A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

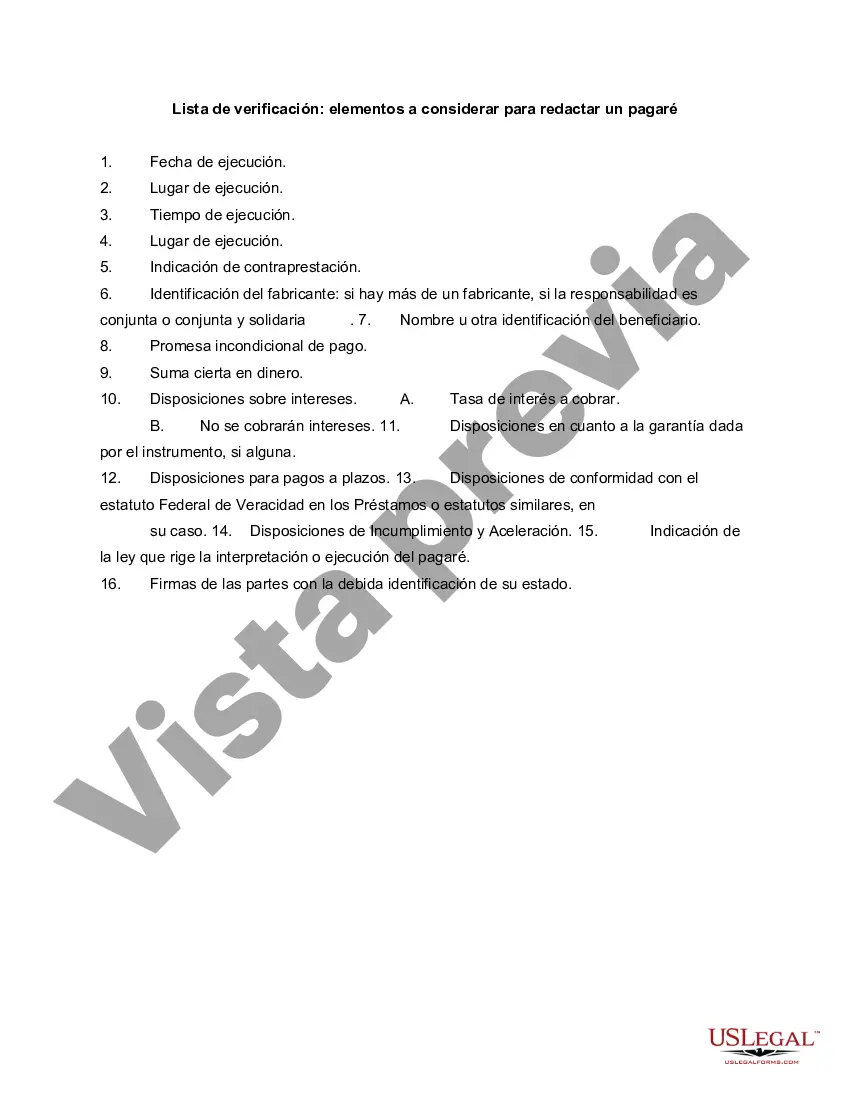

Nassau New York Checklist — Items to Consider for Drafting a Promissory Note When drafting a promissory note in Nassau, New York, it is essential to ensure that all relevant details and legal requirements are properly addressed. Here is a checklist of items to consider while drafting a promissory note in Nassau, New York: 1. Parties involved: Clearly identify the borrower (promise) and the lender (promise) along with their legal names and contact information. 2. Loan amount: Specify the exact amount of money being loaned, in both numeric and written forms, and ensure accuracy. 3. Interest rate: Determine the interest rate on the loan and specify whether it is fixed or variable. Include any additional charges or fees. 4. Repayment terms: Set the repayment term, including the start date and due date for each installment. Consider whether the loan will be repaid in equal installments or with a balloon payment at the end. 5. Payment schedule: Clearly outline the frequency of payments (e.g., monthly, quarterly) and the preferred method of payment (e.g., check, bank transfer). 6. Late fees and penalties: Determine if there will be any late fees or penalties for missed payments and specify the amount or percentage. 7. Collateral: If the loan is secured, describe the collateral being offered and its value. 8. Promissory note terms: Include essential terms such as acceleration (in case of default), waiver of presentments, non-waiver of default rights, and governing law. 9. Default provisions: Clearly define what constitutes a default and the consequences that follow, such as acceleration of the debt or involving legal action. 10. Confidentiality clause: Address the confidentiality of the promissory note, ensuring that both parties agree to keep the details of the loan private. 11. Governing law: Indicate that the promissory note will be governed by the laws of Nassau, New York, and specify the appropriate jurisdiction for resolving disputes. 12. Signatures and witnesses: Provide spaces for the borrower and lender to sign the promissory note and include witness signatures if required. Different types of Nassau New York Checklist for Drafting a Promissory Note may include variations in the specific terms and conditions mentioned above. It is vital to consult with legal professionals familiar with Nassau, New York's specific laws and regulations regarding promissory notes to ensure compliance and create a legally binding document.Nassau New York Checklist — Items to Consider for Drafting a Promissory Note When drafting a promissory note in Nassau, New York, it is essential to ensure that all relevant details and legal requirements are properly addressed. Here is a checklist of items to consider while drafting a promissory note in Nassau, New York: 1. Parties involved: Clearly identify the borrower (promise) and the lender (promise) along with their legal names and contact information. 2. Loan amount: Specify the exact amount of money being loaned, in both numeric and written forms, and ensure accuracy. 3. Interest rate: Determine the interest rate on the loan and specify whether it is fixed or variable. Include any additional charges or fees. 4. Repayment terms: Set the repayment term, including the start date and due date for each installment. Consider whether the loan will be repaid in equal installments or with a balloon payment at the end. 5. Payment schedule: Clearly outline the frequency of payments (e.g., monthly, quarterly) and the preferred method of payment (e.g., check, bank transfer). 6. Late fees and penalties: Determine if there will be any late fees or penalties for missed payments and specify the amount or percentage. 7. Collateral: If the loan is secured, describe the collateral being offered and its value. 8. Promissory note terms: Include essential terms such as acceleration (in case of default), waiver of presentments, non-waiver of default rights, and governing law. 9. Default provisions: Clearly define what constitutes a default and the consequences that follow, such as acceleration of the debt or involving legal action. 10. Confidentiality clause: Address the confidentiality of the promissory note, ensuring that both parties agree to keep the details of the loan private. 11. Governing law: Indicate that the promissory note will be governed by the laws of Nassau, New York, and specify the appropriate jurisdiction for resolving disputes. 12. Signatures and witnesses: Provide spaces for the borrower and lender to sign the promissory note and include witness signatures if required. Different types of Nassau New York Checklist for Drafting a Promissory Note may include variations in the specific terms and conditions mentioned above. It is vital to consult with legal professionals familiar with Nassau, New York's specific laws and regulations regarding promissory notes to ensure compliance and create a legally binding document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.