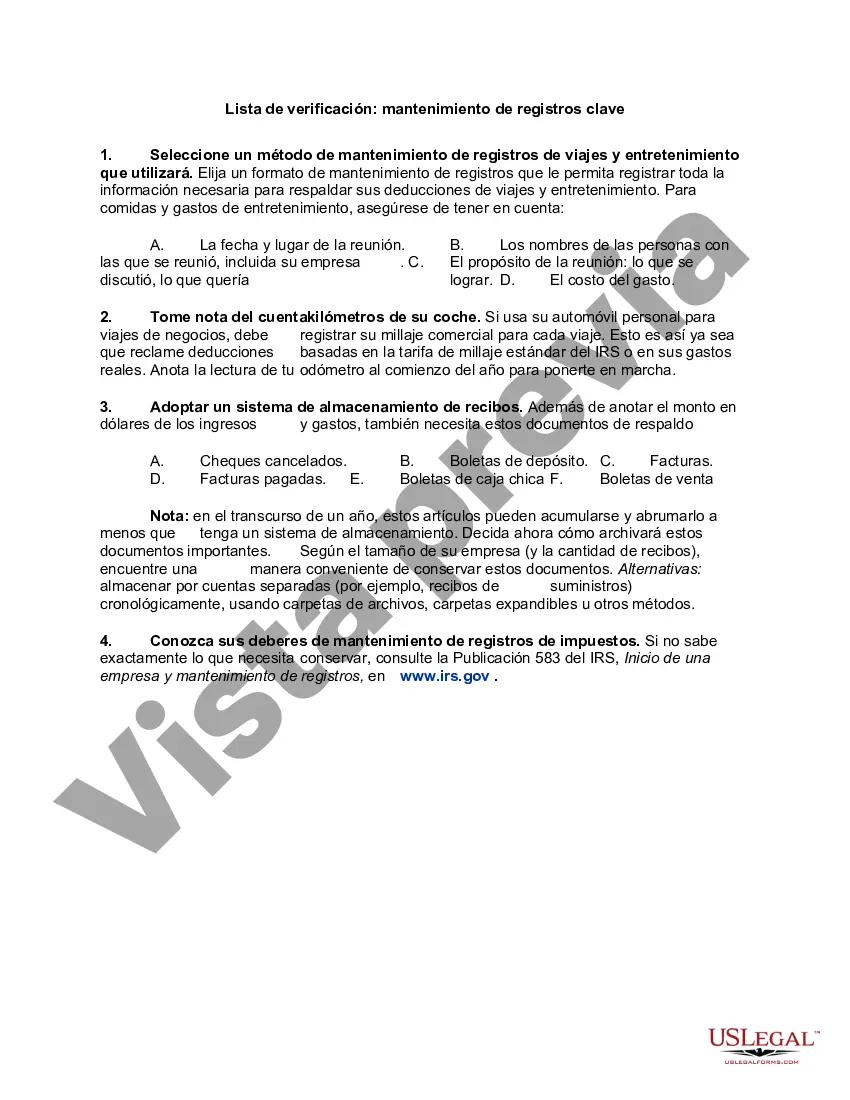

Cook Illinois Checklist — Key Record Keeping is a crucial aspect of managing and organizing various important records and documents in the state of Illinois. This comprehensive checklist encompasses a wide range of record-keeping requirements for businesses, individuals, and organizations operating within Cook County, Illinois. 1. Tax Records: One significant aspect of Cook Illinois Checklist — Key Record Keeping is maintaining accurate and up-to-date tax records. These records include income tax returns, sales tax records, property tax information, and any other relevant tax-related documents. 2. Payroll Records: Another essential component of the checklist is proper payroll record-keeping. This involves maintaining detailed payroll information, such as employee wage rates, hours worked, deductions, benefits, and payroll taxes. Keeping accurate payroll records is vital for ensuring compliance with state and federal regulations. 3. Business Licenses and Permits: Cook Illinois Checklist — Key Record Keeping includes documenting all necessary business licenses, permits, and certifications required to conduct business operations within the county. This may include professional licenses, health department permits, zoning permits, or any specific permits related to specific industries. 4. Employment Records: The checklist also focuses on maintaining comprehensive employment records. This includes keeping track of job applications, resumes, employment contracts, performance evaluations, disciplinary actions, and termination records. Maintaining these records is crucial for ensuring legal compliance and addressing any future employment-related disputes. 5. Contracts and Agreements: Cook Illinois Checklist — Key Record Keeping emphasizes the need to keep all contracts, agreements, and legal documents related to business operations. This may include lease agreements, vendor contracts, partnership agreements, purchase orders, and any other legally binding documents. 6. Financial Statements: Businesses and organizations are required to maintain accurate financial statements, including income statements, balance sheets, cash flow statements, and other financial records. These statements provide a clear overview of the financial health and performance of the entity. 7. Insurance Policies: The checklist also places importance on record-keeping related to insurance policies. This includes maintaining copies of insurance policies, premium payments, claims history, and any correspondence with insurance providers. 8. Intellectual Property Records: For businesses that hold intellectual property rights, such as patents, copyrights, or trademarks, Cook Illinois Checklist — Key Record Keeping emphasizes the need to maintain proper documentation to protect and defend such rights. 9. Maintenance and Repairs: Record-keeping related to property maintenance, repairs, and improvements is also included in the checklist. This involves keeping receipts, invoices, and records of any maintenance work performed on buildings, equipment, or vehicles. 10. Safety and Compliance Documents: Finally, Cook Illinois Checklist — Key Record Keeping highlights the importance of maintaining safety records, including training records, safety inspections, incident reports, and any other documents related to compliance with safety regulations. In conclusion, Cook Illinois Checklist — Key Record Keeping covers various vital aspects of record-keeping requirements for businesses and individuals within Cook County, Illinois. Effectively managing and organizing these records ensures compliance with legal obligations, facilitates efficient business operations, and provides a solid foundation for future growth and success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Lista de verificación: mantenimiento de registros clave - Checklist - Key Record Keeping

Description

How to fill out Cook Illinois Lista De Verificación: Mantenimiento De Registros Clave?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your county, including the Cook Checklist - Key Record Keeping.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Cook Checklist - Key Record Keeping will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Cook Checklist - Key Record Keeping:

- Make sure you have opened the right page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Cook Checklist - Key Record Keeping on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!