Kings New York Checklist — Key Employee Life Insurance is a crucial aspect of any business that aims to protect its most valuable asset: key employees. This type of life insurance provides financial security and peace of mind in the event of the untimely loss of key personnel who play integral roles in an organization's success. Kings New York understands the importance of safeguarding businesses from potential financial hardships that may arise due to the loss of a key employee. One type of Kings New York Checklist — Key Employee Life Insurance is the "Basic Key Employee Life Insurance." This policy provides a set amount of coverage for a designated key employee. The coverage amount is predetermined and paid as a lump sum to the business in the event of the employee's death. This ensures that the company can cover expenses such as recruitment, training, or temporarily replacing the key employee until a suitable replacement is found. Another type of Kings New York Checklist — Key Employee Life Insurance is the "Executive Key Employee Life Insurance." This policy is specifically tailored for high-level executives or critical personnel who have extensive experience, unique skills, or hold essential positions. The coverage amount for this type of insurance is typically higher to account for the executive's immense contribution to the company's success. With the Executive Key Employee Life Insurance, businesses can protect themselves from potential financial setbacks caused by the loss of top-level employees. A third type of Kings New York Checklist — Key Employee Life Insurance is the "Variable Key Employee Life Insurance." This policy provides coverage with a cash value component that allows the employee to build cash value over time. The cash value can be withdrawn or borrowed against in case of emergencies or financial needs. The primary advantage of the Variable Key Employee Life Insurance is the flexibility it offers to employees, allowing them to utilize the policy's benefits while still maintaining coverage in the event of their demise. Kings New York Checklist — Key Employee Life Insurance is an essential risk management tool that businesses should consider protecting themselves from the potential financial implications of losing key personnel. By offering various types of coverage, Kings New York aims to provide businesses with options that suit their specific needs, whether its basic coverage, executive-level protection, or a policy that offers flexibility and cash value accumulation. With Kings New York Checklist — Key Employee Life Insurance, businesses can ensure continuity and stability even in the face of unexpected events.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Lista de verificación: seguro de vida para empleados clave - Checklist - Key Employee Life Insurance

Description

How to fill out Kings New York Lista De Verificación: Seguro De Vida Para Empleados Clave?

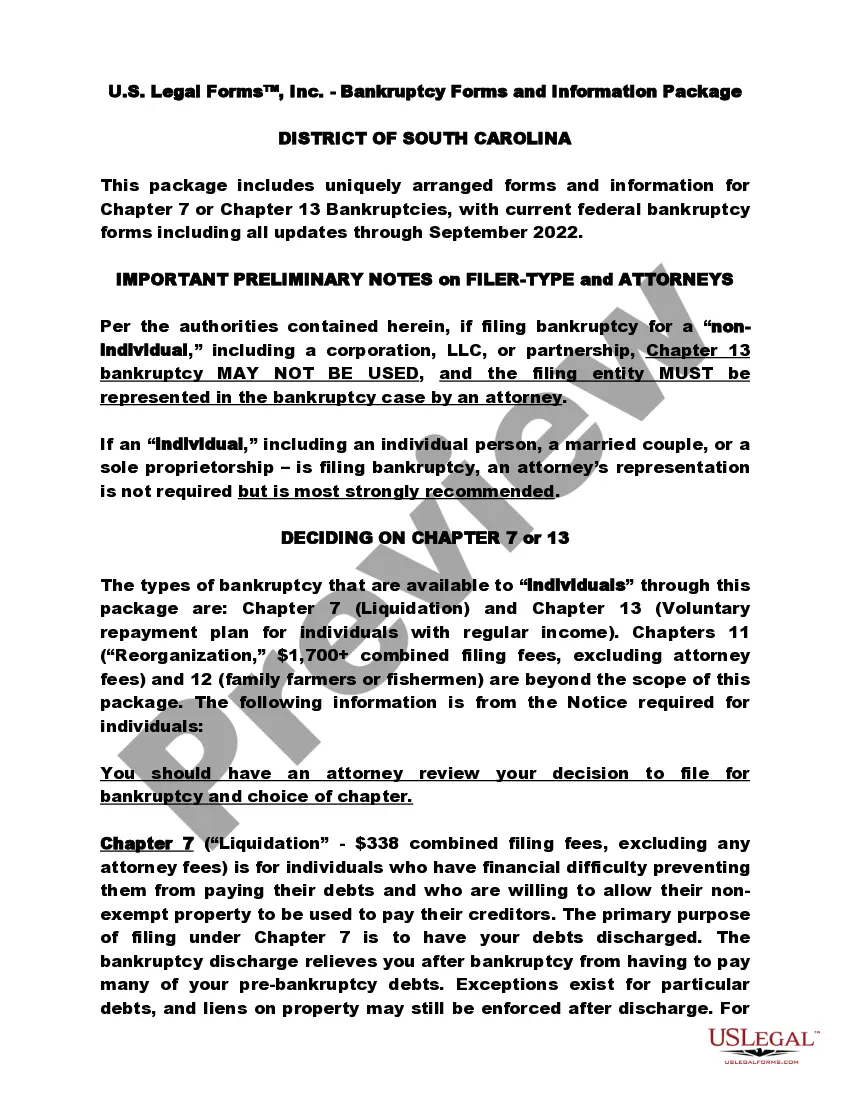

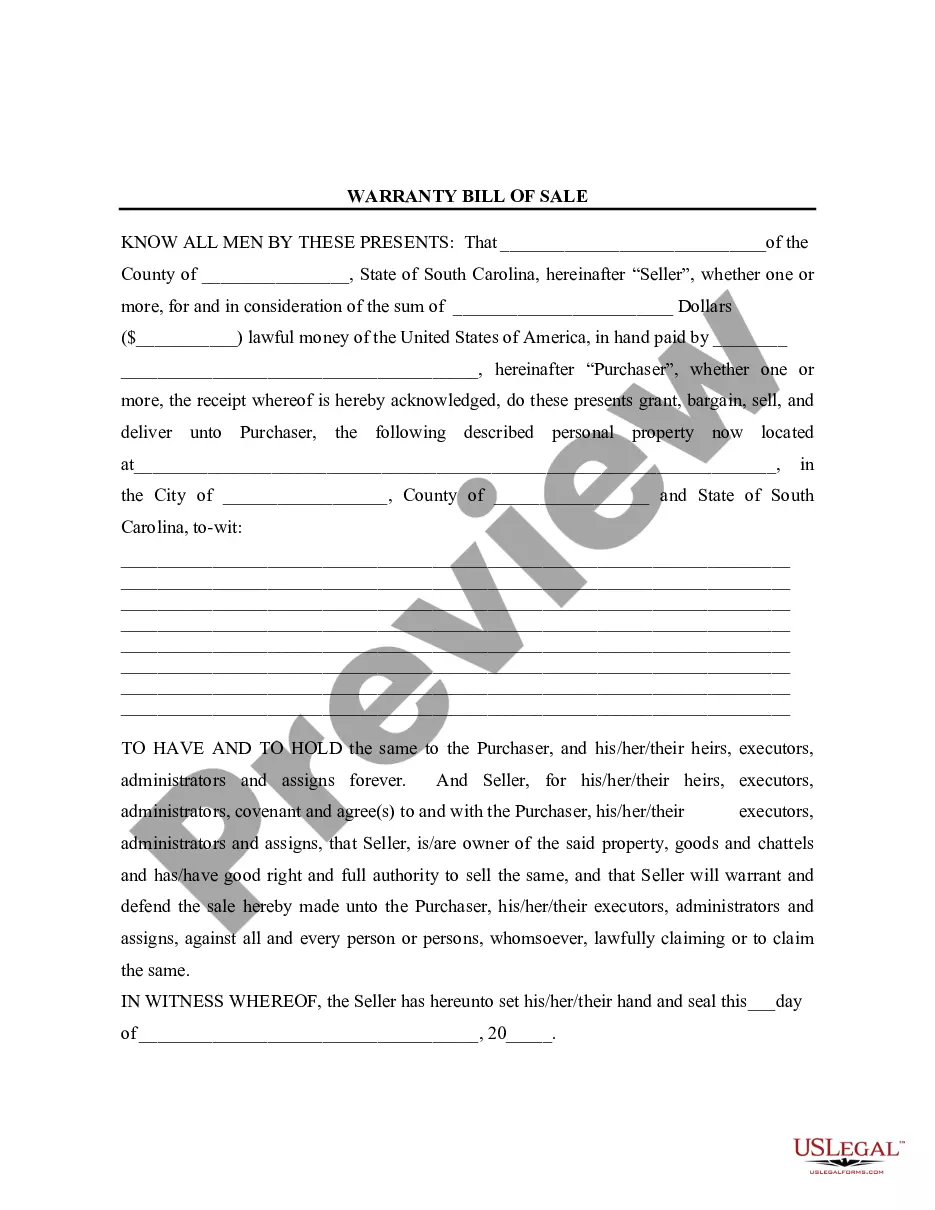

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Kings Checklist - Key Employee Life Insurance without expert assistance.

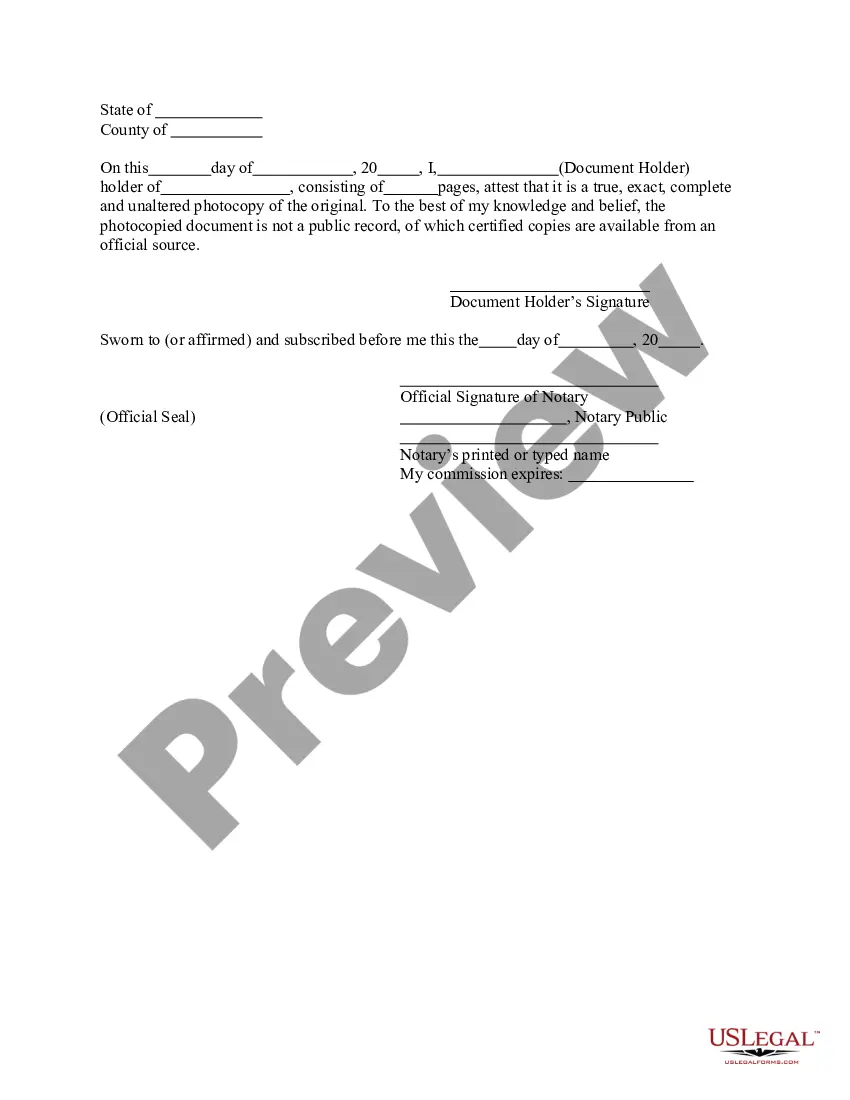

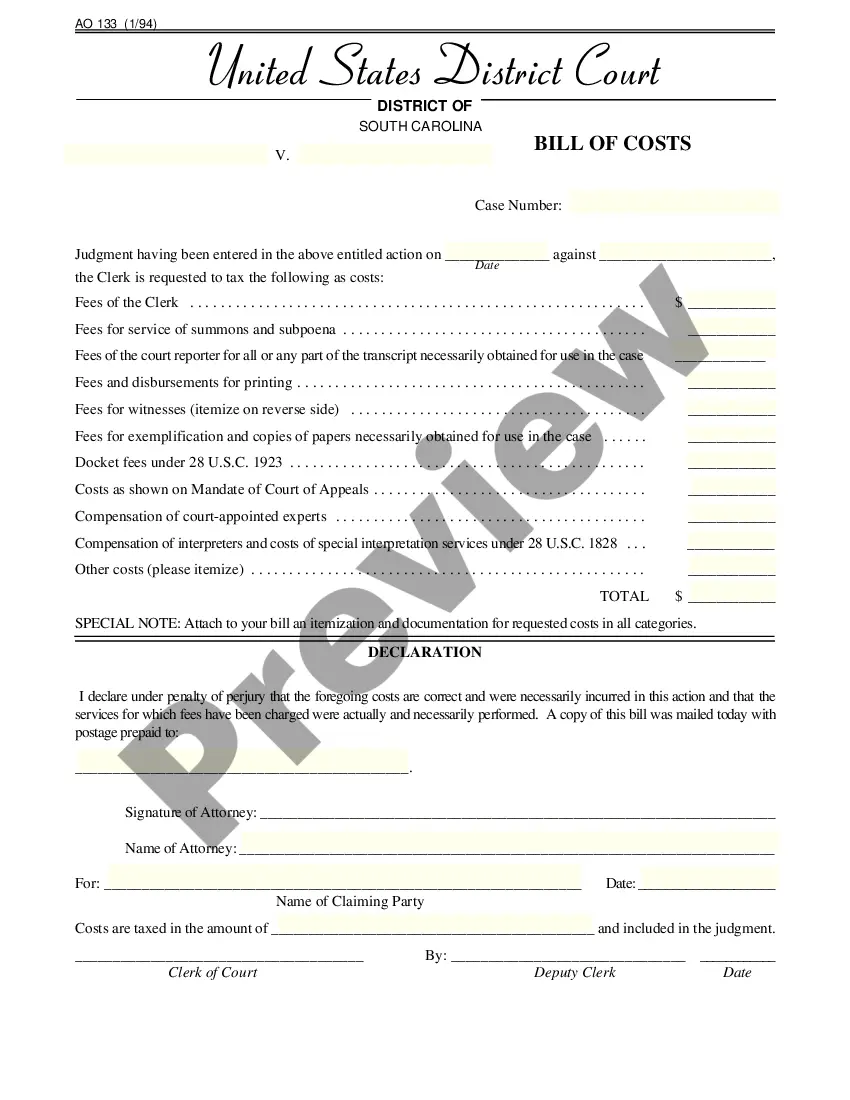

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Kings Checklist - Key Employee Life Insurance by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Kings Checklist - Key Employee Life Insurance:

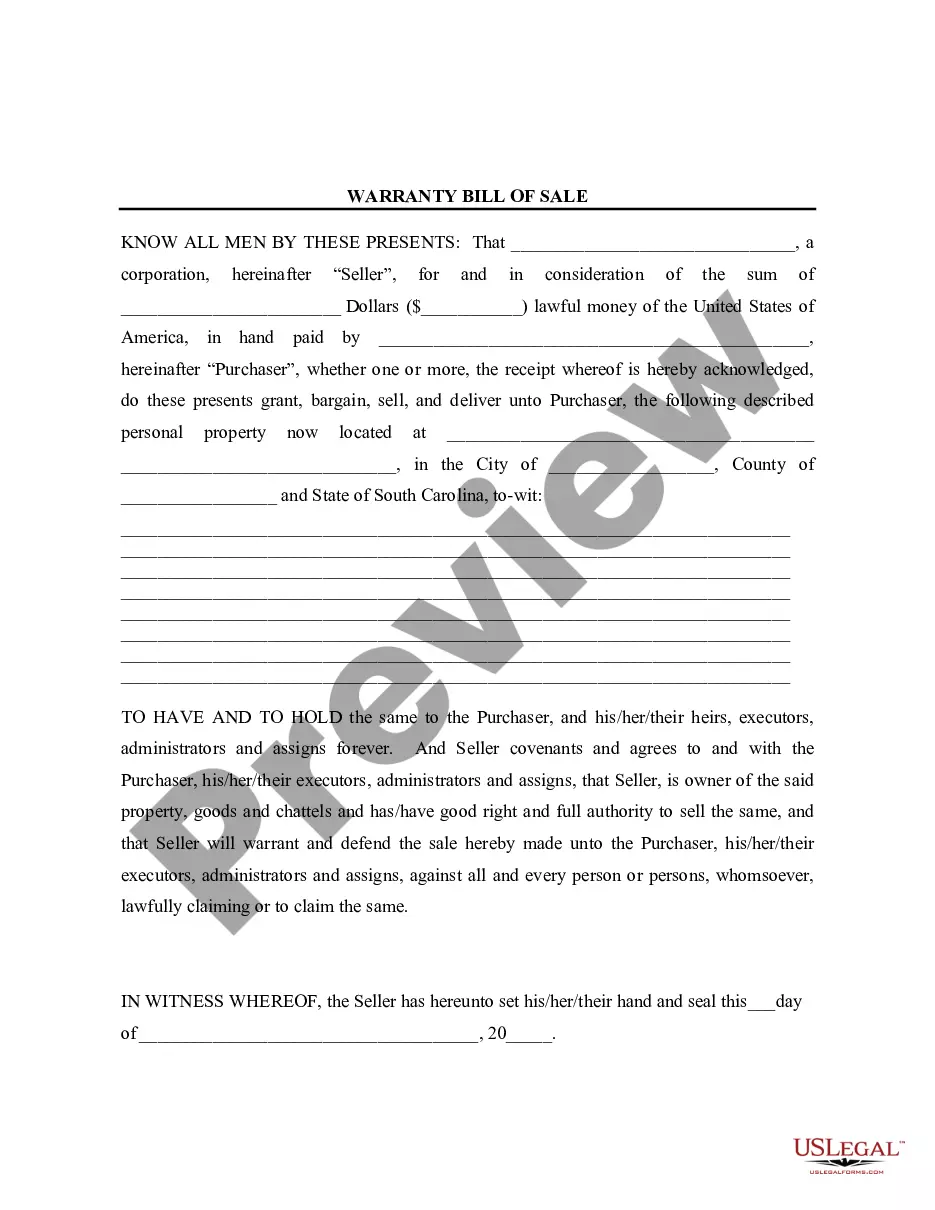

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a few clicks!