A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

San Jose, California is a vibrant city located in the heart of Silicon Valley. Known for its high-tech industry, cultural diversity, and beautiful landscapes, San Jose attracts millions of visitors each year. When it comes to drafting a promissory note in San Jose, there are several key items to consider. Here is a checklist that will help you ensure your promissory note is comprehensive and legally sound: 1. Identify the Parties: Clearly state the full legal names and addresses of the borrower (also known as the promise) and the lender (also known as the promise). 2. Define the Amount: Specify the principal amount of the loan that the borrower agrees to repay, including any interest, fees, or charges associated with the loan. 3. Establish the Interest Rate: Outline the rate at which interest will accrue on the loan, whether it is a fixed rate or variable rate, and indicate whether any late fees or penalties will apply. 4. Define the Repayment Terms: Detail the repayment schedule, including the frequency of payments (monthly, quarterly, etc.), the due date for each installment, and the method of payment (e.g., check, electronic transfer, etc.). 5. Address Default and Remedies: Clearly state the actions that will constitute a default, such as missed payments or breaching any other terms. Define the remedies available to the lender in the event of default, such as accelerated repayment or legal action. 6. Include Governing Law: Specify that the promissory note will be governed by the laws of the state of California and identify the county in which any legal disputes will be resolved. 7. Include Late Fees and Penalties: If applicable, include provisions on late fees and penalties for late payments, NSF checks, or other instances of noncompliance. 8. Include Representations and Warranties: Include statements that the borrower makes to assure the lender of their authority, capacity, and willingness to repay the loan as agreed. 9. Specify Transferability: Address whether the promissory note can be transferred to another party, and if so, under what conditions and with the proper written consent. 10. Add Miscellaneous Clauses: Consider including provisions such as notices, amendments, waivers, and governing language, which clarify any additional terms and conditions not covered explicitly in the promissory note. It is worth noting that while there may not be different types of San Jose California Checklist — Items to Consider for Drafting a Promissory Note, variations can arise based on the specific details of the loan agreement, such as secured vs. unsecured notes, commercial vs. personal loans, and varying interest rate structures. Consequently, it is crucial to consult with a qualified attorney or legal professional to ensure your promissory note accurately reflects the unique circumstances of your loan transaction.San Jose, California is a vibrant city located in the heart of Silicon Valley. Known for its high-tech industry, cultural diversity, and beautiful landscapes, San Jose attracts millions of visitors each year. When it comes to drafting a promissory note in San Jose, there are several key items to consider. Here is a checklist that will help you ensure your promissory note is comprehensive and legally sound: 1. Identify the Parties: Clearly state the full legal names and addresses of the borrower (also known as the promise) and the lender (also known as the promise). 2. Define the Amount: Specify the principal amount of the loan that the borrower agrees to repay, including any interest, fees, or charges associated with the loan. 3. Establish the Interest Rate: Outline the rate at which interest will accrue on the loan, whether it is a fixed rate or variable rate, and indicate whether any late fees or penalties will apply. 4. Define the Repayment Terms: Detail the repayment schedule, including the frequency of payments (monthly, quarterly, etc.), the due date for each installment, and the method of payment (e.g., check, electronic transfer, etc.). 5. Address Default and Remedies: Clearly state the actions that will constitute a default, such as missed payments or breaching any other terms. Define the remedies available to the lender in the event of default, such as accelerated repayment or legal action. 6. Include Governing Law: Specify that the promissory note will be governed by the laws of the state of California and identify the county in which any legal disputes will be resolved. 7. Include Late Fees and Penalties: If applicable, include provisions on late fees and penalties for late payments, NSF checks, or other instances of noncompliance. 8. Include Representations and Warranties: Include statements that the borrower makes to assure the lender of their authority, capacity, and willingness to repay the loan as agreed. 9. Specify Transferability: Address whether the promissory note can be transferred to another party, and if so, under what conditions and with the proper written consent. 10. Add Miscellaneous Clauses: Consider including provisions such as notices, amendments, waivers, and governing language, which clarify any additional terms and conditions not covered explicitly in the promissory note. It is worth noting that while there may not be different types of San Jose California Checklist — Items to Consider for Drafting a Promissory Note, variations can arise based on the specific details of the loan agreement, such as secured vs. unsecured notes, commercial vs. personal loans, and varying interest rate structures. Consequently, it is crucial to consult with a qualified attorney or legal professional to ensure your promissory note accurately reflects the unique circumstances of your loan transaction.

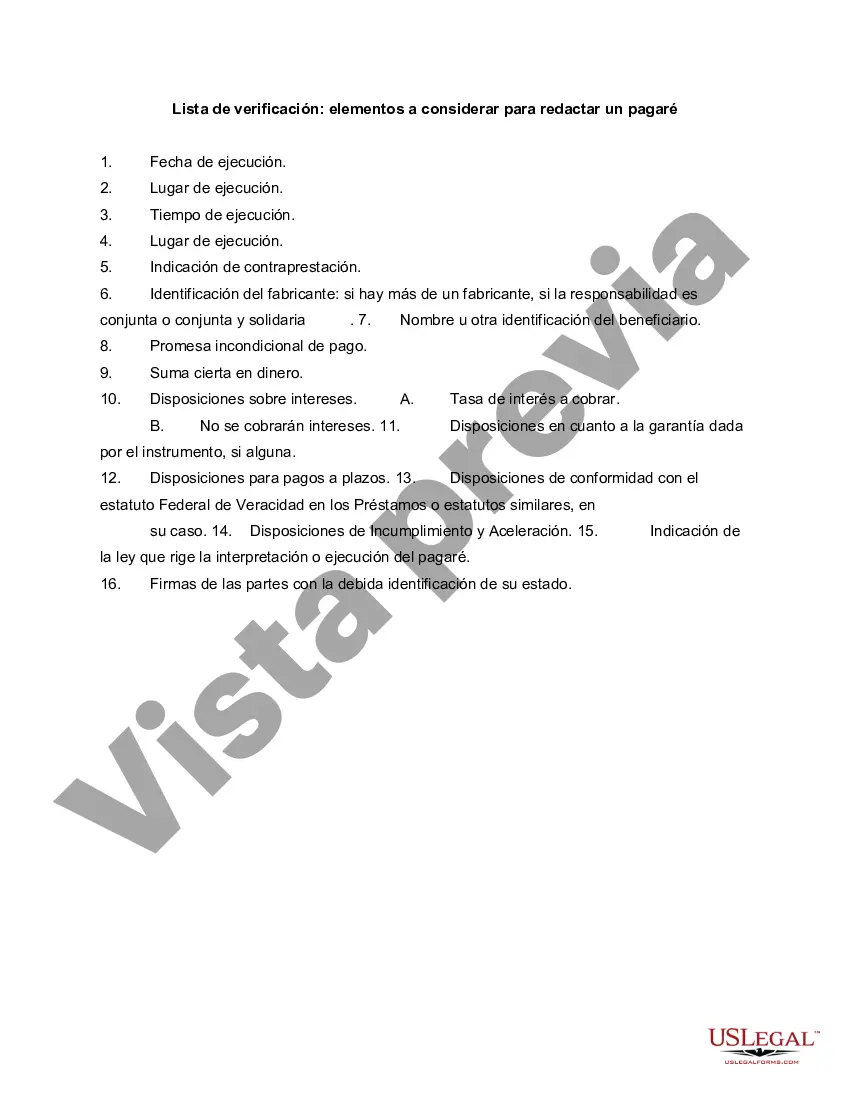

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.