A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

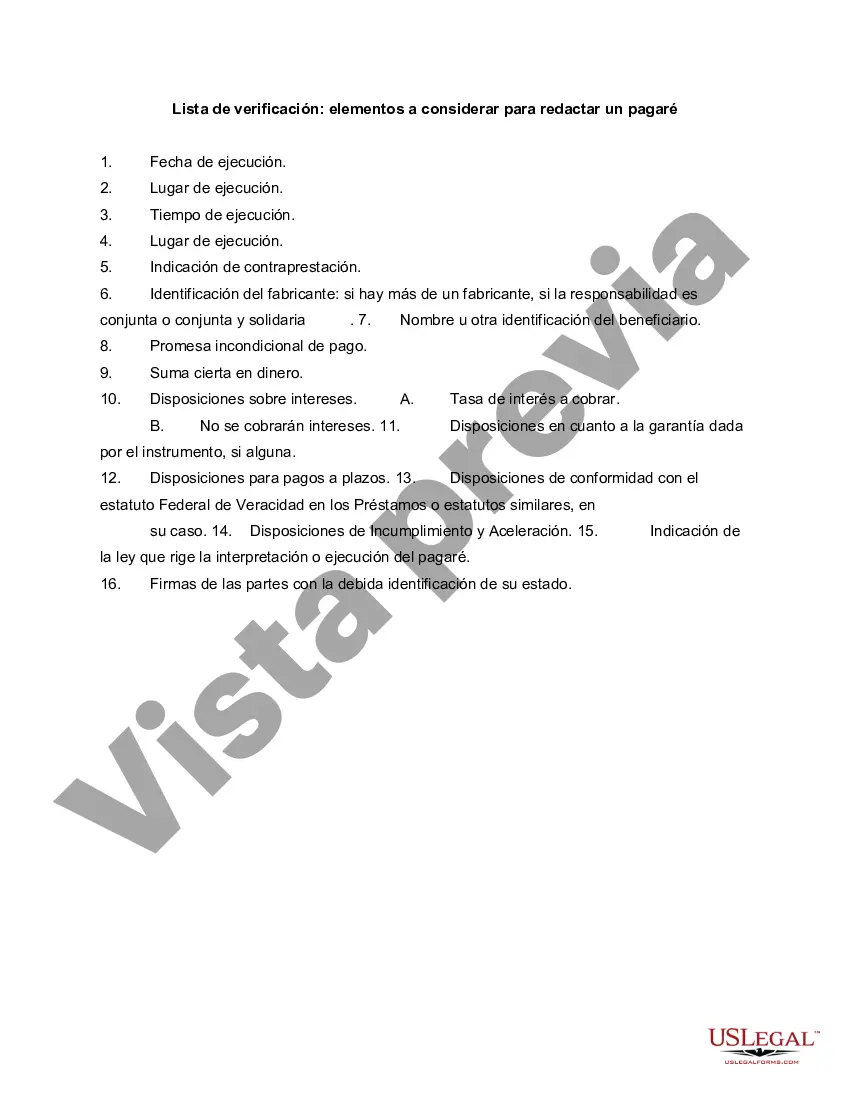

A promissory note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. The King Washington Checklist provides a comprehensive guide for drafting a promissory note, ensuring all necessary aspects are considered. Whether you are a lender or borrower, it is essential to carefully review the following items when creating a promissory note. 1. Parties Involved: Clearly state the full names and contact information of both the lender and borrower. Identify their roles and responsibilities throughout the loan agreement. 2. Loan Amount and Interest Rate: Specify the exact amount of money being lent and the agreed-upon interest rate. This information is crucial for calculating repayment amounts. 3. Repayment Terms: Determine the repayment period and method of payment. You can choose regular monthly installments, lump-sum payments, or any other suitable arrangement. Be specific about the due dates and frequency of payments. 4. Late Payment Penalties: It is important to establish the consequences of late or missed payments. Consider including the interest rate that will be applied to overdue amounts or any additional charges. 5. Collateral: If the loan is secured, describe the collateral being used to secure the debt. This could include personal property, real estate, or any other valuable assets. 6. Default Clause: Define the conditions under which the borrower would be considered in default, such as failure to make payments for a certain period. Outline the actions the lender can take in case of default, such as accelerating the debt or pursuing legal remedies. 7. Governing Law: Determine the jurisdiction whose laws will govern the promissory note. This is typically the country or state where the loan agreement is being executed. 8. Confidentiality Clause: If the promissory note contains sensitive information, it may be prudent to include a confidentiality clause to protect the parties involved. 9. Co-signers or Guarantors: If third parties are involved in guaranteeing the repayment of the loan, clearly state their roles and responsibilities within the promissory note. 10. Notary Public and Witnesses: Depending on the legal requirements, consider involving a notary public to witness the signing of the promissory note. Some jurisdictions may also require additional witnesses. Different types of promissory notes may exist based on specific circumstances and requirements. For example, a demand promissory note establishes that the lender can request full repayment at any time, while an installment promissory note sets a fixed payment schedule. Other types include secured and unsecured promissory notes, variable interest rate promissory notes, and balloon promissory notes with a larger payment due at the end of the term. By adhering to the King Washington Checklist and carefully considering these key items, you can create a well-drafted promissory note that protects the interests of all parties involved in the loan agreement.A promissory note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. The King Washington Checklist provides a comprehensive guide for drafting a promissory note, ensuring all necessary aspects are considered. Whether you are a lender or borrower, it is essential to carefully review the following items when creating a promissory note. 1. Parties Involved: Clearly state the full names and contact information of both the lender and borrower. Identify their roles and responsibilities throughout the loan agreement. 2. Loan Amount and Interest Rate: Specify the exact amount of money being lent and the agreed-upon interest rate. This information is crucial for calculating repayment amounts. 3. Repayment Terms: Determine the repayment period and method of payment. You can choose regular monthly installments, lump-sum payments, or any other suitable arrangement. Be specific about the due dates and frequency of payments. 4. Late Payment Penalties: It is important to establish the consequences of late or missed payments. Consider including the interest rate that will be applied to overdue amounts or any additional charges. 5. Collateral: If the loan is secured, describe the collateral being used to secure the debt. This could include personal property, real estate, or any other valuable assets. 6. Default Clause: Define the conditions under which the borrower would be considered in default, such as failure to make payments for a certain period. Outline the actions the lender can take in case of default, such as accelerating the debt or pursuing legal remedies. 7. Governing Law: Determine the jurisdiction whose laws will govern the promissory note. This is typically the country or state where the loan agreement is being executed. 8. Confidentiality Clause: If the promissory note contains sensitive information, it may be prudent to include a confidentiality clause to protect the parties involved. 9. Co-signers or Guarantors: If third parties are involved in guaranteeing the repayment of the loan, clearly state their roles and responsibilities within the promissory note. 10. Notary Public and Witnesses: Depending on the legal requirements, consider involving a notary public to witness the signing of the promissory note. Some jurisdictions may also require additional witnesses. Different types of promissory notes may exist based on specific circumstances and requirements. For example, a demand promissory note establishes that the lender can request full repayment at any time, while an installment promissory note sets a fixed payment schedule. Other types include secured and unsecured promissory notes, variable interest rate promissory notes, and balloon promissory notes with a larger payment due at the end of the term. By adhering to the King Washington Checklist and carefully considering these key items, you can create a well-drafted promissory note that protects the interests of all parties involved in the loan agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.