Maricopa Arizona Checklist — Key Employee Life Insurance: Protect Your Business Investment Key employees play a crucial role in the success and growth of any business. In Maricopa, Arizona, businesses understand the importance of safeguarding their key employees against unforeseen events or accidents. That's where Maricopa Arizona Checklist — Key Employee Life Insurance steps in to provide financial security and protection. Key employee life insurance is designed to protect a business in case of the death of its key employees. This type of insurance serves as a safety net, ensuring that the business can continue its operations smoothly even in the absence of a key employee who played a significant role in the organization. Maricopa Arizona Checklist — Key Employee Life Insurance offers various types of coverage tailored to meet the unique needs of each business: 1. Key Person Life Insurance: Also known as key man insurance, this type of coverage is taken out by the employer on the life of a key employee. In the event of their untimely death, the policy provides a death benefit to the business, allowing it to cover expenses such as hiring and training a replacement, repaying debts, and maintaining business continuity during the transitional period. 2. Executive Bonus Plan: An executive bonus plan is another form of key employee life insurance that provides a dual benefit. In this arrangement, the employer pays the premiums on a life insurance policy owned by the key employee. The employee receives the death benefit while alive, while the employer can deduct the premium as a business expense. 3. Split-Dollar Life Insurance: This type of policy is implemented by the employer and key employee together, sharing the cost and benefits. In this arrangement, both parties collaborate to pay premiums, and upon the key employee’s death, the benefits are shared according to the predetermined agreement. This allows the employee's family to receive a portion of the death benefit and the business to recover its investment. Maricopa Arizona Checklist — Key Employee Life Insurance is crucial for businesses of all sizes, whether they are start-ups or well-established companies. Having such insurance coverage ensures that a sudden loss doesn't derail the business and its operations. By offering financial support in difficult times, key employee life insurance protects the investment a business has made in its key personnel. If you are a business in Maricopa, Arizona, it is highly recommended reviewing your checklist and evaluate the need for key employee life insurance. Consider the different types of coverage available, such as Key Person Life Insurance, Executive Bonus Plans, and Split-Dollar Life Insurance, to choose the most suitable option for your business. Secure the future of your business with Maricopa Arizona Checklist — Key Employee Life Insurance. Invest in the protection that safeguards your key employees and your business growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Lista de verificación: seguro de vida para empleados clave - Checklist - Key Employee Life Insurance

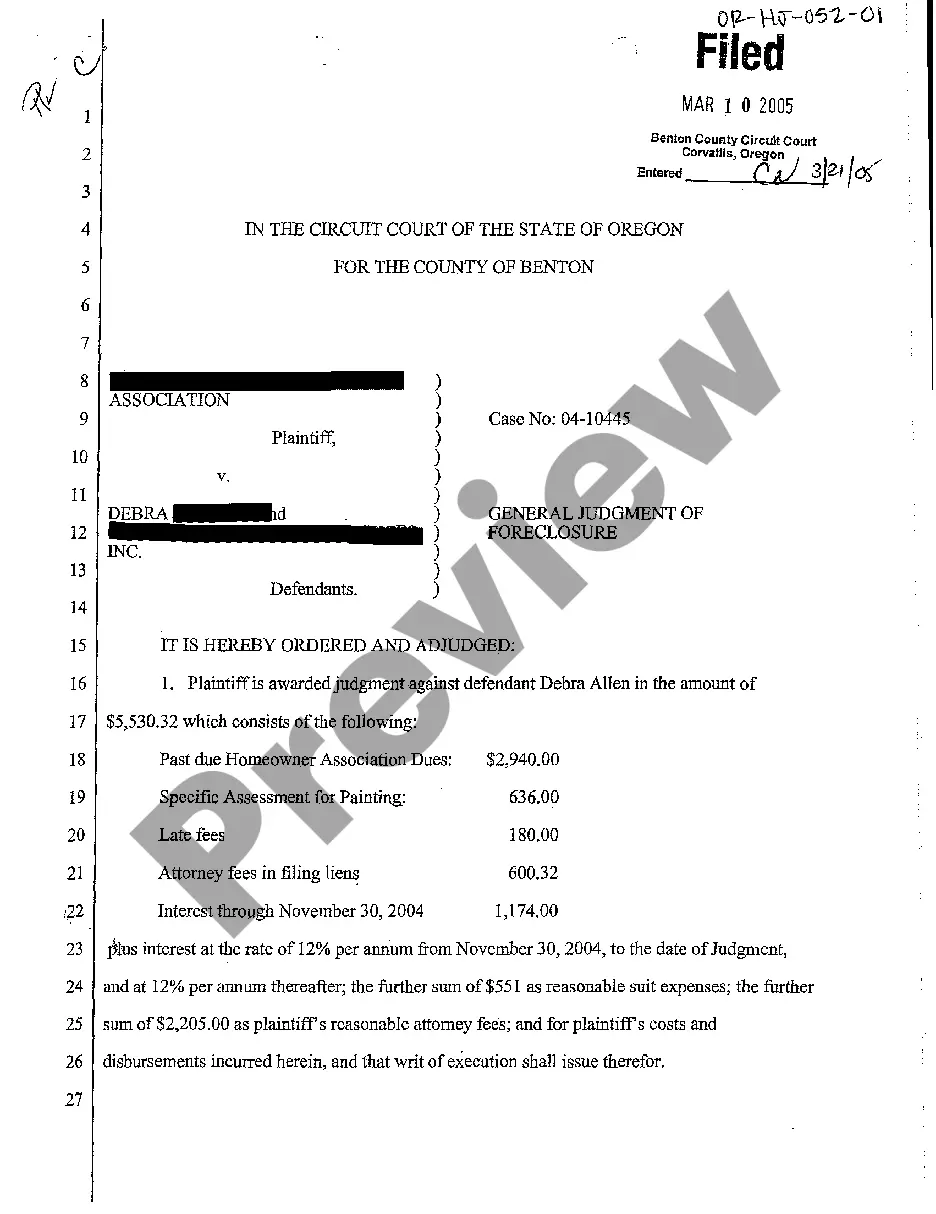

Description

How to fill out Maricopa Arizona Lista De Verificación: Seguro De Vida Para Empleados Clave?

Whether you intend to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Maricopa Checklist - Key Employee Life Insurance is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to get the Maricopa Checklist - Key Employee Life Insurance. Adhere to the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Checklist - Key Employee Life Insurance in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!