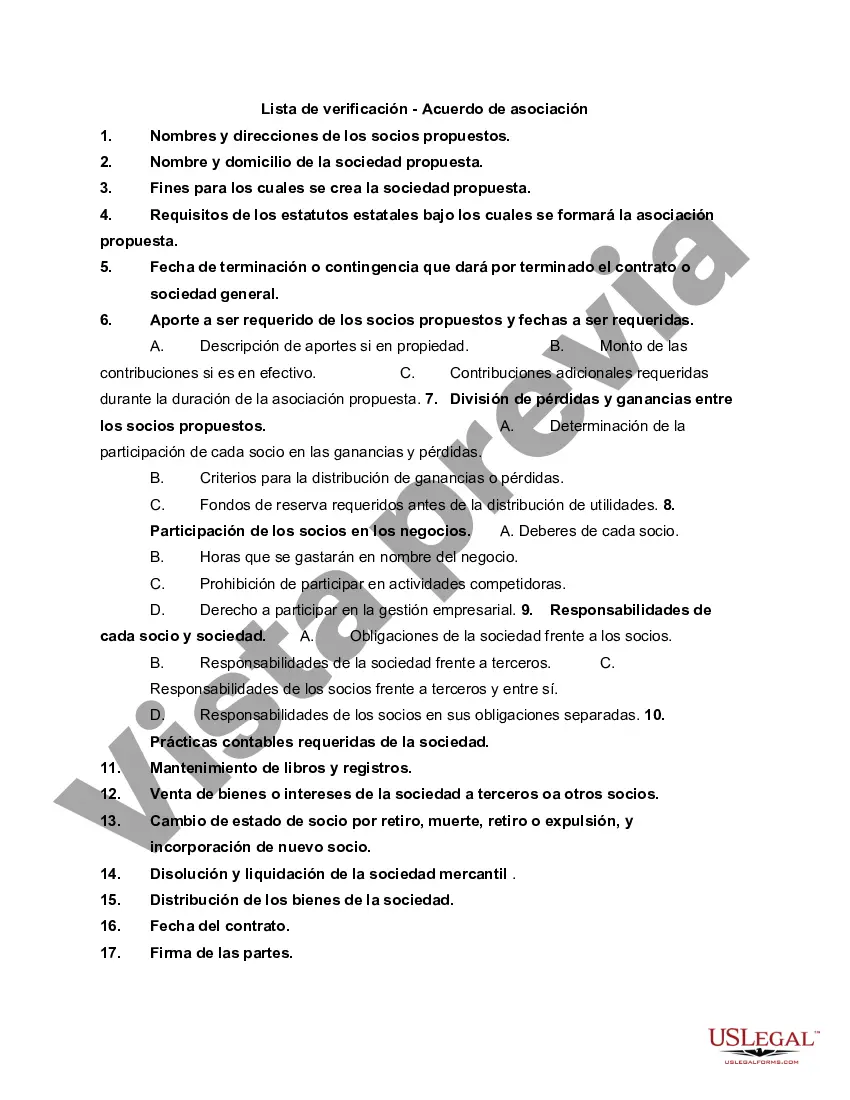

Allegheny Pennsylvania Checklist — Partnership Agreement: A Detailed Description In Allegheny, Pennsylvania, a checklist for partnership agreements is essential for ensuring a smooth and legally binding partnership. Whether you are starting a new business, forming a joint venture, or expanding an existing company, having a partnership agreement is crucial to defining the rights, responsibilities, and obligations of each partner involved. This comprehensive checklist outlines the vital components to consider when drafting a partnership agreement specific to Allegheny, Pennsylvania. 1. Names and Addresses: Start the partnership agreement by clearly stating the full names and addresses of all partners involved. This ensures that all parties can be easily identified within the agreement. 2. Partnership Business: Describe the nature of the partnership business, including its purpose and the industry it operates in. Explain the goals, products, or services the partnership will provide. 3. Contributions: Outline the contributions made by each partner, such as capital investment, assets, or intellectual property. Specify the value and nature of these contributions, as well as how they will be treated within the partnership. 4. Profit and Loss Sharing: Clearly define how profits and losses will be allocated among partners. Outline the percentage or ratio distribution and specify the process of calculating and distributing profits and losses. 5. Management and Decision-Making: Detail the decision-making structure within the partnership, including how managerial responsibilities will be assigned and who has the authority to make business decisions. Include procedures for resolving disputes and disagreements. 6. Partnership Duration: Specify the duration of the partnership, whether it is for a fixed term or ongoing. If there is a time limit, outline details regarding partnership renewal or dissolution. 7. Partner Withdrawal and Retirement: Define the procedures and consequences for partner withdrawal or retirement from the partnership. Include provisions for buyouts, transfer of ownership, and successor arrangements. 8. Dissolution and Liquidation: Outline the procedures for dissolving the partnership, including the distribution of assets and liabilities. Specify whether any partners will continue the business or if it will be wound up entirely. 9. Restrictive Covenants: Address any non-competition, non-solicitation, or confidentiality clauses to protect the partnership's interests and maintain confidentiality after a partner's departure. 10. Governing Law: Identify Allegheny, Pennsylvania, as the governing jurisdiction for the partnership agreement. Include provisions for resolving disputes or conflicts in accordance with the state laws. Types of Allegheny Pennsylvania Checklist — Partnership Agreements: 1. General Partnership Agreement: This type of agreement is used when two or more partners operate a business together and share equal rights, responsibilities, and liabilities. 2. Limited Partnership Agreement: This agreement involves two types of partners: general partners, who have unlimited liability and manage the business, and limited partners, who have limited liability and contribute financially but do not participate in management. 3. Limited Liability Partnership Agreement: This agreement protects partners from personal liability for the actions of other partners. It is commonly used in professional service firms such as law or accounting practices. In conclusion, a partnership agreement is vital for any business venture in Allegheny, Pennsylvania. It serves as a legally binding document that establishes the terms, roles, and expectations of partners. By following this checklist and tailoring it to the specific needs of your partnership, you can ensure a fair, transparent, and successful business relationship in Allegheny, Pennsylvania.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Lista de verificación - Acuerdo de asociación - Checklist - Partnership Agreement

Description

How to fill out Allegheny Pennsylvania Lista De Verificación - Acuerdo De Asociación?

If you need to get a trustworthy legal form provider to find the Allegheny Checklist - Partnership Agreement, consider US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support team make it easy to get and complete various papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply select to search or browse Allegheny Checklist - Partnership Agreement, either by a keyword or by the state/county the form is intended for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Allegheny Checklist - Partnership Agreement template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less costly and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate agreement, or complete the Allegheny Checklist - Partnership Agreement - all from the comfort of your home.

Join US Legal Forms now!