A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

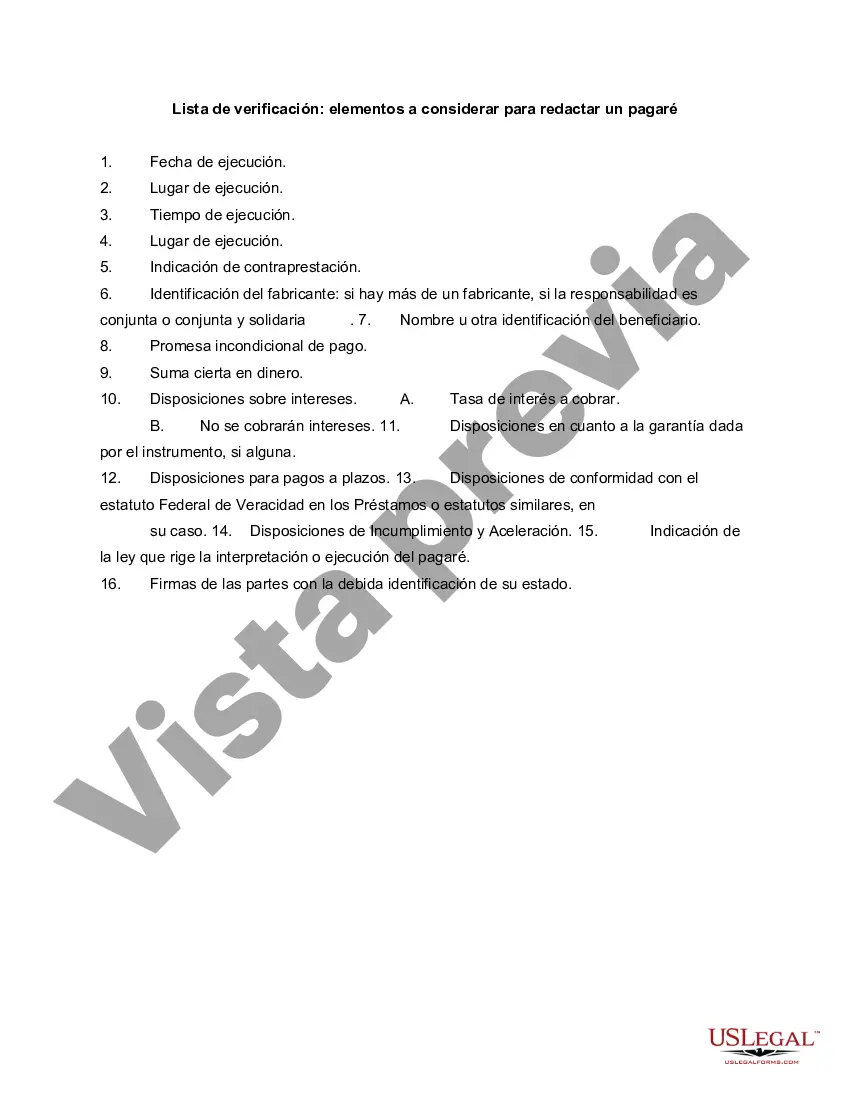

Los Angeles California Checklist — Items to Consider for Drafting a Promissory Note: 1. Purpose: Clearly state the purpose of the promissory note, such as a loan, business transaction, or purchase agreement. 2. Parties involved: Identify the borrower (obliged) and lender (obliged) in the promissory note. Include their full legal names, addresses, and contact information. 3. Loan amount and interest: Specify the principal amount being borrowed and the agreed interest rate. Ensure compliance with the state's usury laws, especially in California. 4. Repayment terms: Outline the repayment schedule, including the frequency (monthly, quarterly, etc.), due dates, and the method of payment (check, bank transfer, etc.). Also, indicate if there are any penalties for late payments. 5. Security provisions: Consider whether the promissory note will be secured by collateral, such as real estate or personal property. If so, provide a clear description of the collateral and its value. 6. Prepayment options: Decide whether the borrower has the option to prepay the loan without incurring any penalties or charges. If prepayment penalties exist, specify them in the promissory note. 7. Default and remedies: Clearly state the consequences if the borrower fails to repay the loan, such as late fees, acceleration of the debt, or the lender's right to pursue legal action or seize collateral. 8. Governing law: Specify that the promissory note is subject to the laws of the state of California and the jurisdiction of Los Angeles County. 9. Signatures and notarization: Ensure that both parties sign the promissory note and have their signatures notarized to make it legally enforceable. 10. Legal advice: Mention that the borrower and lender should seek legal advice before signing the promissory note to ensure compliance with all applicable laws and protect their respective rights. Different types of Los Angeles California Checklist — Items to Consider for Drafting a Promissory Note: 1. Personal Loan Promissory Note: Designed for loans between individuals, friends, or family members. 2. Business Loan Promissory Note: Tailored for loans between a business entity and an individual or another business. 3. Real Estate Promissory Note: Used when a loan is secured by real estate, such as a mortgage or a deed of trust. 4. Promissory Note with Collateral: Pertains to loans that require collateral, which could be personal property like vehicles, jewelry, or investment accounts. 5. Unsecured Promissory Note: Suitable for loans without any collateral or security provisions involved. Remember that these checklists serve as a general guide and should not substitute legal advice.Los Angeles California Checklist — Items to Consider for Drafting a Promissory Note: 1. Purpose: Clearly state the purpose of the promissory note, such as a loan, business transaction, or purchase agreement. 2. Parties involved: Identify the borrower (obliged) and lender (obliged) in the promissory note. Include their full legal names, addresses, and contact information. 3. Loan amount and interest: Specify the principal amount being borrowed and the agreed interest rate. Ensure compliance with the state's usury laws, especially in California. 4. Repayment terms: Outline the repayment schedule, including the frequency (monthly, quarterly, etc.), due dates, and the method of payment (check, bank transfer, etc.). Also, indicate if there are any penalties for late payments. 5. Security provisions: Consider whether the promissory note will be secured by collateral, such as real estate or personal property. If so, provide a clear description of the collateral and its value. 6. Prepayment options: Decide whether the borrower has the option to prepay the loan without incurring any penalties or charges. If prepayment penalties exist, specify them in the promissory note. 7. Default and remedies: Clearly state the consequences if the borrower fails to repay the loan, such as late fees, acceleration of the debt, or the lender's right to pursue legal action or seize collateral. 8. Governing law: Specify that the promissory note is subject to the laws of the state of California and the jurisdiction of Los Angeles County. 9. Signatures and notarization: Ensure that both parties sign the promissory note and have their signatures notarized to make it legally enforceable. 10. Legal advice: Mention that the borrower and lender should seek legal advice before signing the promissory note to ensure compliance with all applicable laws and protect their respective rights. Different types of Los Angeles California Checklist — Items to Consider for Drafting a Promissory Note: 1. Personal Loan Promissory Note: Designed for loans between individuals, friends, or family members. 2. Business Loan Promissory Note: Tailored for loans between a business entity and an individual or another business. 3. Real Estate Promissory Note: Used when a loan is secured by real estate, such as a mortgage or a deed of trust. 4. Promissory Note with Collateral: Pertains to loans that require collateral, which could be personal property like vehicles, jewelry, or investment accounts. 5. Unsecured Promissory Note: Suitable for loans without any collateral or security provisions involved. Remember that these checklists serve as a general guide and should not substitute legal advice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.