A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

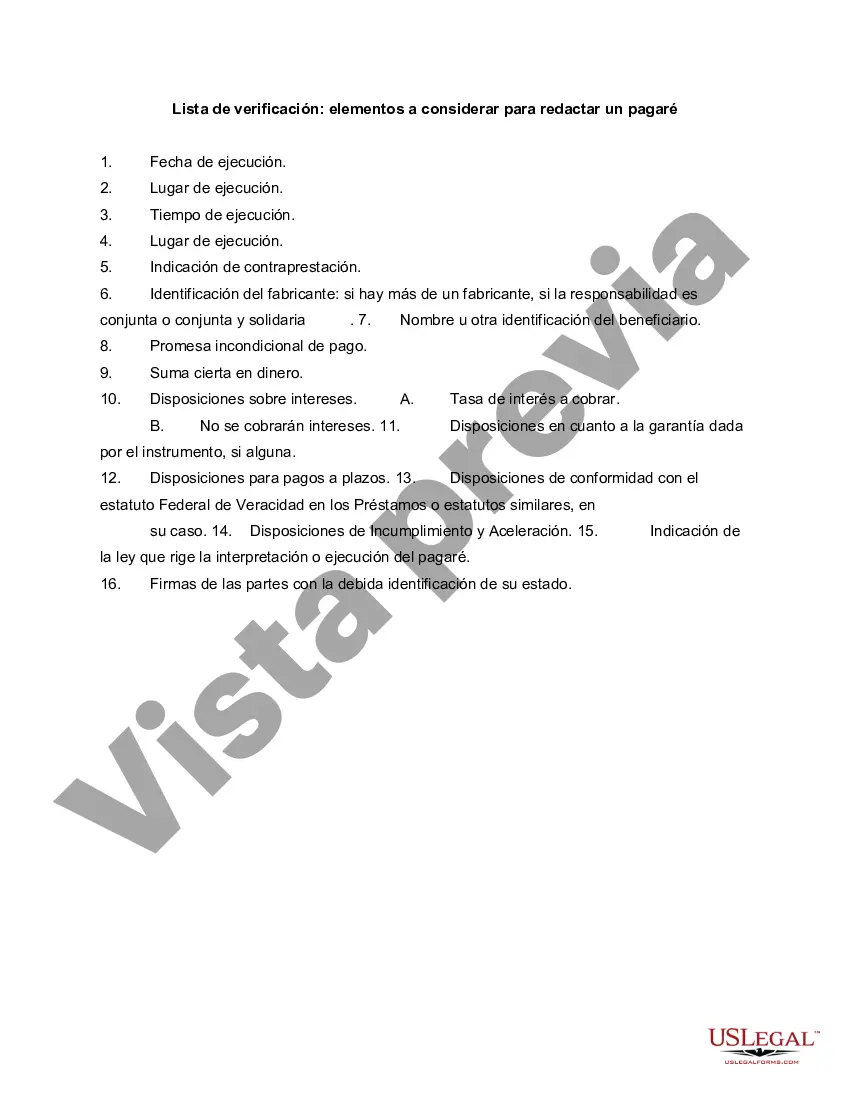

Franklin Ohio Checklist — Items to Consider for Drafting a Promissory Note When creating a promissory note in Franklin, Ohio, it is crucial to include several essential elements to ensure its validity and enforceability. A promissory note is a legally binding document that outlines the terms and conditions of a loan or debt agreement between a lender and a borrower. Here are important items to consider when drafting a promissory note in Franklin, Ohio: 1. Parties involved: Identify and provide detailed information about both the lender (creditor) and borrower (debtor). Include their full legal names, addresses, and contact details. 2. Date: Clearly state the date when the promissory note is created. This helps establish the timeline for repayment and reflects when the agreement was made. 3. Principal amount: Specify the total amount borrowed or owed by the borrower. State this in both written and numeric form to avoid any confusion or misinterpretation. 4. Interest rate: Determine the interest rate applicable to the loan. Describe whether it is a fixed rate or a variable rate that may change over time. Be sure to comply with state usury laws, which set maximum interest rates that can be charged. 5. Repayment terms: Clearly define the repayment terms, including the amount of each installment or payment, the frequency (monthly, quarterly, etc.), and the due dates. Also, mention the consequences of late or missed payments if any. 6. Security or collateral: Indicate whether the loan is secured or unsecured. If secured, describe the collateral provided by the borrower (e.g., real estate, vehicles, etc.). Clearly outline the rights and obligations of both parties regarding the pledged assets. 7. Governing law: State that the promissory note is governed by the laws of Ohio, particularly those of Franklin County if applicable. This ensures proper jurisdiction in case of a dispute. 8. Events of default: Specify circumstances that constitute a default on the loan, such as failure to make timely payments or breaching any other terms of the agreement. Clearly outline the consequences of default, including acceleration clauses, collection costs, and attorney fees. 9. Legal counsel: Suggest that both parties consult legal counsel before signing the promissory note. This ensures that they fully understand and agree to the terms. It may also provide extra protection and clarity, particularly regarding state-specific regulations. 10. Signatures: Include a space for both parties to sign and date the promissory note. Signatures affirm consent to the terms and show the agreement's validity. It is essential to note that this checklist is not exhaustive, and seeking legal advice is highly recommended. Different types of promissory notes may exist depending on specific circumstances, such as secured promissory notes, unsecured promissory notes, demand promissory notes, or installment promissory notes. Each type may have different considerations, requirements, and specific clauses to address unique loan conditions in Franklin, Ohio.Franklin Ohio Checklist — Items to Consider for Drafting a Promissory Note When creating a promissory note in Franklin, Ohio, it is crucial to include several essential elements to ensure its validity and enforceability. A promissory note is a legally binding document that outlines the terms and conditions of a loan or debt agreement between a lender and a borrower. Here are important items to consider when drafting a promissory note in Franklin, Ohio: 1. Parties involved: Identify and provide detailed information about both the lender (creditor) and borrower (debtor). Include their full legal names, addresses, and contact details. 2. Date: Clearly state the date when the promissory note is created. This helps establish the timeline for repayment and reflects when the agreement was made. 3. Principal amount: Specify the total amount borrowed or owed by the borrower. State this in both written and numeric form to avoid any confusion or misinterpretation. 4. Interest rate: Determine the interest rate applicable to the loan. Describe whether it is a fixed rate or a variable rate that may change over time. Be sure to comply with state usury laws, which set maximum interest rates that can be charged. 5. Repayment terms: Clearly define the repayment terms, including the amount of each installment or payment, the frequency (monthly, quarterly, etc.), and the due dates. Also, mention the consequences of late or missed payments if any. 6. Security or collateral: Indicate whether the loan is secured or unsecured. If secured, describe the collateral provided by the borrower (e.g., real estate, vehicles, etc.). Clearly outline the rights and obligations of both parties regarding the pledged assets. 7. Governing law: State that the promissory note is governed by the laws of Ohio, particularly those of Franklin County if applicable. This ensures proper jurisdiction in case of a dispute. 8. Events of default: Specify circumstances that constitute a default on the loan, such as failure to make timely payments or breaching any other terms of the agreement. Clearly outline the consequences of default, including acceleration clauses, collection costs, and attorney fees. 9. Legal counsel: Suggest that both parties consult legal counsel before signing the promissory note. This ensures that they fully understand and agree to the terms. It may also provide extra protection and clarity, particularly regarding state-specific regulations. 10. Signatures: Include a space for both parties to sign and date the promissory note. Signatures affirm consent to the terms and show the agreement's validity. It is essential to note that this checklist is not exhaustive, and seeking legal advice is highly recommended. Different types of promissory notes may exist depending on specific circumstances, such as secured promissory notes, unsecured promissory notes, demand promissory notes, or installment promissory notes. Each type may have different considerations, requirements, and specific clauses to address unique loan conditions in Franklin, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.