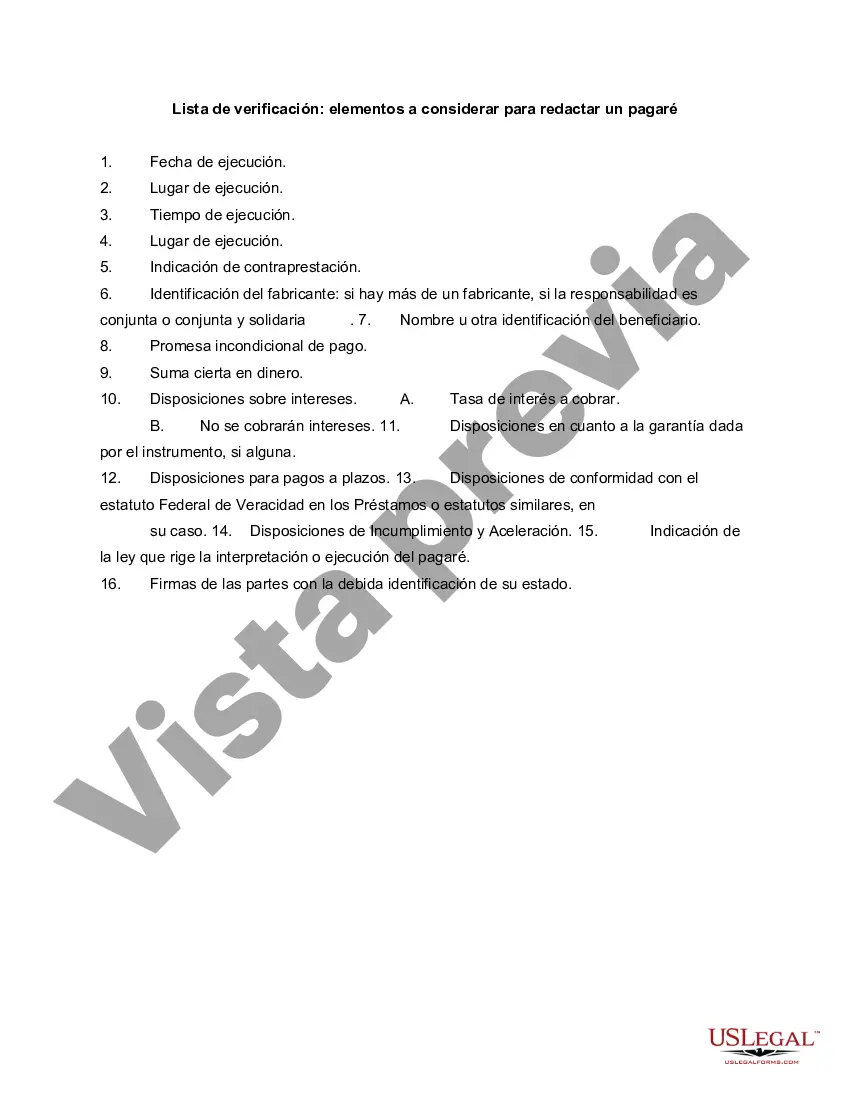

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Title: Harris Texas Checklist — Items to Consider for Drafting a Promissory Note Introduction: A promissory note is a legal instrument that outlines the terms of a loan agreement between a lender and a borrower. Drafting a well-structured promissory note is crucial for both parties involved to protect their rights and ensure clarity. This article aims to provide a comprehensive checklist of essential elements to consider when drafting a promissory note specifically in Harris, Texas. 1. Parties Involved: Clearly identify the lender (also called the payee) and the borrower (also called the maker) in the promissory note. Include their legal names, addresses, and contact information. Additionally, specify if the lender intends to assign or sell the promissory note to a third party. 2. Loan Amount and Repayment Terms: Specify the exact amount of the loan, whether it's in dollars or a designated currency. Outline the repayment terms, including the frequency of payments (monthly, quarterly, etc.), due dates, interest rates, and any penalties for late payments. 3. Interest Rates and Late Fees: Clearly state the interest rate applicable to the loan and define whether it is simple or compound interest. If late fees or penalties apply for non-payment or late payments, detail them explicitly in the promissory note. 4. Collateral or Security: If the promissory note is secured by any collateral or assets (real estate, vehicles, equipment, etc.), describe them precisely, including their location, value, and legal descriptions. Clearly outline what happens if the borrower defaults on the loan and how collateral can be seized, sold, or repossessed. 5. Governing Law and Jurisdiction: Specify that the promissory note will be governed by the laws of the state of Texas, specifically Harris County. Include a clause indicating that any disputes or legal actions related to the promissory note will be resolved in a specific Harris County court. 6. Signatures and Date: Include spaces for the printed names, signatures, and dates of both the lender and borrower on the promissory note. Emphasize the importance of ensuring the document is signed in front of a notary public to add an extra layer of authenticity. Types of Harris Texas Checklist — Items to Consider for Drafting a Promissory Note: 1. Secured Promissory Note — This checklist focuses on drafting a promissory note that includes collateral or security to protect the lender's interests. 2. Unsecured Promissory Note — This checklist focuses on drafting a promissory note where no specific collateral is involved, making the loan riskier for the lender. 3. Simple Promissory Note — This checklist outlines the essential elements required for drafting a basic promissory note. 4. Promissory Note with Loan Modification — This checklist includes considerations for modifying an existing promissory note, such as altering the repayment terms, interest rates, or extending the repayment period. Remember to consult with legal professionals or seek legal advice to ensure that the drafted promissory note complies with all applicable laws and regulations in Harris, Texas. This checklist provides a general overview but should not be considered as legal advice.Title: Harris Texas Checklist — Items to Consider for Drafting a Promissory Note Introduction: A promissory note is a legal instrument that outlines the terms of a loan agreement between a lender and a borrower. Drafting a well-structured promissory note is crucial for both parties involved to protect their rights and ensure clarity. This article aims to provide a comprehensive checklist of essential elements to consider when drafting a promissory note specifically in Harris, Texas. 1. Parties Involved: Clearly identify the lender (also called the payee) and the borrower (also called the maker) in the promissory note. Include their legal names, addresses, and contact information. Additionally, specify if the lender intends to assign or sell the promissory note to a third party. 2. Loan Amount and Repayment Terms: Specify the exact amount of the loan, whether it's in dollars or a designated currency. Outline the repayment terms, including the frequency of payments (monthly, quarterly, etc.), due dates, interest rates, and any penalties for late payments. 3. Interest Rates and Late Fees: Clearly state the interest rate applicable to the loan and define whether it is simple or compound interest. If late fees or penalties apply for non-payment or late payments, detail them explicitly in the promissory note. 4. Collateral or Security: If the promissory note is secured by any collateral or assets (real estate, vehicles, equipment, etc.), describe them precisely, including their location, value, and legal descriptions. Clearly outline what happens if the borrower defaults on the loan and how collateral can be seized, sold, or repossessed. 5. Governing Law and Jurisdiction: Specify that the promissory note will be governed by the laws of the state of Texas, specifically Harris County. Include a clause indicating that any disputes or legal actions related to the promissory note will be resolved in a specific Harris County court. 6. Signatures and Date: Include spaces for the printed names, signatures, and dates of both the lender and borrower on the promissory note. Emphasize the importance of ensuring the document is signed in front of a notary public to add an extra layer of authenticity. Types of Harris Texas Checklist — Items to Consider for Drafting a Promissory Note: 1. Secured Promissory Note — This checklist focuses on drafting a promissory note that includes collateral or security to protect the lender's interests. 2. Unsecured Promissory Note — This checklist focuses on drafting a promissory note where no specific collateral is involved, making the loan riskier for the lender. 3. Simple Promissory Note — This checklist outlines the essential elements required for drafting a basic promissory note. 4. Promissory Note with Loan Modification — This checklist includes considerations for modifying an existing promissory note, such as altering the repayment terms, interest rates, or extending the repayment period. Remember to consult with legal professionals or seek legal advice to ensure that the drafted promissory note complies with all applicable laws and regulations in Harris, Texas. This checklist provides a general overview but should not be considered as legal advice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.