A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

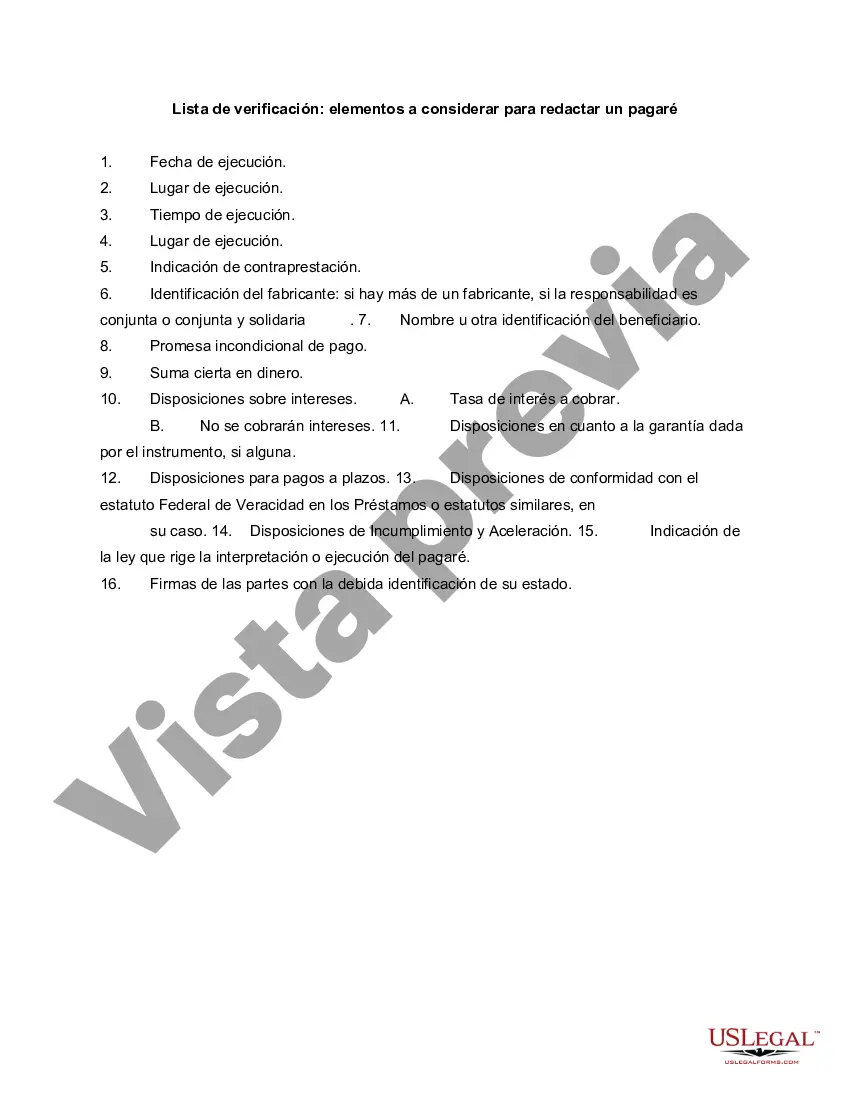

Mecklenburg North Carolina is a county located in the state of North Carolina, with Charlotte being its largest and most populous city. When drafting a promissory note in Mecklenburg County, there are several important factors to consider ensuring it complies with local laws and regulations. Here is a checklist of items to consider: 1. Legal Requirements: Familiarize yourself with the laws governing promissory notes in Mecklenburg County. Consult with an attorney or research the North Carolina General Statutes to understand the specific legal requirements for drafting a valid promissory note. 2. Parties Involved: Clearly identify and provide the full legal names, addresses, and contact information for all parties involved in the promissory note, including the lender (also known as the payee) and the borrower (also known as the maker). 3. Loan Amount and Interest Rate: Specify the principal loan amount, expressed in USD, and the interest rate charged on the loan. It is important to include both the annual interest rate and specify whether it is fixed or variable. 4. Repayment Terms: Outline the terms for repayment, including the number of installments, frequency (monthly, bi-monthly, etc.), and due dates for each payment. Specify the repayment start date and any late payment penalties or grace periods. 5. Collateral: If the promissory note is secured by collateral, such as real estate or personal property, clearly describe the collateral in detail. Include the property address, title information, and any existing liens or encumbrances. 6. Governing Law and Venue: Indicate that the promissory note will be governed by and construed in accordance with the laws of North Carolina, particularly Mecklenburg County. Specify the county where any legal disputes will be resolved. 7. Default and Remedies: Include provisions on what constitutes a default, such as missed payments or breaches of the agreement. Outline the remedies available to the lender, such as accelerating the loan, demanding full payment, or pursuing legal action. 8. Signatures and Notarization: Ensure that all parties involved sign the promissory note, including their full legal names and dates. Consider having the signatures notarized to strengthen the validity of the document. Types of Mecklenburg North Carolina Checklist — Items to Consider for Drafting a Promissory Note: 1. Personal Promissory Note: Used for loans made between individuals, such as friends or family members, without involving financial institutions. 2. Business Promissory Note: Pertains to loans made within a business context, involving companies, corporations, or partnerships. 3. Real Estate Promissory Note: Specifically used when a loan is secured by real estate, allowing the lender to foreclose on the property in case of default. 4. Secured Promissory Note: A promissory note backed by collateral to provide additional security for the lender, usually requiring a specific asset as collateral. 5. Unsecured Promissory Note: A promissory note without any specified collateral, relying solely on the borrower's creditworthiness and trust. It is crucial to customize the promissory note according to the specific circumstances of the loan agreement and seek legal advice when necessary.Mecklenburg North Carolina is a county located in the state of North Carolina, with Charlotte being its largest and most populous city. When drafting a promissory note in Mecklenburg County, there are several important factors to consider ensuring it complies with local laws and regulations. Here is a checklist of items to consider: 1. Legal Requirements: Familiarize yourself with the laws governing promissory notes in Mecklenburg County. Consult with an attorney or research the North Carolina General Statutes to understand the specific legal requirements for drafting a valid promissory note. 2. Parties Involved: Clearly identify and provide the full legal names, addresses, and contact information for all parties involved in the promissory note, including the lender (also known as the payee) and the borrower (also known as the maker). 3. Loan Amount and Interest Rate: Specify the principal loan amount, expressed in USD, and the interest rate charged on the loan. It is important to include both the annual interest rate and specify whether it is fixed or variable. 4. Repayment Terms: Outline the terms for repayment, including the number of installments, frequency (monthly, bi-monthly, etc.), and due dates for each payment. Specify the repayment start date and any late payment penalties or grace periods. 5. Collateral: If the promissory note is secured by collateral, such as real estate or personal property, clearly describe the collateral in detail. Include the property address, title information, and any existing liens or encumbrances. 6. Governing Law and Venue: Indicate that the promissory note will be governed by and construed in accordance with the laws of North Carolina, particularly Mecklenburg County. Specify the county where any legal disputes will be resolved. 7. Default and Remedies: Include provisions on what constitutes a default, such as missed payments or breaches of the agreement. Outline the remedies available to the lender, such as accelerating the loan, demanding full payment, or pursuing legal action. 8. Signatures and Notarization: Ensure that all parties involved sign the promissory note, including their full legal names and dates. Consider having the signatures notarized to strengthen the validity of the document. Types of Mecklenburg North Carolina Checklist — Items to Consider for Drafting a Promissory Note: 1. Personal Promissory Note: Used for loans made between individuals, such as friends or family members, without involving financial institutions. 2. Business Promissory Note: Pertains to loans made within a business context, involving companies, corporations, or partnerships. 3. Real Estate Promissory Note: Specifically used when a loan is secured by real estate, allowing the lender to foreclose on the property in case of default. 4. Secured Promissory Note: A promissory note backed by collateral to provide additional security for the lender, usually requiring a specific asset as collateral. 5. Unsecured Promissory Note: A promissory note without any specified collateral, relying solely on the borrower's creditworthiness and trust. It is crucial to customize the promissory note according to the specific circumstances of the loan agreement and seek legal advice when necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.