A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

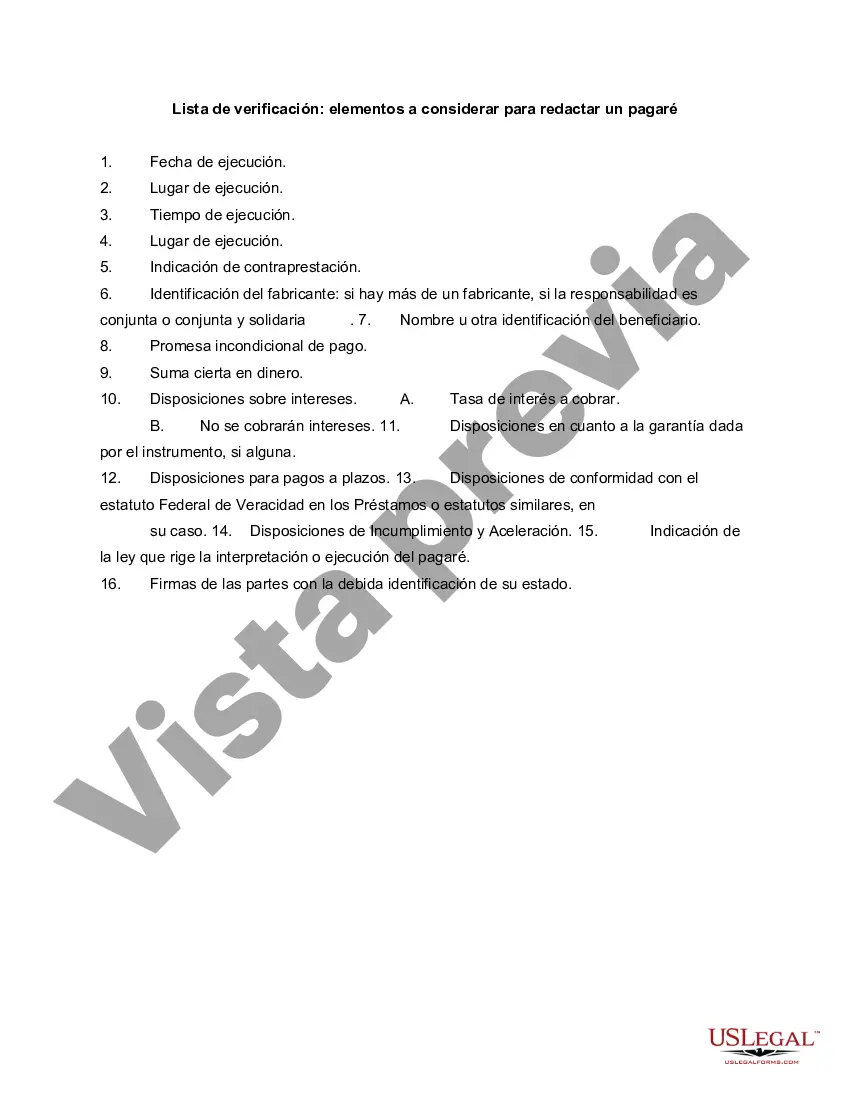

Salt Lake City, Utah is a vibrant and growing city located in the western part of the United States. It is the capital and most populous city in the state of Utah. Known for its stunning natural landscapes, outdoor recreational activities, and thriving business community, Salt Lake City is a great place to live, work, and visit. When it comes to drafting a promissory note in Salt Lake City, there are several crucial items that should be considered to ensure its legality and effectiveness. These items can be categorized into various categories such as parties involved, terms and conditions, and collateral. Let's explore each category in detail: 1. Parties Involved: — Borrower: The individual or entity who will be borrowing the money. — Lender: The individual or entity who will be lending the money. 2. Terms and Conditions: — Principal Amount: The total amount of money borrowed by the borrower. — Interest Rate: The rate at which interest will be charged on the loan. — Payment Terms: The schedule and frequency of loan repayment. — Late Payment Penalties: The consequences for failing to make payments on time. — Prepayment and Default: The regulations regarding early loan repayment and potential consequences for defaulting on the loan. — Governing Law: The jurisdiction and laws that will be followed in case of any legal disputes. 3. Collateral: — Security Agreement: If the loan is secured by collateral, it should detail the nature of the collateral and the process of repossession in case of default. — Personal Guarantee: In some cases, a third party may provide a personal guarantee to ensure repayment in case the borrower defaults. It is important to note that the specific requirements and legal provisions for drafting a promissory note in Salt Lake City may vary depending on the circumstances and the nature of the loan. Seeking guidance from a legal professional specializing in contract law is highly recommended ensuring compliance with all relevant laws and regulations. In summary, when drafting a promissory note in Salt Lake City, Utah, it is crucial to consider key factors such as parties involved, terms and conditions, and collateral. Consulting with a legal professional who is well-versed in contract law will help ensure that the promissory note is comprehensive, legally binding, and in compliance with local regulations.Salt Lake City, Utah is a vibrant and growing city located in the western part of the United States. It is the capital and most populous city in the state of Utah. Known for its stunning natural landscapes, outdoor recreational activities, and thriving business community, Salt Lake City is a great place to live, work, and visit. When it comes to drafting a promissory note in Salt Lake City, there are several crucial items that should be considered to ensure its legality and effectiveness. These items can be categorized into various categories such as parties involved, terms and conditions, and collateral. Let's explore each category in detail: 1. Parties Involved: — Borrower: The individual or entity who will be borrowing the money. — Lender: The individual or entity who will be lending the money. 2. Terms and Conditions: — Principal Amount: The total amount of money borrowed by the borrower. — Interest Rate: The rate at which interest will be charged on the loan. — Payment Terms: The schedule and frequency of loan repayment. — Late Payment Penalties: The consequences for failing to make payments on time. — Prepayment and Default: The regulations regarding early loan repayment and potential consequences for defaulting on the loan. — Governing Law: The jurisdiction and laws that will be followed in case of any legal disputes. 3. Collateral: — Security Agreement: If the loan is secured by collateral, it should detail the nature of the collateral and the process of repossession in case of default. — Personal Guarantee: In some cases, a third party may provide a personal guarantee to ensure repayment in case the borrower defaults. It is important to note that the specific requirements and legal provisions for drafting a promissory note in Salt Lake City may vary depending on the circumstances and the nature of the loan. Seeking guidance from a legal professional specializing in contract law is highly recommended ensuring compliance with all relevant laws and regulations. In summary, when drafting a promissory note in Salt Lake City, Utah, it is crucial to consider key factors such as parties involved, terms and conditions, and collateral. Consulting with a legal professional who is well-versed in contract law will help ensure that the promissory note is comprehensive, legally binding, and in compliance with local regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.