King Washington Checklist — Key Record Keeping is a comprehensive system designed to aid individuals and organizations in effectively managing and maintaining their important records. Whether you are a business owner, a financial advisor, a legal professional, or simply an individual looking to organize your personal documents, this checklist is essential for keeping track of vital records. The checklist provides a step-by-step guide on the types of records that should be included and maintained systematically. It assists in creating a well-organized record keeping system that ensures easy accessibility, efficient retrieval, and ultimate protection of key documents. The key record keeping checklist encompasses various categories, each addressing specific types of records. Some key categories covered are: 1. Financial Records: This category includes bank statements, tax returns, investment statements, receipts, invoices, and any other financial documentation that needs to be tracked. 2. Legal Documents: This section outlines the need to maintain essential legal documents such as contracts, leases, licenses, insurance policies, wills, trusts, and any other legal agreements or certificates. 3. Personal Identification: It emphasizes the significance of keeping important identification documents such as passports, social security cards, driver's licenses, birth certificates, and any other relevant personal identification papers. 4. Medical Records: This category focuses on maintaining medical records, including health insurance information, prescriptions, medical history, vaccination records, and any other health-related documents. 5. Property Documents: It highlights the importance of preserving property-related papers, such as mortgage documents, property deeds, titles, maintenance records, and home insurance policies. 6. Business Records: For entrepreneurs and business owners, this section outlines the need to maintain business licenses, permits, financial statements, contracts, employee records, and any other documentation related to the company's operations. By utilizing the King Washington Checklist — Key Record Keeping, individuals and organizations can significantly reduce the risk of losing or misplacing vital records. It serves as a valuable resource for establishing a systematic approach to record management, ensuring compliance with legal and financial requirements, and safeguarding personal and business documentation. Start implementing this checklist today to streamline your record keeping practices, alleviate stress associated with document organization, and maintain a robust archive of important records for future reference.

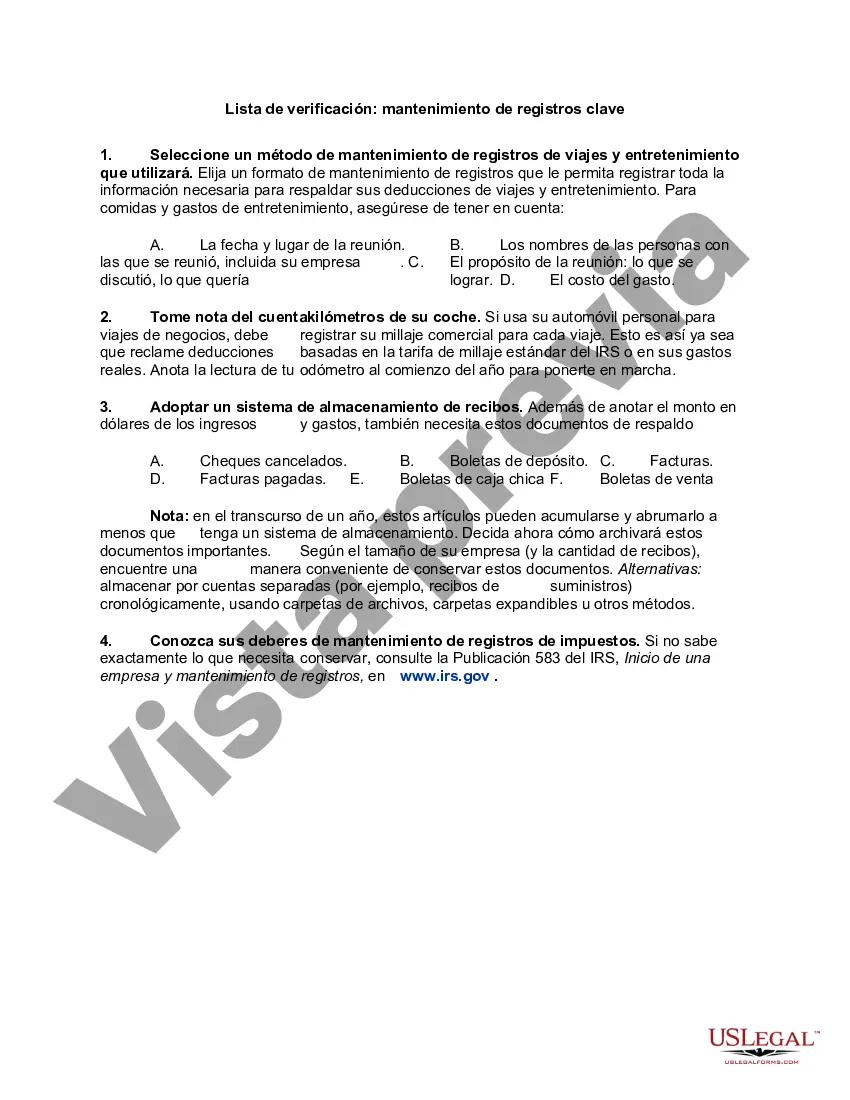

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Lista de verificación: mantenimiento de registros clave - Checklist - Key Record Keeping

Description

How to fill out King Washington Lista De Verificación: Mantenimiento De Registros Clave?

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like King Checklist - Key Record Keeping is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to get the King Checklist - Key Record Keeping. Follow the instructions below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the King Checklist - Key Record Keeping in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!