A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

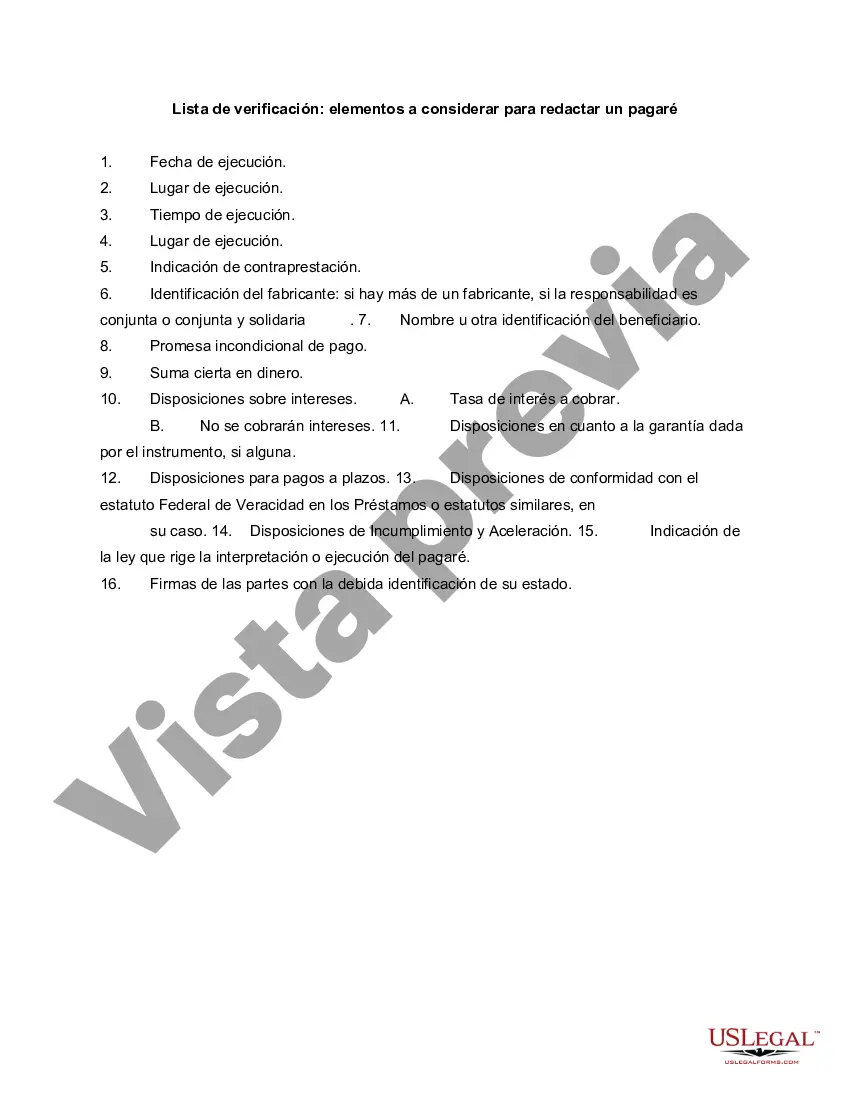

Broward Florida Checklist — Items to Consider for Drafting a Promissory Note When creating a promissory note in Broward, Florida, it is essential to ensure that all necessary elements are included to make it legally enforceable. A promissory note is a legally binding contract between a borrower and a lender, outlining the terms and conditions of a loan. Here are several key items to consider when drafting a promissory note in Broward: 1. Parties involved: Clearly identify the borrower (the individual or entity borrowing the money) and the lender (the individual or entity providing the funds). Include their full legal names, addresses, and contact information. 2. Loan amount and repayment terms: Specify the principal amount of the loan granted to the borrower. Clearly outline how the loan will be repaid, including the repayment schedule (monthly, quarterly, or annually), the interest rate, and the due dates for each payment. 3. Interest and late payment fees: Determine the interest rate for the loan and specify whether it is simple or compound interest. Additionally, mention whether any penalties or late payment fees will be imposed if the borrower fails to make timely payments. 4. Collateral or security: Indicate if any collateral is involved in securing the loan. If so, describe the collateral and specify how it will be transferred to the lender in case of default on payments. 5. Prepayment options: Discuss whether the borrower has the right to prepay the loan without any penalties and if so, describe the procedure and any conditions associated with it. 6. Governing law: State that the promissory note is governed by the laws of the state of Florida and specify Broward County as the jurisdiction for any legal proceedings. 7. Default and remedies: Outline the actions that the lender can take if the borrower defaults on the loan, such as acceleration of the debt (making the entire remaining balance due immediately) or repossession of collateral. 8. Signatures and notarization: Signatures of both the borrower and the lender are necessary to make the promissory note legally binding. It is advisable to have the signatures notarized to ensure authenticity. Different types of promissory notes in Broward, Florida may include: 1. Secured promissory note: A promissory note that involves collateral to secure the loan, providing the lender an added level of security if the borrower defaults. 2. Unsecured promissory note: A promissory note where no collateral is involved. In this case, the lender relies solely on the borrower's creditworthiness to repay the loan. 3. Demand promissory note: A promissory note that allows the lender to request repayment at any time, potentially providing more flexibility for the lender. It is crucial to consult with a legal professional when drafting a promissory note in Broward, Florida, as specific laws may apply, and each situation may have unique considerations.Broward Florida Checklist — Items to Consider for Drafting a Promissory Note When creating a promissory note in Broward, Florida, it is essential to ensure that all necessary elements are included to make it legally enforceable. A promissory note is a legally binding contract between a borrower and a lender, outlining the terms and conditions of a loan. Here are several key items to consider when drafting a promissory note in Broward: 1. Parties involved: Clearly identify the borrower (the individual or entity borrowing the money) and the lender (the individual or entity providing the funds). Include their full legal names, addresses, and contact information. 2. Loan amount and repayment terms: Specify the principal amount of the loan granted to the borrower. Clearly outline how the loan will be repaid, including the repayment schedule (monthly, quarterly, or annually), the interest rate, and the due dates for each payment. 3. Interest and late payment fees: Determine the interest rate for the loan and specify whether it is simple or compound interest. Additionally, mention whether any penalties or late payment fees will be imposed if the borrower fails to make timely payments. 4. Collateral or security: Indicate if any collateral is involved in securing the loan. If so, describe the collateral and specify how it will be transferred to the lender in case of default on payments. 5. Prepayment options: Discuss whether the borrower has the right to prepay the loan without any penalties and if so, describe the procedure and any conditions associated with it. 6. Governing law: State that the promissory note is governed by the laws of the state of Florida and specify Broward County as the jurisdiction for any legal proceedings. 7. Default and remedies: Outline the actions that the lender can take if the borrower defaults on the loan, such as acceleration of the debt (making the entire remaining balance due immediately) or repossession of collateral. 8. Signatures and notarization: Signatures of both the borrower and the lender are necessary to make the promissory note legally binding. It is advisable to have the signatures notarized to ensure authenticity. Different types of promissory notes in Broward, Florida may include: 1. Secured promissory note: A promissory note that involves collateral to secure the loan, providing the lender an added level of security if the borrower defaults. 2. Unsecured promissory note: A promissory note where no collateral is involved. In this case, the lender relies solely on the borrower's creditworthiness to repay the loan. 3. Demand promissory note: A promissory note that allows the lender to request repayment at any time, potentially providing more flexibility for the lender. It is crucial to consult with a legal professional when drafting a promissory note in Broward, Florida, as specific laws may apply, and each situation may have unique considerations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.