A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

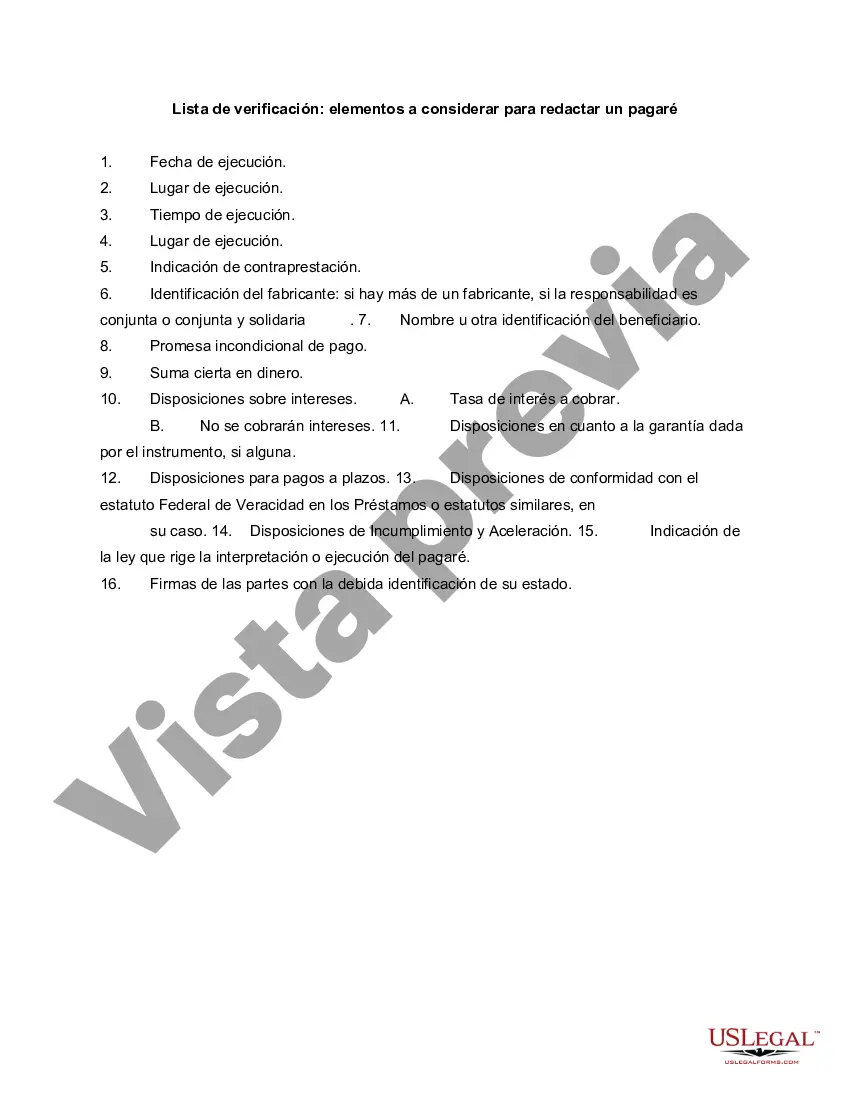

Title: Wayne Michigan Checklist — Items to Consider for Drafting a Promissory Note Introduction: When entering into a financial agreement, it is essential to have a legally binding document that outlines the terms of repayment. As such, drafting a promissory note becomes crucial. This article provides a detailed checklist of items to consider when creating a promissory note in Wayne, Michigan, ensuring a clear and enforceable agreement. Key Considerations for Drafting a Promissory Note in Wayne, Michigan: 1. Identifying Parties: Clearly state the names and contact information of both the lender and borrower, including their legal addresses registered in Wayne, Michigan. 2. Loan Amount and Interest Terms: Specify the exact amount of money lent and outline the agreed interest rate, which must adhere to applicable usury laws in Wayne, Michigan. 3. Repayment Terms: Specify a clear payment schedule, including the total repayment amount, the frequency of payments (weekly, monthly, etc.), and the due date for each installment. 4. Late Payments and Default: Outline the penalties for late or missed payments, including any additional interest or charges that may be applicable. 5. Collateral Details: If the loan is secured by collateral, describe the asset in detail and mention its location, condition, and value. Ensure compliance with any relevant laws and regulations pertaining to collateral in Wayne, Michigan. 6. Governing Law: State that the promissory note is governed by the laws of Wayne, Michigan, to establish jurisdiction for any legal matters that may arise. 7. Signatures and Date: Both the lender and borrower should sign and date the promissory note, indicating their agreement to the terms stated within it. Notarization may be required in certain cases. Types of Promissory Notes in Wayne, Michigan: 1. Secured Promissory Note: This note includes collateral to secure the loan. Wayne, Michigan law regulates secured transactions and defines the specific requirements for such notes. 2. Unsecured Promissory Note: This note does not involve any collateral, relying solely on the borrower's promise of repayment. It is vital to establish the borrower's creditworthiness before entering into such an agreement. 3. Demand Promissory Note: This type of promissory note allows the lender to demand full repayment at any time with proper notice, usually within a set period. Conclusion: Drafting a promissory note in Wayne, Michigan requires careful attention to detail, adherence to local laws, and consideration of the specific circumstances involved in the loan. By following the checklist above, individuals can ensure a comprehensive and legally binding agreement that protects their interests as borrowers or lenders.Title: Wayne Michigan Checklist — Items to Consider for Drafting a Promissory Note Introduction: When entering into a financial agreement, it is essential to have a legally binding document that outlines the terms of repayment. As such, drafting a promissory note becomes crucial. This article provides a detailed checklist of items to consider when creating a promissory note in Wayne, Michigan, ensuring a clear and enforceable agreement. Key Considerations for Drafting a Promissory Note in Wayne, Michigan: 1. Identifying Parties: Clearly state the names and contact information of both the lender and borrower, including their legal addresses registered in Wayne, Michigan. 2. Loan Amount and Interest Terms: Specify the exact amount of money lent and outline the agreed interest rate, which must adhere to applicable usury laws in Wayne, Michigan. 3. Repayment Terms: Specify a clear payment schedule, including the total repayment amount, the frequency of payments (weekly, monthly, etc.), and the due date for each installment. 4. Late Payments and Default: Outline the penalties for late or missed payments, including any additional interest or charges that may be applicable. 5. Collateral Details: If the loan is secured by collateral, describe the asset in detail and mention its location, condition, and value. Ensure compliance with any relevant laws and regulations pertaining to collateral in Wayne, Michigan. 6. Governing Law: State that the promissory note is governed by the laws of Wayne, Michigan, to establish jurisdiction for any legal matters that may arise. 7. Signatures and Date: Both the lender and borrower should sign and date the promissory note, indicating their agreement to the terms stated within it. Notarization may be required in certain cases. Types of Promissory Notes in Wayne, Michigan: 1. Secured Promissory Note: This note includes collateral to secure the loan. Wayne, Michigan law regulates secured transactions and defines the specific requirements for such notes. 2. Unsecured Promissory Note: This note does not involve any collateral, relying solely on the borrower's promise of repayment. It is vital to establish the borrower's creditworthiness before entering into such an agreement. 3. Demand Promissory Note: This type of promissory note allows the lender to demand full repayment at any time with proper notice, usually within a set period. Conclusion: Drafting a promissory note in Wayne, Michigan requires careful attention to detail, adherence to local laws, and consideration of the specific circumstances involved in the loan. By following the checklist above, individuals can ensure a comprehensive and legally binding agreement that protects their interests as borrowers or lenders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.