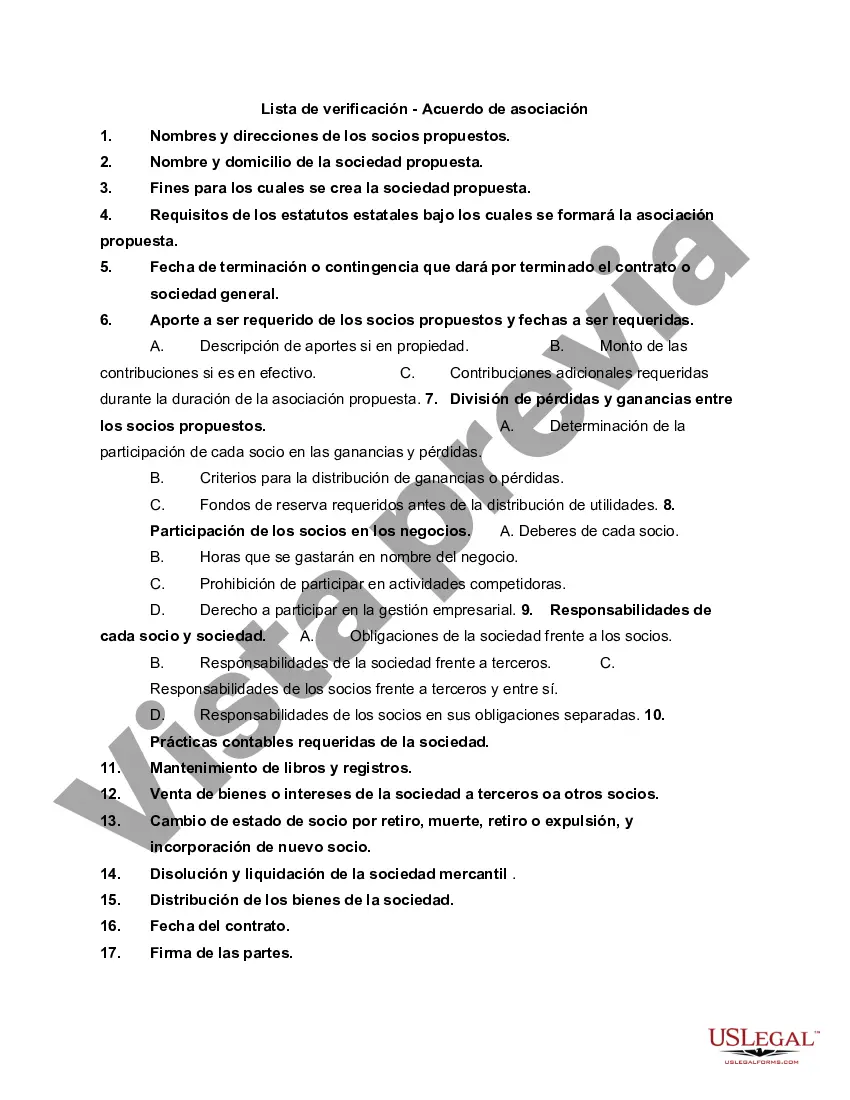

Kings New York Checklist — Partnership Agreement: A partnership agreement is a legally binding document that outlines the terms and conditions of a partnership between two or more parties. Kings New York Checklist offers a comprehensive partnership agreement checklist, ensuring that all necessary elements are included and that the agreement is in compliance with New York state laws. The Kings New York Checklist partnership agreement covers various crucial aspects, such as the roles and responsibilities of each partner, profit and loss distribution, decision-making processes, dispute resolution, termination clauses, and intellectual property rights. By following this checklist, partners can establish a solid foundation for their business collaboration and avoid potential conflicts in the future. Different types of partnership agreements under the Kings New York Checklist may include: 1. General Partnership Agreement: This is the most common type of partnership, where all partners have unlimited liability and share equal responsibility for the partnership's obligations. 2. Limited Partnership Agreement: In this agreement, there are two types of partners: general partners who have unlimited liability, and limited partners who have limited liability. Limited partners are not actively involved in the day-to-day operations and are primarily responsible for providing capital. 3. Limited Liability Partnership Agreement (LLP): This type of agreement allows partners to enjoy limited liability while still actively participating in the management and operation of the business. Laps are often preferred by professionals, such as lawyers or accountants. 4. Joint Venture Agreement: Although similar to a partnership, a joint venture is typically formed for a specific project or a limited period. Each party contributes resources and expertise to achieve a common goal, and profits and losses are shared according to the agreement. By utilizing the Kings New York Checklist partnership agreement, business partners can ensure that all the necessary components of their specific partnership type are addressed. This includes drafting clear terms for equity distribution, defining decision-making processes, addressing potential conflicts, and protecting the interests of each partner. Overall, the Kings New York Checklist — Partnership Agreement aims to provide a thorough and compliant framework for partners to establish a successful and legally binding business collaboration in the state of New York.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Lista de verificación - Acuerdo de asociación - Checklist - Partnership Agreement

Description

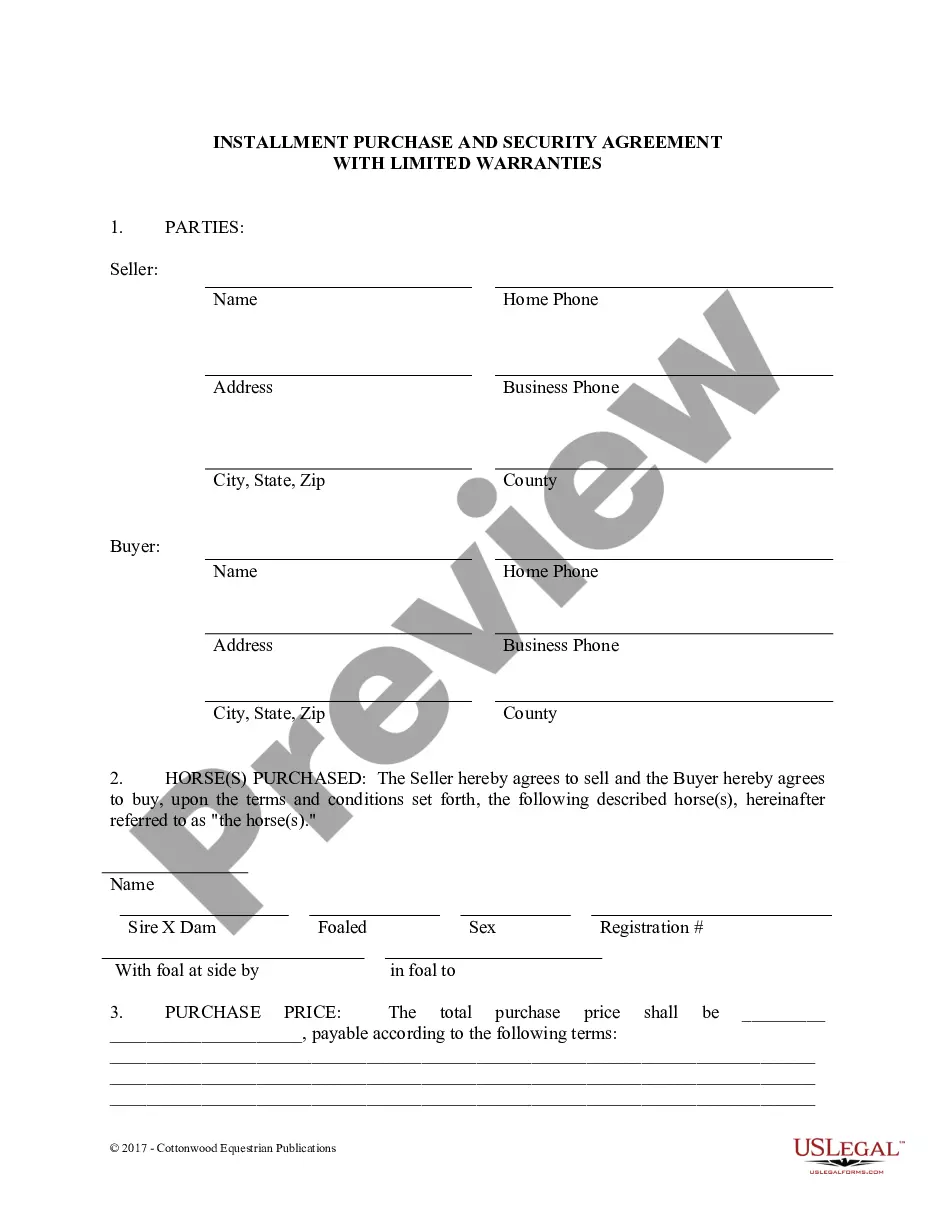

How to fill out Kings New York Lista De Verificación - Acuerdo De Asociación?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Kings Checklist - Partnership Agreement.

Locating forms on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Kings Checklist - Partnership Agreement will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Kings Checklist - Partnership Agreement:

- Make sure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Kings Checklist - Partnership Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!