A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Collin Texas Checklist — Items to Consider for Drafting a Promissory Note: A promissory note is a legal document that outlines the terms and conditions under which one party promises to pay a certain amount of money to another party. When drafting a promissory note in Collin, Texas, it is important to consider various factors to ensure its validity and enforceability. Here is a detailed description and checklist of key items to consider when drafting a promissory note: 1. Parties involved: Identify the full legal names and contact information of both the lender (also known as the payee) and the borrower (also known as the promise). Ensure that their identities are accurately stated in the note. 2. Loan amount and currency: Clearly state the principal amount that the borrower promises to repay, ensuring it is mentioned in both numeric and written formats. Additionally, specify the currency (e.g., USD — United States Dollars) in which the loan is made. 3. Interest rate: Clearly define the interest rate charged on the loan, whether it is fixed or variable. If it is variable, provide details on how it will be determined (e.g., based on a specific index or benchmark). 4. Repayment terms: Specify the repayment schedule, including the frequency of payments (e.g., monthly, quarterly) and the due date for each installment. Ensure these are clearly defined to avoid any confusion. 5. Late payment provisions: Include provisions that address late payments, including any applicable late fees, penalties, or interest rate increases. State the grace period (if any) before such penalties are applied. 6. Collateral or security interest: If the loan is secured by collateral, describe the collateral in detail. Clearly specify the rights of the lender in the event of default or non-payment by the borrower. 7. Events of default: Enumerate the circumstances that will constitute a default by the borrower, such as non-payment, bankruptcy, or breach of any other terms of the agreement. Specify the actions the lender can take in case of default. 8. Governing law and jurisdiction: Specify that Collin, Texas law will govern the promissory note and ensure that any legal proceedings related to the note will take place in the appropriate courts located in Collin County, Texas. 9. Waivers and amendments: Include provisions stating that any waiver or amendment to the terms of the promissory note must be in writing and signed by all parties involved. 10. Signatures and notarization: Ensure that the promissory note includes spaces for the signatures of both the lender and the borrower. Notarization is not always required, but it can add a layer of authenticity and enforceability. Different types of Collin Texas Checklist — Items to Consider for Drafting a Promissory Note may include variations based on the specific loan purpose or nature of the transaction. For example, a checklist for a business loan promissory note may emphasize additional considerations such as financial covenants, representations and warranties, or default remedies specific to business transactions.Collin Texas Checklist — Items to Consider for Drafting a Promissory Note: A promissory note is a legal document that outlines the terms and conditions under which one party promises to pay a certain amount of money to another party. When drafting a promissory note in Collin, Texas, it is important to consider various factors to ensure its validity and enforceability. Here is a detailed description and checklist of key items to consider when drafting a promissory note: 1. Parties involved: Identify the full legal names and contact information of both the lender (also known as the payee) and the borrower (also known as the promise). Ensure that their identities are accurately stated in the note. 2. Loan amount and currency: Clearly state the principal amount that the borrower promises to repay, ensuring it is mentioned in both numeric and written formats. Additionally, specify the currency (e.g., USD — United States Dollars) in which the loan is made. 3. Interest rate: Clearly define the interest rate charged on the loan, whether it is fixed or variable. If it is variable, provide details on how it will be determined (e.g., based on a specific index or benchmark). 4. Repayment terms: Specify the repayment schedule, including the frequency of payments (e.g., monthly, quarterly) and the due date for each installment. Ensure these are clearly defined to avoid any confusion. 5. Late payment provisions: Include provisions that address late payments, including any applicable late fees, penalties, or interest rate increases. State the grace period (if any) before such penalties are applied. 6. Collateral or security interest: If the loan is secured by collateral, describe the collateral in detail. Clearly specify the rights of the lender in the event of default or non-payment by the borrower. 7. Events of default: Enumerate the circumstances that will constitute a default by the borrower, such as non-payment, bankruptcy, or breach of any other terms of the agreement. Specify the actions the lender can take in case of default. 8. Governing law and jurisdiction: Specify that Collin, Texas law will govern the promissory note and ensure that any legal proceedings related to the note will take place in the appropriate courts located in Collin County, Texas. 9. Waivers and amendments: Include provisions stating that any waiver or amendment to the terms of the promissory note must be in writing and signed by all parties involved. 10. Signatures and notarization: Ensure that the promissory note includes spaces for the signatures of both the lender and the borrower. Notarization is not always required, but it can add a layer of authenticity and enforceability. Different types of Collin Texas Checklist — Items to Consider for Drafting a Promissory Note may include variations based on the specific loan purpose or nature of the transaction. For example, a checklist for a business loan promissory note may emphasize additional considerations such as financial covenants, representations and warranties, or default remedies specific to business transactions.

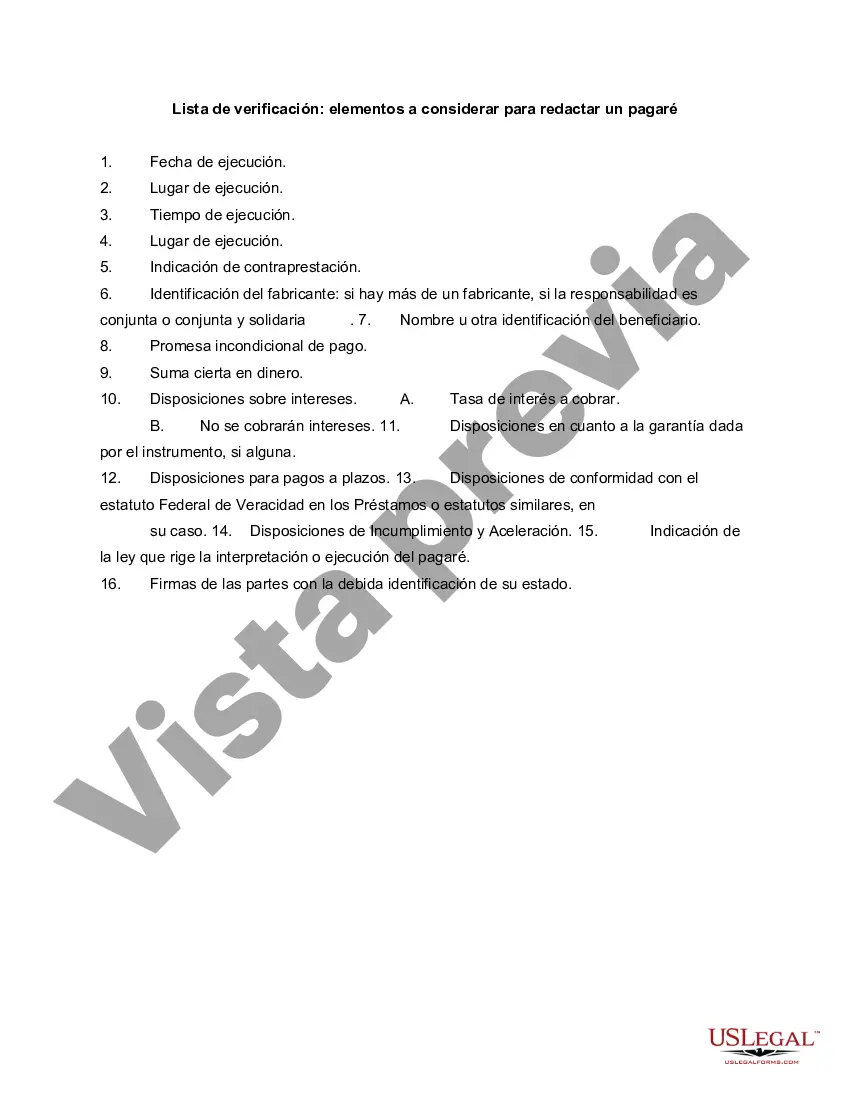

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.