manage their medical expenses while offering the convenience of self-administration. The Cook Illinois Medical Care Reimbursement Request — Flexible Benefits Plan covers a wide range of eligible medical care expenses, including but not limited to doctor visits, hospital stays, prescription medications, dental treatments, vision care, and mental health services. The plan allows employees to seek reimbursement for both out-of-pocket expenses and expenses covered under their health insurance plans. Under this flexible benefits plan, employees can choose the reimbursement option that suits their needs best. The plan offers two main types of reimbursement accounts: a Health Care Flexible Spending Account (FSA) and a Health Savings Account (HSA). These accounts allow employees to set aside a portion of their pre-tax income to cover eligible medical expenses. The Health Care Flexible Spending Account (FSA) allows employees to contribute a set amount of money from their paycheck to be used for eligible medical expenses throughout the year. This account is typically used for smaller, predictable expenses such as co-pays, prescriptions, and over-the-counter medications. On the other hand, the Health Savings Account (HSA) is designed for employees enrolled in a compatible high-deductible health plan (DHP). Contributions to an HSA can be made by both the employee and the employer, and the funds in the account can be used to cover qualified medical expenses. Unlike an FSA, any unspent funds in an HSA can be rolled over and saved for future use, providing employees with the potential for long-term savings. To request reimbursement under the Cook Illinois Medical Care Reimbursement Request — Flexible Benefits Plan, employees need to fill out a reimbursement request form detailing the expenses incurred and submit relevant supporting documents such as receipts and invoices. The reimbursement request process is straightforward, allowing employees to easily receive reimbursement for eligible expenses. In summary, Cook Illinois Medical Care Reimbursement Request — Flexible Benefits Plan is a comprehensive and flexible program that aims to assist employees in managing their medical care expenses. With options such as Health Care Flexible Spending Account (FSA) and Health Savings Account (HSA), employees can choose the reimbursement account that best fits their needs. By providing coverage for a wide range of eligible medical expenses, this plan promotes the well-being and financial stability of Cook Illinois Corporation employees.Cook Illinois Medical Care Reimbursement Request — Flexible Benefits Plan is a comprehensive plan that allows eligible employees of Cook Illinois Corporation to receive reimbursement for medical care expenses. This plan is designed to provide flexible options for employees to manage their medical expenses while offering the convenience of self-administration. The Cook Illinois Medical Care Reimbursement Request — Flexible Benefits Plan covers a wide range of eligible medical care expenses, including but not limited to doctor visits, hospital stays, prescription medications, dental treatments, vision care, and mental health services. The plan allows employees to seek reimbursement for both out-of-pocket expenses and expenses covered under their health insurance plans. Under this flexible benefits plan, employees can choose the reimbursement option that suits their needs best. The plan offers two main types of reimbursement accounts: a Health Care Flexible Spending Account (FSA) and a Health Savings Account (HSA). These accounts allow employees to set aside a portion of their pre-tax income to cover eligible medical expenses. The Health Care Flexible Spending Account (FSA) allows employees to contribute a set amount of money from their paycheck to be used for eligible medical expenses throughout the year. This account is typically used for smaller, predictable expenses such as co-pays, prescriptions, and over-the-counter medications. On the other hand, the Health Savings Account (HSA) is designed for employees enrolled in a compatible high-deductible health plan (DHP). Contributions to an HSA can be made by both the employee and the employer, and the funds in the account can be used to cover qualified medical expenses. Unlike an FSA, any unspent funds in an HSA can be rolled over and saved for future use, providing employees with the potential for long-term savings. To request reimbursement under the Cook Illinois Medical Care Reimbursement Request — Flexible Benefits Plan, employees need to fill out a reimbursement request form detailing the expenses incurred and submit relevant supporting documents such as receipts and invoices. The reimbursement request process is straightforward, allowing employees to easily receive reimbursement for eligible expenses. In summary, Cook Illinois Medical Care Reimbursement Request — Flexible Benefits Plan is a comprehensive and flexible program that aims to assist employees in managing their medical care expenses. With options such as Health Care Flexible Spending Account (FSA) and Health Savings Account (HSA), employees can choose the reimbursement account that best fits their needs. By providing coverage for a wide range of eligible medical expenses, this plan promotes the well-being and financial stability of Cook Illinois Corporation employees.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.