Hennepin County is the largest county in the state of Minnesota, encompassing the bustling city of Minneapolis and its surrounding suburbs. If you are considering buying a business in Hennepin County, it is essential to conduct a thorough evaluation to ensure you make an informed decision. To assist you in this process, here is a detailed description of a Hennepin Minnesota Checklist — Evaluation to Buy a Business, along with different types of evaluation checklists that can be used: 1. Financial Evaluation Checklist: — Determine the current financial health of the business by reviewing its financial statements, including balance sheets, income statements, and cash flow reports. — Assess the profitability and revenue growth trends of the business over the past few years. — Evaluate the existing debt and liabilities of the business. — Analyze the business's cash flow and the stability of its customer base. 2. Operational Evaluation Checklist: — Examine the operational processes and systems of the business, including inventory management, supply chain, and production processes. — Assess the current staffing structure, employee roles, and any potential issues related to human resources. — Evaluate the business's current contracts, licenses, permits, and legal obligations. — Research the industry and competitive landscape to understand the business's position and any potential threats or opportunities. 3. Marketing and Sales Evaluation Checklist: — Identify the target market and assess the business's current marketing strategies to attract and retain customers. — Evaluate the effectiveness of the business's branding, online presence (website and social media), and advertising efforts. — Analyze the customer retention rates and the potential for growth in customer base. — Review any existing sales contracts, partnerships, or distribution channels. 4. Legal and Regulatory Compliance Checklist: — Verify whether the business adheres to all necessary licenses, permits, and regulations required by Hennepin County and other relevant authorities. — Assess any potential legal issues, ongoing lawsuits, or pending litigation affecting the business. — Review the existing contracts and agreements with suppliers, customers, and employees for any potential risks. 5. Due Diligence Checklist: — Conduct a thorough examination of the business's financial records, contracts, tax returns, and other relevant documents. — Verify the accuracy of the provided information, ensuring there are no misrepresentations or omissions. — Seek professional assistance from accountants, lawyers, and business valuation experts to assess the business's value and potential risks. By considering the above evaluation checklists, potential buyers can gain a comprehensive understanding of a business's financial, operational, marketing, and legal aspects. This evaluation process will help buyers make informed decisions and mitigate risks associated with purchasing a business in Hennepin County, Minnesota.

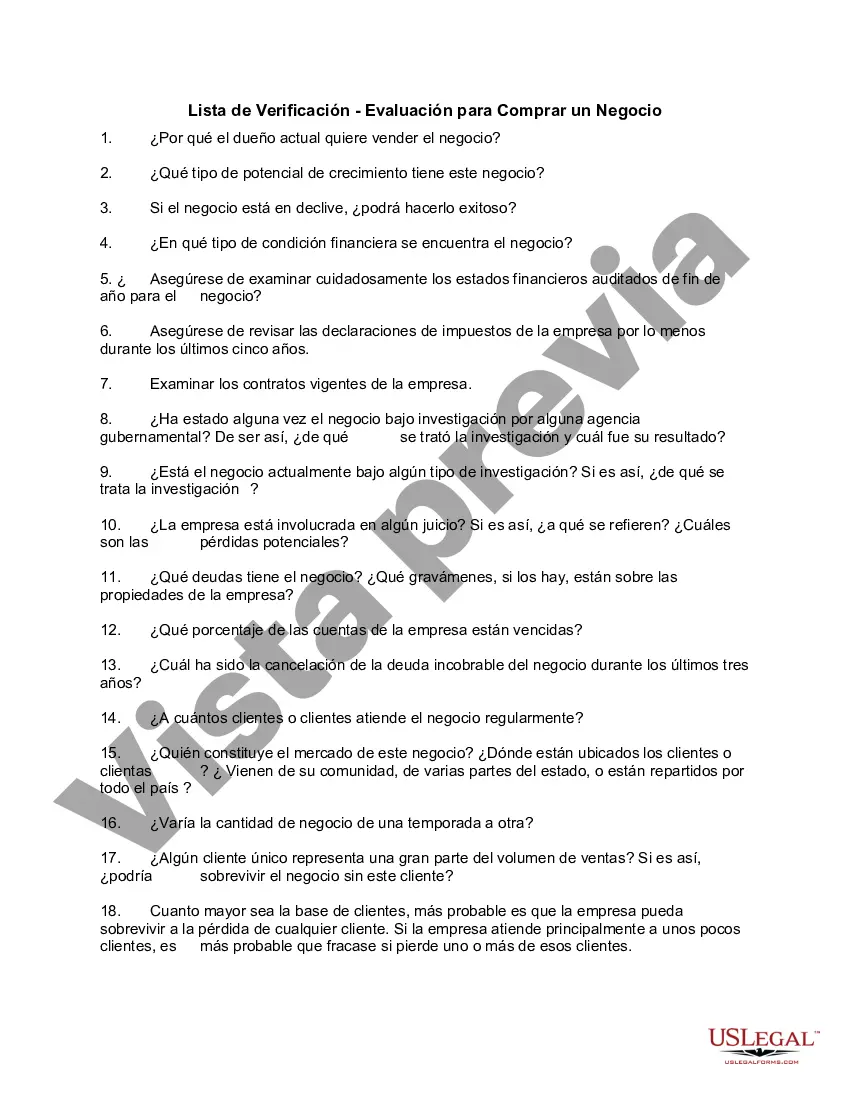

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Lista de Verificación - Evaluación para Comprar un Negocio - Checklist - Evaluation to Buy a Business

Description

How to fill out Hennepin Minnesota Lista De Verificación - Evaluación Para Comprar Un Negocio?

Preparing papers for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Hennepin Checklist - Evaluation to Buy a Business without professional help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Hennepin Checklist - Evaluation to Buy a Business on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Hennepin Checklist - Evaluation to Buy a Business:

- Examine the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To find the one that meets your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a few clicks!