A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

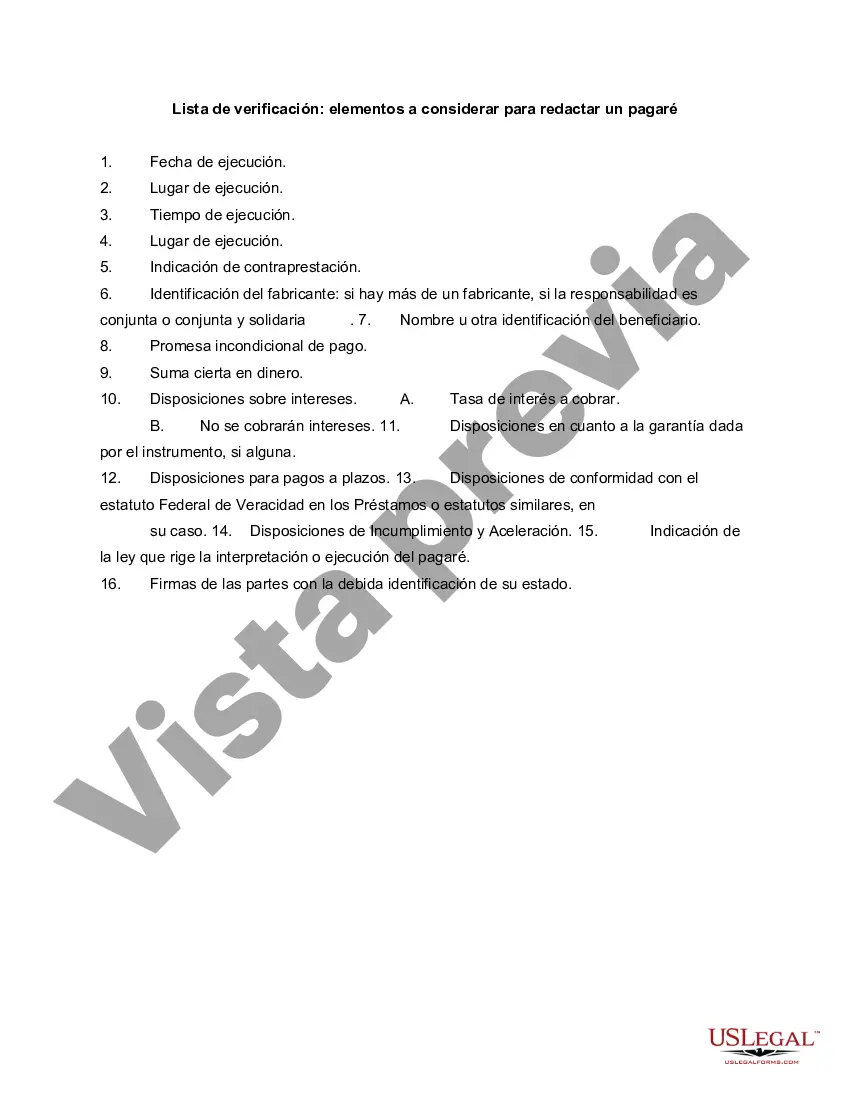

When drafting a promissory note in Travis, Texas, there are several key items to consider ensuring a legally binding agreement. A promissory note is a document that outlines the terms of a loan or debt repayment, providing security for both the lender and the borrower. Here is a detailed checklist to guide you through the process: 1. Parties involved: Clearly identify the lender (also known as the payee) and the borrower (also known as the maker) in the promissory note. Include their full legal names, addresses, and contact information. 2. Loan amount and interest: Specify the principal amount being borrowed in Travis, Texas, and the interest rate. Clearly state whether the interest is fixed or variable, and include any applicable fees or charges. 3. Repayment terms: Determine the repayment schedule for the loan. This includes outlining the frequency of payments (monthly, quarterly, or annually) and the due dates. Specify the method of payment (e.g., check, direct deposit) and the consequences of late or missed payments. 4. Collateral or security: If the loan is secured, describe the collateral provided by the borrower to secure the debt. Clearly state the specifics of the collateral, such as property details or asset descriptions. 5. Governing law: In Travis, Texas, the governing law for promissory notes is the Texas Uniform Commercial Code (UCC). Reference this in the note to ensure consistency with state laws. 6. Events of default: Define the events that would trigger default, such as non-payment, bankruptcy, or breach of any other terms and conditions. Clearly state the consequences of default, including possible legal actions and remedies available to the lender. 7. Usury laws: Travis, Texas, has usury laws that restrict the amount of interest that can be charged on certain types of loans. Ensure that the interest rate specified in the promissory note complies with these regulations. 8. Signatures and witnesses: Both the lender and the borrower must sign and date the promissory note. It is recommended to have at least one witness present during the signing process, though this may not be a legal requirement. Types of promissory notes in Travis, Texas can include: 1. Unsecured promissory note: This type of note does not require collateral and relies solely on the borrower's promise to repay the debt. 2. Secured promissory note: This note includes collateral provided by the borrower, such as real estate or vehicles, which can be claimed by the lender in case of default. 3. Demand promissory note: This note allows the lender to demand full repayment of the loan at any time, rather than specifying a fixed repayment schedule. 4. Installment promissory note: This note divides the loan into equal installments over a specified period. It sets a fixed payment schedule for the borrower. By considering these key items and following Travis, Texas laws, you can ensure that your promissory note is legally sound and protects the interests of both parties involved in the loan agreement.When drafting a promissory note in Travis, Texas, there are several key items to consider ensuring a legally binding agreement. A promissory note is a document that outlines the terms of a loan or debt repayment, providing security for both the lender and the borrower. Here is a detailed checklist to guide you through the process: 1. Parties involved: Clearly identify the lender (also known as the payee) and the borrower (also known as the maker) in the promissory note. Include their full legal names, addresses, and contact information. 2. Loan amount and interest: Specify the principal amount being borrowed in Travis, Texas, and the interest rate. Clearly state whether the interest is fixed or variable, and include any applicable fees or charges. 3. Repayment terms: Determine the repayment schedule for the loan. This includes outlining the frequency of payments (monthly, quarterly, or annually) and the due dates. Specify the method of payment (e.g., check, direct deposit) and the consequences of late or missed payments. 4. Collateral or security: If the loan is secured, describe the collateral provided by the borrower to secure the debt. Clearly state the specifics of the collateral, such as property details or asset descriptions. 5. Governing law: In Travis, Texas, the governing law for promissory notes is the Texas Uniform Commercial Code (UCC). Reference this in the note to ensure consistency with state laws. 6. Events of default: Define the events that would trigger default, such as non-payment, bankruptcy, or breach of any other terms and conditions. Clearly state the consequences of default, including possible legal actions and remedies available to the lender. 7. Usury laws: Travis, Texas, has usury laws that restrict the amount of interest that can be charged on certain types of loans. Ensure that the interest rate specified in the promissory note complies with these regulations. 8. Signatures and witnesses: Both the lender and the borrower must sign and date the promissory note. It is recommended to have at least one witness present during the signing process, though this may not be a legal requirement. Types of promissory notes in Travis, Texas can include: 1. Unsecured promissory note: This type of note does not require collateral and relies solely on the borrower's promise to repay the debt. 2. Secured promissory note: This note includes collateral provided by the borrower, such as real estate or vehicles, which can be claimed by the lender in case of default. 3. Demand promissory note: This note allows the lender to demand full repayment of the loan at any time, rather than specifying a fixed repayment schedule. 4. Installment promissory note: This note divides the loan into equal installments over a specified period. It sets a fixed payment schedule for the borrower. By considering these key items and following Travis, Texas laws, you can ensure that your promissory note is legally sound and protects the interests of both parties involved in the loan agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.