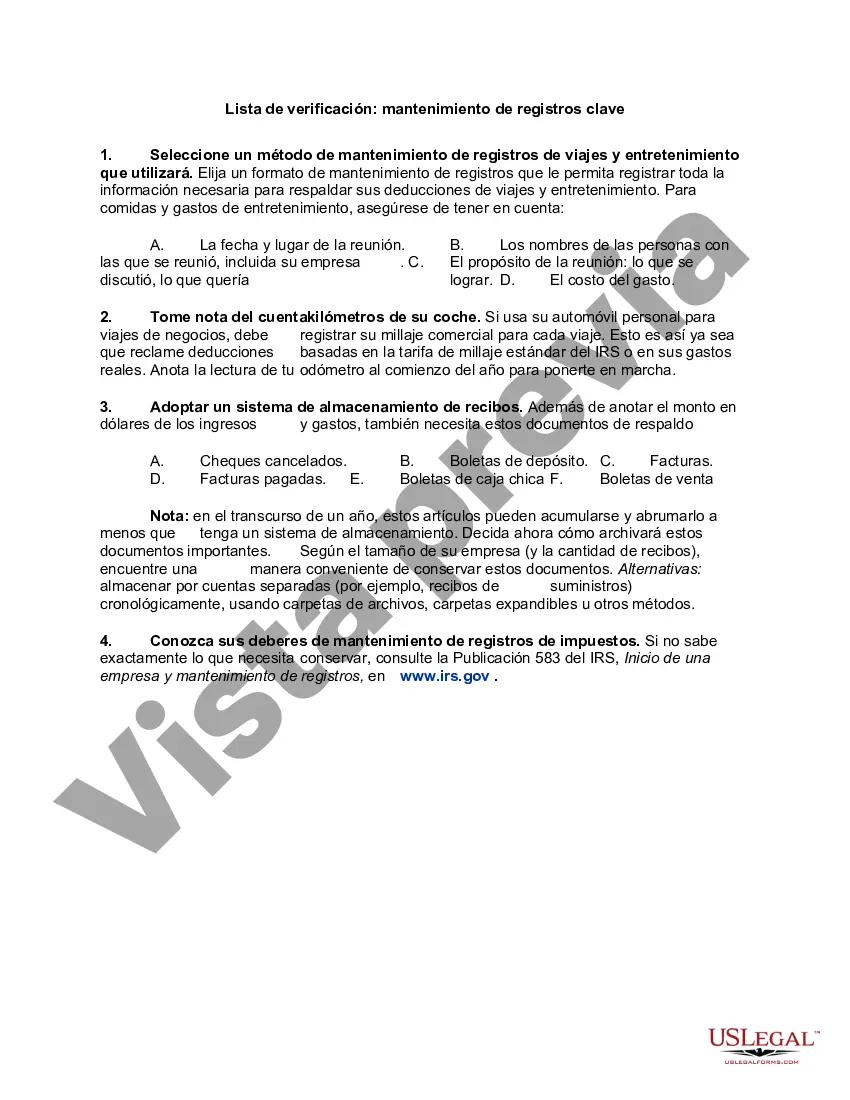

Collin Texas Checklist — Key Record Keeping offers a comprehensive set of guidelines and documents to ensure efficient record management and organization in the Collin County, Texas area. The checklist covers essential records and paperwork that individuals, businesses, and organizations should keep for legal, financial, and practical purposes. 1. Personal Records Checklist: This checklist focuses on individual document management and includes records such as birth certificates, passports, identification documents, social security cards, tax returns, property deeds, marriage and divorce certificates, wills, and medical records. Keeping track of these documents can help individuals navigate various life events seamlessly. 2. Business Records Checklist: This checklist caters to small business owners and entrepreneurs, enlisting critical record-keeping practices maintaining compliance with local and federal regulations. It includes documents such as licenses and permits, tax records, financial statements, employment contracts, customer agreements, insurance policies, invoices, and accounts receivable/payable records. 3. Educational Institutions Records Checklist: Educational institutions can benefit from this checklist to ensure proper management of student records, grading sheets, attendance records, disciplinary files, transcripts, enrollment forms, financial aid documents, accreditation certificates, educational policies, and faculty records. Adhering to these guidelines ensures transparency and helps educational institutions provide accurate information to students and parents. 4. Non-profit Organizations Records Checklist: Aimed at non-profit organizations, this checklist outlines crucial record-keeping practices maintaining transparency, accountability, and compliance with state and federal regulations. It includes documents like articles of incorporation, tax-exempt status documentation, donor records, financial statements, meeting minutes, grant applications, program documentation, and volunteer agreements. 5. Real Estate Records Checklist: This checklist is designed for real estate professionals, property managers, and homeowners, emphasizing the importance of efficient record-keeping in the industry. It covers documents such as property title deeds, rental agreements, lease agreements, mortgage documents, property tax records, property maintenance and repair documentation, insurance policies, and eviction records. Each checklist within the Collin Texas — Key Record Keeping Guide aims to assist individuals, businesses, educational institutions, non-profit organizations, and real estate professionals in maintaining the necessary records for legal compliance, efficient operations, and seamless transitions during significant life events. Properly organized and stored records provide an invaluable resource when it comes to accessing information promptly and accurately.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Lista de verificación: mantenimiento de registros clave - Checklist - Key Record Keeping

Description

How to fill out Collin Texas Lista De Verificación: Mantenimiento De Registros Clave?

Whether you plan to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Collin Checklist - Key Record Keeping is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to get the Collin Checklist - Key Record Keeping. Follow the guide below:

- Make certain the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Collin Checklist - Key Record Keeping in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!