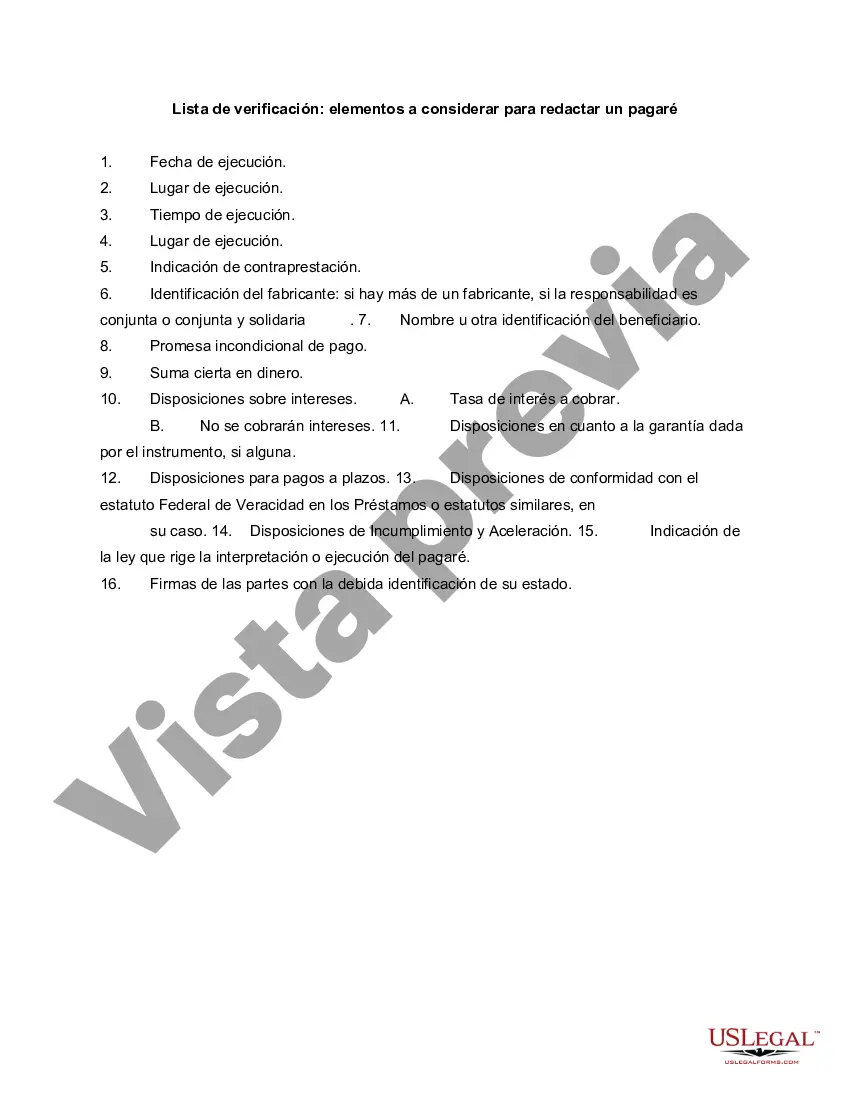

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Hennepin County, Minnesota is a diverse and vibrant region located in the central part of the state. Home to the bustling city of Minneapolis, Hennepin County offers a wide range of opportunities for businesses and individuals alike. When it comes to drafting a promissory note, there are several key items that should be considered to ensure a legally binding and comprehensive agreement. 1. Parties involved: The promissory note should clearly identify the lender and the borrower. Include their full legal names, addresses, and contact information. 2. Loan amount and repayment terms: Specify the exact amount of money being borrowed and outline how and when the borrower will repay the loan. This includes establishing the interest rate, repayment schedule, and any applicable late fees or penalties. 3. Definition of default: Clearly define what constitutes a default on the loan. This may include missed payments, failure to maintain insurance, or any other agreed-upon terms that, if violated, would trigger default. 4. Collateral: If the loan is secured by collateral, describe the asset(s) being used as security in detail. This can be real estate, equipment, or any other valuable property. 5. Governing law and jurisdiction: Identify the applicable laws that will govern the promissory note and specify which courts will have jurisdiction in case of a dispute. In the case of Hennepin County, Minnesota, this would typically be Minnesota state laws and the Hennepin County court system. 6. Signatures and witnesses: Ensure that both parties sign the promissory note and have their signatures witnessed by a third party. This helps to validate the document and prevents any potential claims of forgery or lack of consent. Some additional types of Hennepin Minnesota checklist items to consider for drafting a promissory note may include: — Secured vs. unsecured promissory note: A secured promissory note is backed by collateral, whereas an unsecured promissory note does not require any collateral. — Term promissory note: This type of promissory note specifies a fixed repayment date, such as a balloon payment at the end of a specific term. — Installment promissory note: With an installment promissory note, the borrower repays the loan in regular installments over a set period of time, usually with interest. — Demand promissory note: This type of note allows the lender to request repayment in full at any time, making it more flexible for the lender. Overall, these checklist items provide guidance when drafting a promissory note in Hennepin County, Minnesota, to ensure all necessary details are considered and included. It is always recommended consulting with legal professionals or utilize pre-drafted templates to ensure compliance with local laws and regulations.Hennepin County, Minnesota is a diverse and vibrant region located in the central part of the state. Home to the bustling city of Minneapolis, Hennepin County offers a wide range of opportunities for businesses and individuals alike. When it comes to drafting a promissory note, there are several key items that should be considered to ensure a legally binding and comprehensive agreement. 1. Parties involved: The promissory note should clearly identify the lender and the borrower. Include their full legal names, addresses, and contact information. 2. Loan amount and repayment terms: Specify the exact amount of money being borrowed and outline how and when the borrower will repay the loan. This includes establishing the interest rate, repayment schedule, and any applicable late fees or penalties. 3. Definition of default: Clearly define what constitutes a default on the loan. This may include missed payments, failure to maintain insurance, or any other agreed-upon terms that, if violated, would trigger default. 4. Collateral: If the loan is secured by collateral, describe the asset(s) being used as security in detail. This can be real estate, equipment, or any other valuable property. 5. Governing law and jurisdiction: Identify the applicable laws that will govern the promissory note and specify which courts will have jurisdiction in case of a dispute. In the case of Hennepin County, Minnesota, this would typically be Minnesota state laws and the Hennepin County court system. 6. Signatures and witnesses: Ensure that both parties sign the promissory note and have their signatures witnessed by a third party. This helps to validate the document and prevents any potential claims of forgery or lack of consent. Some additional types of Hennepin Minnesota checklist items to consider for drafting a promissory note may include: — Secured vs. unsecured promissory note: A secured promissory note is backed by collateral, whereas an unsecured promissory note does not require any collateral. — Term promissory note: This type of promissory note specifies a fixed repayment date, such as a balloon payment at the end of a specific term. — Installment promissory note: With an installment promissory note, the borrower repays the loan in regular installments over a set period of time, usually with interest. — Demand promissory note: This type of note allows the lender to request repayment in full at any time, making it more flexible for the lender. Overall, these checklist items provide guidance when drafting a promissory note in Hennepin County, Minnesota, to ensure all necessary details are considered and included. It is always recommended consulting with legal professionals or utilize pre-drafted templates to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.