A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Title: Chicago, Illinois Checklist — Items to Consider for Drafting a Promissory Note Introduction: When creating a legally binding document, such as a promissory note, it is crucial to consider specific items and adhere to the relevant legal requirements. This checklist will guide you through important considerations for drafting a promissory note in Chicago, Illinois. Ensuring that your promissory note is accurately drafted will help protect your interests while maintaining legal compliance in the area. 1. Type of Promissory Note: — Secured Promissory Note: If the borrower pledges collateral to secure the loan, it should be clearly specified. — Unsecured Promissory Note: When no collateral is involved, highlighting the borrower's sole obligation to repay the loan is essential. 2. Parties Involved: — Lender: Include the full legal name and contact information. — Borrower: Include the full legal name and contact information. 3. Loan Amount and Interest: — Clearly state the principal loan amount provided by the lender. — Specify the interest rate agreed upon, ensuring it complies with state regulations. 4. Repayment Terms: — Establish the installment frequency (monthly, quarterly, etc.), including the payment start and end dates. — Define the payment amount for each installment, how it will be made, and where it should be sent. 5. Late Payment Terms: — Describe any penalties or charges for late payments, adhering to relevant Illinois laws regarding interest and charges. 6. Default and Acceleration: — Clearly state the terms under which a borrower would be considered in default. — Include provisions outlining the lender's right to declare the entire unpaid balance due in case of default. 7. Governing Law and Jurisdiction: — Specify that the promissory note is governed by Illinois law and identify the appropriate Illinois jurisdiction for any legal disputes. 8. Dispute Resolution: — Determine whether any alternative dispute resolution methods, such as mediation or arbitration, are preferred. 9. Prepayment: — Address whether prepayment is permitted and if any penalties or fees will apply. 10. Signatures and Witnesses: — Ensure that both the lender and borrower sign the promissory note. — Consider having witnesses present to provide additional legal validity. 11. Legal Counsel: — While not mandatory, consulting an attorney experienced in promissory note drafting can help ensure compliance with local regulations and provide added protection. Conclusion: By considering these essential items when drafting your promissory note in Chicago, Illinois, you can create a legally sound document that protects your interests and complies with local regulations. Remember that seeking professional advice is always a prudent step, as laws may change, and individual circumstances vary. Safeguard your financial agreements by meticulously preparing your promissory note.Title: Chicago, Illinois Checklist — Items to Consider for Drafting a Promissory Note Introduction: When creating a legally binding document, such as a promissory note, it is crucial to consider specific items and adhere to the relevant legal requirements. This checklist will guide you through important considerations for drafting a promissory note in Chicago, Illinois. Ensuring that your promissory note is accurately drafted will help protect your interests while maintaining legal compliance in the area. 1. Type of Promissory Note: — Secured Promissory Note: If the borrower pledges collateral to secure the loan, it should be clearly specified. — Unsecured Promissory Note: When no collateral is involved, highlighting the borrower's sole obligation to repay the loan is essential. 2. Parties Involved: — Lender: Include the full legal name and contact information. — Borrower: Include the full legal name and contact information. 3. Loan Amount and Interest: — Clearly state the principal loan amount provided by the lender. — Specify the interest rate agreed upon, ensuring it complies with state regulations. 4. Repayment Terms: — Establish the installment frequency (monthly, quarterly, etc.), including the payment start and end dates. — Define the payment amount for each installment, how it will be made, and where it should be sent. 5. Late Payment Terms: — Describe any penalties or charges for late payments, adhering to relevant Illinois laws regarding interest and charges. 6. Default and Acceleration: — Clearly state the terms under which a borrower would be considered in default. — Include provisions outlining the lender's right to declare the entire unpaid balance due in case of default. 7. Governing Law and Jurisdiction: — Specify that the promissory note is governed by Illinois law and identify the appropriate Illinois jurisdiction for any legal disputes. 8. Dispute Resolution: — Determine whether any alternative dispute resolution methods, such as mediation or arbitration, are preferred. 9. Prepayment: — Address whether prepayment is permitted and if any penalties or fees will apply. 10. Signatures and Witnesses: — Ensure that both the lender and borrower sign the promissory note. — Consider having witnesses present to provide additional legal validity. 11. Legal Counsel: — While not mandatory, consulting an attorney experienced in promissory note drafting can help ensure compliance with local regulations and provide added protection. Conclusion: By considering these essential items when drafting your promissory note in Chicago, Illinois, you can create a legally sound document that protects your interests and complies with local regulations. Remember that seeking professional advice is always a prudent step, as laws may change, and individual circumstances vary. Safeguard your financial agreements by meticulously preparing your promissory note.

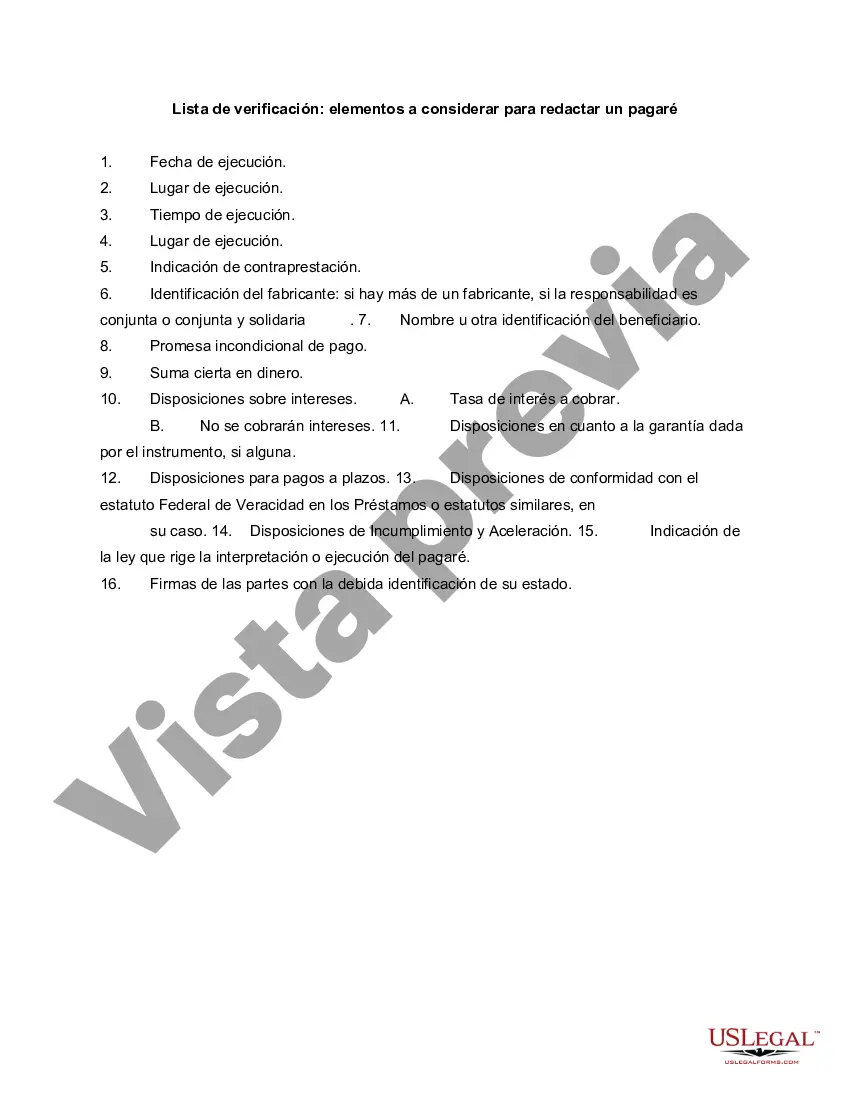

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.