A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

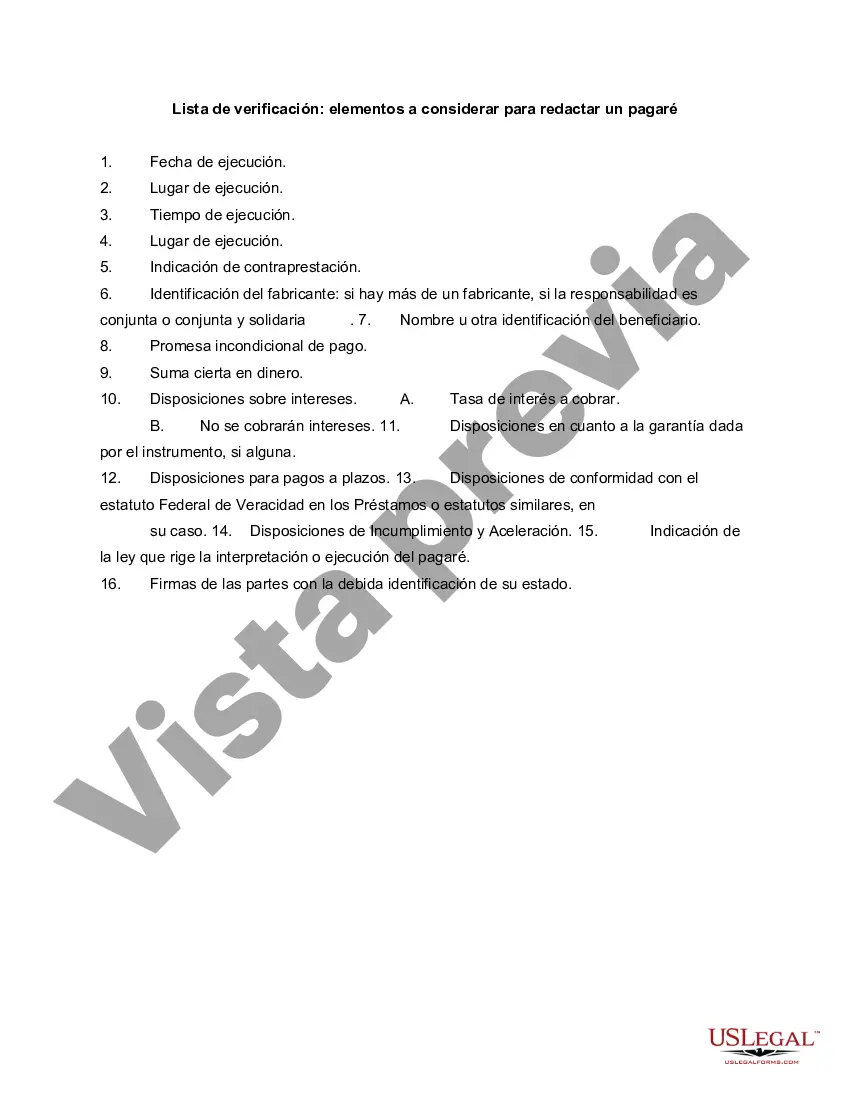

Bronx, New York is one of the five boroughs of New York City and the only one situated mainly on the mainland. Known for its rich cultural diversity, the Bronx offers a unique experience to its residents and visitors. When drafting a promissory note, there are several important items to consider, ensuring the legality and enforceability of the document. Key factors to include in your Bronx, New York Checklist — Items to Consider for Drafting a Promissory Note are: 1. Parties Involved: Include the full legal names and addresses of both the lender (lending party) and the borrower (receiving party). 2. Loan Amount and Terms: Clearly state the principal amount being lent and ensure you incorporate the agreed-upon terms including interest rate, payment due dates, and any additional fees or charges. 3. Repayment Schedule: Outline the specific schedule for loan repayment, noting intervals and dates for installments or lump sum payments. Address any grace periods or late payment penalties that apply. 4. Collateral: If applicable, include details about any collateral provided by the borrower as security for the loan. This might include real estate, vehicles, or other valuable assets. 5. Guarantor(s): If a third party is guaranteeing the loan, provide their information, including legal name, address, and contact details. It's important to outline their responsibility and obligations should the borrower default. 6. Default and Remedies: Clearly state the consequences and remedies in case of default, such as late fees, accelerated repayment, or the right to take legal action. 7. Governing Law: Specify the jurisdiction and law that will apply to the promissory note, particularly referencing the laws of the state of New York. 8. Notarization and Witness: Consider getting the promissory note notarized and witnessed to add an extra layer of authenticity and legally binding weight. Different types of Bronx, New York Checklists — Items to Consider for Drafting a Promissory Note might involve variations in terms of loan amounts, repayment periods, or specific provisions tailored to different loan purposes, such as business loans, personal loans, or student loans. However, the essential components mentioned above remain crucial regardless of loan type. By including these key elements in your Bronx, New York Checklist — Items to Consider for Drafting a Promissory Note, you can ensure the document is comprehensive, enforceable, and protective of all parties involved in the loan transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.