A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Maricopa, Arizona, is a vibrant city situated in Pinal County. When drafting a promissory note in Maricopa, there are several important factors and considerations to keep in mind. Ensuring accuracy and legality is crucial to protect the interests of all parties involved. Below is a detailed checklist of items to consider when drafting a promissory note in Maricopa, Arizona: 1. Parties Involved: Clearly identify the borrower (promise) and lender (promise) in the promissory note. Include their full legal names, addresses, and contact information. 2. Loan Details: Specify the loan amount and whether it is a fixed or variable interest rate. Outline the repayment terms, including the due date, frequency of payments, and any grace period. 3. Payment Schedule: Clearly state the agreed-upon payment schedule, including the amount due, due dates, and acceptable modes of payment (e.g., check, bank transfer). 4. Interest Rate: State the interest rate charged on the loan, if applicable. Ensure compliance with usury laws, which regulate maximum interest rates. 5. Late Payment Penalties: Specify the consequences of late payments, such as late fees or increased interest rates. Comply with Arizona state laws regarding permissible late payment penalties. 6. Security or Collateral: Determine whether the loan is secured or unsecured. If there is collateral involved, describe it in detail, including its estimated value, location, and any necessary insurance requirements. 7. Default Provision: Clearly define what constitutes a default, such as missed payments, and outline the legal consequences for defaulting on the loan. Specify any additional fees or the lender's right to accelerate the loan. 8. Governing Law: State that the promissory note will be governed by and interpreted in accordance with the laws of the state of Arizona and Maricopa County. 9. Legal and Professional Advice: Advise the borrower to seek legal and financial counsel regarding the terms and implications of the promissory note. Include a statement indicating that both parties have had the opportunity to review and consult professionals. 10. Signatures and Witnesses: Include spaces for the borrower's and lender's signatures, as well as the date the promissory note is executed. Depending on the situation, consider including spaces for witnesses' signatures. Different types of promissory notes in Maricopa, Arizona, may include: 1. Mortgage Promissory Note: A promissory note used specifically for mortgage loans, where the property acts as collateral. 2. Business Promissory Note: Used for business loans, usually involving more significant amounts and complex terms, such as revenue-sharing agreements or balloon payments. 3. Student Loan Promissory Note: Used for educational loans, outlining repayment terms and any deferment or forbearance options. 4. Personal Promissory Note: A general promissory note used for personal loans between individuals, friends, or family members. Remember, when drafting a promissory note in Maricopa, Arizona, it is essential to consult with a legal professional to ensure compliance with applicable laws, safeguard both parties' interests, and ensure the enforceability of the note.Maricopa, Arizona, is a vibrant city situated in Pinal County. When drafting a promissory note in Maricopa, there are several important factors and considerations to keep in mind. Ensuring accuracy and legality is crucial to protect the interests of all parties involved. Below is a detailed checklist of items to consider when drafting a promissory note in Maricopa, Arizona: 1. Parties Involved: Clearly identify the borrower (promise) and lender (promise) in the promissory note. Include their full legal names, addresses, and contact information. 2. Loan Details: Specify the loan amount and whether it is a fixed or variable interest rate. Outline the repayment terms, including the due date, frequency of payments, and any grace period. 3. Payment Schedule: Clearly state the agreed-upon payment schedule, including the amount due, due dates, and acceptable modes of payment (e.g., check, bank transfer). 4. Interest Rate: State the interest rate charged on the loan, if applicable. Ensure compliance with usury laws, which regulate maximum interest rates. 5. Late Payment Penalties: Specify the consequences of late payments, such as late fees or increased interest rates. Comply with Arizona state laws regarding permissible late payment penalties. 6. Security or Collateral: Determine whether the loan is secured or unsecured. If there is collateral involved, describe it in detail, including its estimated value, location, and any necessary insurance requirements. 7. Default Provision: Clearly define what constitutes a default, such as missed payments, and outline the legal consequences for defaulting on the loan. Specify any additional fees or the lender's right to accelerate the loan. 8. Governing Law: State that the promissory note will be governed by and interpreted in accordance with the laws of the state of Arizona and Maricopa County. 9. Legal and Professional Advice: Advise the borrower to seek legal and financial counsel regarding the terms and implications of the promissory note. Include a statement indicating that both parties have had the opportunity to review and consult professionals. 10. Signatures and Witnesses: Include spaces for the borrower's and lender's signatures, as well as the date the promissory note is executed. Depending on the situation, consider including spaces for witnesses' signatures. Different types of promissory notes in Maricopa, Arizona, may include: 1. Mortgage Promissory Note: A promissory note used specifically for mortgage loans, where the property acts as collateral. 2. Business Promissory Note: Used for business loans, usually involving more significant amounts and complex terms, such as revenue-sharing agreements or balloon payments. 3. Student Loan Promissory Note: Used for educational loans, outlining repayment terms and any deferment or forbearance options. 4. Personal Promissory Note: A general promissory note used for personal loans between individuals, friends, or family members. Remember, when drafting a promissory note in Maricopa, Arizona, it is essential to consult with a legal professional to ensure compliance with applicable laws, safeguard both parties' interests, and ensure the enforceability of the note.

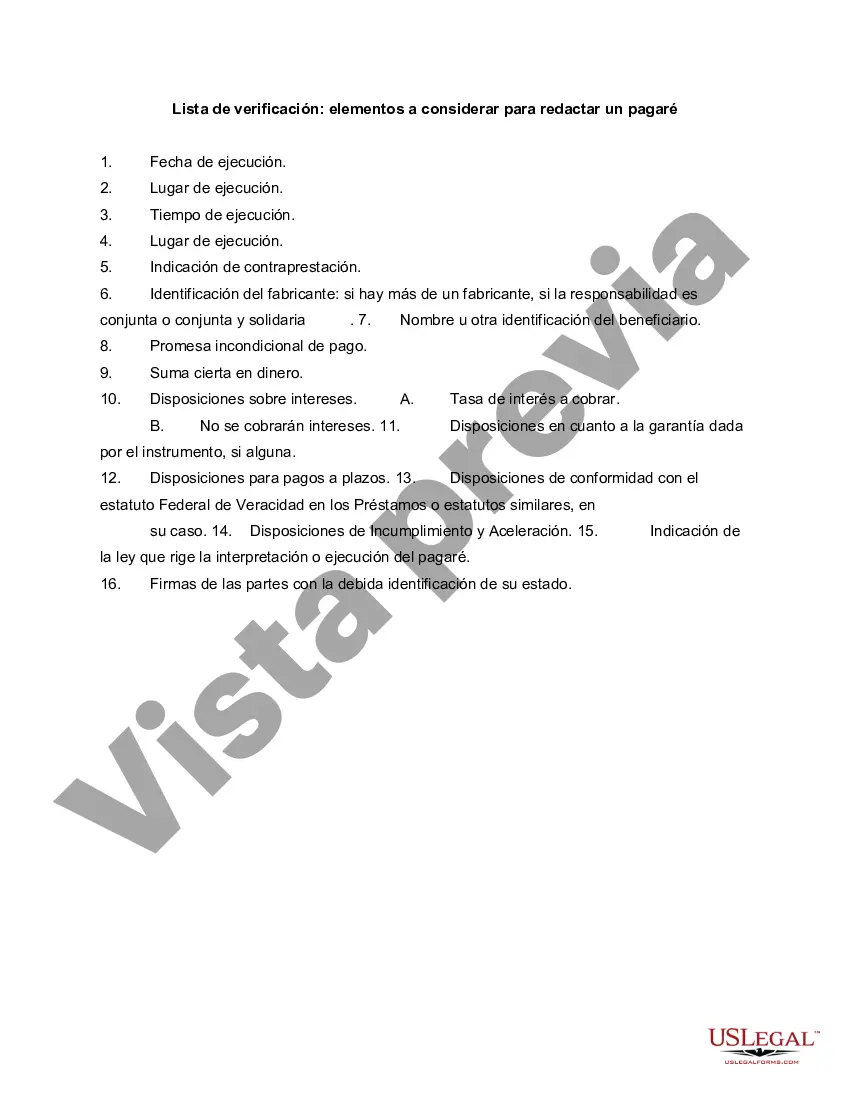

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.