A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Cook Illinois Checklist — Items to Consider for Drafting a Promissory Note: A promissory note is a legally binding document that establishes a formal promise between a borrower and a lender. When drafting a promissory note in Cook County, Illinois, there are several important factors to consider ensuring its enforceability and compliance with state laws. Here is a detailed description of what you need to know when drafting a promissory note in Illinois. 1. Parties involved: Identify the borrower (the party receiving the loan) and the lender (the party providing the loan). Include their legal names, addresses, and contact information. 2. Loan amount and interest: Clearly state the principal amount being loaned and the interest rate, if any. Specify whether the interest is fixed or adjustable and explain the calculation method. 3. Repayment terms: Define the repayment schedule, including the due date(s) of payments, frequency (monthly, quarterly, etc.), and the total number of payments required. If installments are expected, provide a breakdown of their amounts. 4. Late fees and penalties: Outline the consequences for late or missed payments, such as imposing late fees or increasing interest rates. Ensure compliance with Illinois state laws regarding the maximum late fees allowed. 5. Collateral: If the loan is secured by collateral, describe the collateral in detail, including its location and estimated value. If there are any conditions or restrictions related to the collateral, include them as well. 6. Acceleration clause: Include an acceleration clause that allows the lender to demand immediate payment of the entire outstanding balance upon the occurrence of specific events, such as default or bankruptcy of the borrower. 7. Default and remedies: Clearly define what constitutes a default and specify the actions the lender can take in case of default. This may include demanding immediate payment, pursuing legal action, or applying additional penalties. 8. Governing law: Specify that the promissory note will be governed by and construed in accordance with the laws of Illinois, particularly Cook County, and any disputes will be resolved in courts located in Cook County. 9. Signatures and witnesses: Include spaces for both parties' signatures, their printed names, and the date of execution. Additionally, include an area for witnesses to sign, although witness signatures may not always be required. Types of Cook Illinois Checklists — Items to Consider for Drafting a Promissory Note: 1. Basic Promissory Note Checklist: This checklist covers the essential elements needed for drafting a standard promissory note, including the loan amount, repayment terms, interest rate, and borrower/lender information. 2. Secured Promissory Note Checklist: This checklist focuses on drafting a promissory note that is secured by collateral. It includes additional considerations such as collateral description, valuation, and conditions relating to the collateral. 3. Adjustable Rate Promissory Note Checklist: If the interest rate is adjustable or variable, this checklist provides guidance on drafting a promissory note that includes the necessary provisions for an adjustable rate, detailing the adjustment period, index, and margin. By following these checklists and considering the specific requirements of Cook County, Illinois, you can ensure your promissory note is comprehensive, legally compliant, and adequately protects the rights of both the borrower and lender.Cook Illinois Checklist — Items to Consider for Drafting a Promissory Note: A promissory note is a legally binding document that establishes a formal promise between a borrower and a lender. When drafting a promissory note in Cook County, Illinois, there are several important factors to consider ensuring its enforceability and compliance with state laws. Here is a detailed description of what you need to know when drafting a promissory note in Illinois. 1. Parties involved: Identify the borrower (the party receiving the loan) and the lender (the party providing the loan). Include their legal names, addresses, and contact information. 2. Loan amount and interest: Clearly state the principal amount being loaned and the interest rate, if any. Specify whether the interest is fixed or adjustable and explain the calculation method. 3. Repayment terms: Define the repayment schedule, including the due date(s) of payments, frequency (monthly, quarterly, etc.), and the total number of payments required. If installments are expected, provide a breakdown of their amounts. 4. Late fees and penalties: Outline the consequences for late or missed payments, such as imposing late fees or increasing interest rates. Ensure compliance with Illinois state laws regarding the maximum late fees allowed. 5. Collateral: If the loan is secured by collateral, describe the collateral in detail, including its location and estimated value. If there are any conditions or restrictions related to the collateral, include them as well. 6. Acceleration clause: Include an acceleration clause that allows the lender to demand immediate payment of the entire outstanding balance upon the occurrence of specific events, such as default or bankruptcy of the borrower. 7. Default and remedies: Clearly define what constitutes a default and specify the actions the lender can take in case of default. This may include demanding immediate payment, pursuing legal action, or applying additional penalties. 8. Governing law: Specify that the promissory note will be governed by and construed in accordance with the laws of Illinois, particularly Cook County, and any disputes will be resolved in courts located in Cook County. 9. Signatures and witnesses: Include spaces for both parties' signatures, their printed names, and the date of execution. Additionally, include an area for witnesses to sign, although witness signatures may not always be required. Types of Cook Illinois Checklists — Items to Consider for Drafting a Promissory Note: 1. Basic Promissory Note Checklist: This checklist covers the essential elements needed for drafting a standard promissory note, including the loan amount, repayment terms, interest rate, and borrower/lender information. 2. Secured Promissory Note Checklist: This checklist focuses on drafting a promissory note that is secured by collateral. It includes additional considerations such as collateral description, valuation, and conditions relating to the collateral. 3. Adjustable Rate Promissory Note Checklist: If the interest rate is adjustable or variable, this checklist provides guidance on drafting a promissory note that includes the necessary provisions for an adjustable rate, detailing the adjustment period, index, and margin. By following these checklists and considering the specific requirements of Cook County, Illinois, you can ensure your promissory note is comprehensive, legally compliant, and adequately protects the rights of both the borrower and lender.

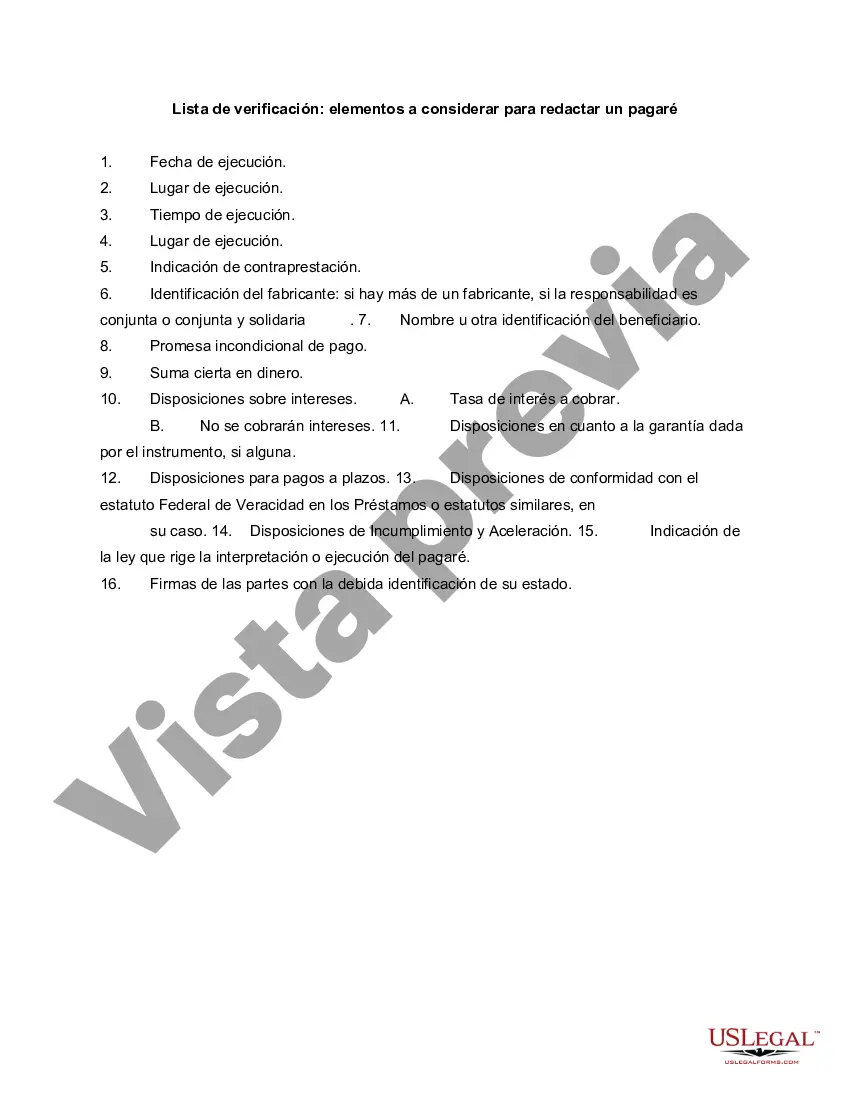

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.