A Flexible Benefits Plan benefits is a plan that allows employees to select from a pool of choices, some or all of which may be tax-advantaged. Potential choices include cash, retirement plan contributions, vacation days, and insurance. It is also called a cafeteria plan.

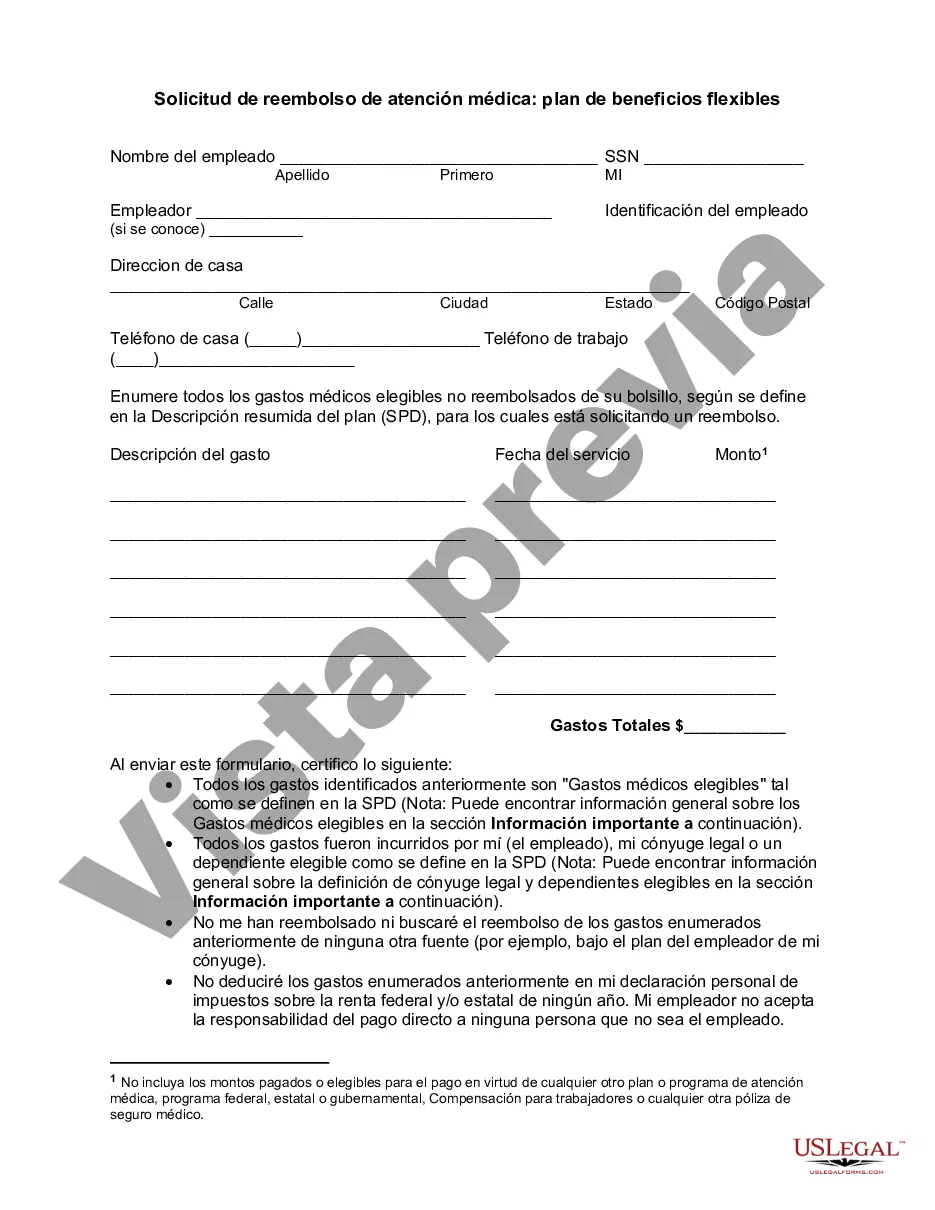

Mecklenburg North Carolina Medical Care Reimbursement Request — Flexible Benefits Plan: The Mecklenburg North Carolina Medical Care Reimbursement Request — Flexible Benefits Plan is a comprehensive healthcare reimbursement program designed to provide financial support for healthcare expenses incurred by eligible individuals in Mecklenburg County, North Carolina. This flexible benefits plan aims to alleviate the financial burden associated with medical care, enabling individuals to receive the necessary treatment without worrying about exorbitant out-of-pocket expenses. The program is available to both employees and residents of Mecklenburg County, with different types of reimbursement options catered to specific needs. Key Features of Mecklenburg North Carolina Medical Care Reimbursement Request — Flexible Benefits Plan: 1. Diverse Coverage: The plan covers a wide range of medical expenses, including but not limited to doctor's visits, prescription medications, hospital stays, surgeries, mental health services, and preventive care. 2. Eligibility Criteria: To qualify for reimbursement, individuals must meet specific eligibility criteria. This may include being a resident of Mecklenburg County, being employed by a participating employer, or being enrolled in a specific healthcare program. 3. Reimbursement Process: The reimbursement process is hassle-free and user-friendly. Participants are required to submit a reimbursement request form along with supporting documentation, such as receipts or invoices. Upon verification, approved expenses are reimbursed in a timely manner, typically through direct deposit or a check. 4. Flexible Spending Account (FSA): One of the options within the Mecklenburg North Carolina Medical Care Reimbursement Request — Flexible Benefits Plan is a Flexible Spending Account (FSA). With an FSA, participants can set aside a portion of their pre-tax income to cover eligible healthcare expenses, reducing their overall taxable income. 5. Health Savings Account (HSA): Another option available is a Health Savings Account (HSA), which allows individuals to save money specifically for healthcare expenses. Contributions to an HSA are tax-deductible, and unused funds can roll over from year to year. 6. Documentation Requirements: Participants are required to keep accurate records of their medical expenses, including receipts, explanations of benefits, and other relevant documentation. These documents are crucial when filing reimbursement requests. 7. Plan Limits and Restrictions: It is essential to review the plan's specific limits, restrictions, and exclusions before submitting reimbursement requests. Some expenses may not be covered or may have specific spending limits. The Mecklenburg North Carolina Medical Care Reimbursement Request — Flexible Benefits Plan provides a valuable resource for individuals seeking financial assistance with medical expenses. It offers flexibility, convenience, and peace of mind, allowing participants to take care of their health without worrying about the associated costs.Mecklenburg North Carolina Medical Care Reimbursement Request — Flexible Benefits Plan: The Mecklenburg North Carolina Medical Care Reimbursement Request — Flexible Benefits Plan is a comprehensive healthcare reimbursement program designed to provide financial support for healthcare expenses incurred by eligible individuals in Mecklenburg County, North Carolina. This flexible benefits plan aims to alleviate the financial burden associated with medical care, enabling individuals to receive the necessary treatment without worrying about exorbitant out-of-pocket expenses. The program is available to both employees and residents of Mecklenburg County, with different types of reimbursement options catered to specific needs. Key Features of Mecklenburg North Carolina Medical Care Reimbursement Request — Flexible Benefits Plan: 1. Diverse Coverage: The plan covers a wide range of medical expenses, including but not limited to doctor's visits, prescription medications, hospital stays, surgeries, mental health services, and preventive care. 2. Eligibility Criteria: To qualify for reimbursement, individuals must meet specific eligibility criteria. This may include being a resident of Mecklenburg County, being employed by a participating employer, or being enrolled in a specific healthcare program. 3. Reimbursement Process: The reimbursement process is hassle-free and user-friendly. Participants are required to submit a reimbursement request form along with supporting documentation, such as receipts or invoices. Upon verification, approved expenses are reimbursed in a timely manner, typically through direct deposit or a check. 4. Flexible Spending Account (FSA): One of the options within the Mecklenburg North Carolina Medical Care Reimbursement Request — Flexible Benefits Plan is a Flexible Spending Account (FSA). With an FSA, participants can set aside a portion of their pre-tax income to cover eligible healthcare expenses, reducing their overall taxable income. 5. Health Savings Account (HSA): Another option available is a Health Savings Account (HSA), which allows individuals to save money specifically for healthcare expenses. Contributions to an HSA are tax-deductible, and unused funds can roll over from year to year. 6. Documentation Requirements: Participants are required to keep accurate records of their medical expenses, including receipts, explanations of benefits, and other relevant documentation. These documents are crucial when filing reimbursement requests. 7. Plan Limits and Restrictions: It is essential to review the plan's specific limits, restrictions, and exclusions before submitting reimbursement requests. Some expenses may not be covered or may have specific spending limits. The Mecklenburg North Carolina Medical Care Reimbursement Request — Flexible Benefits Plan provides a valuable resource for individuals seeking financial assistance with medical expenses. It offers flexibility, convenience, and peace of mind, allowing participants to take care of their health without worrying about the associated costs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.