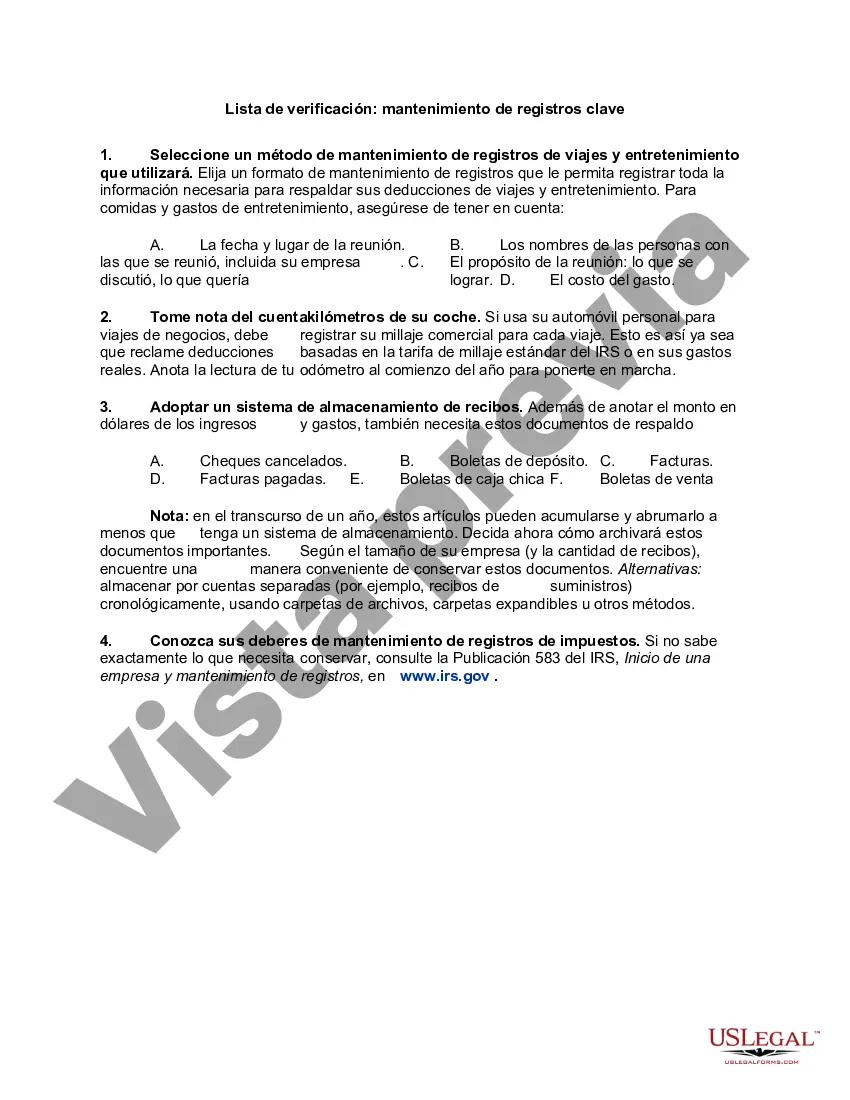

Title: San Jose, California Checklist — Key Record Keeping: A Comprehensive Guide Introduction: San Jose, California, is a vibrant city known for its technological advancements, thriving economy, and picturesque landscapes. Whether you are a resident or a business owner in San Jose, it is crucial to maintain proper record-keeping procedures to ensure compliance, facilitate organized documentation, and track essential information. This comprehensive checklist presents key record-keeping practices tailored for various entities in San Jose, including individuals, businesses, and organizations. Types of San Jose, California Checklist — Key Record Keeping: 1. Personal Record-Keeping Checklist: — Identification documents: Keep copies of your driver's license, passport, social security card, and birth certificate in a secure location. — Financial records: Maintain records of bank statements, tax returns, investment statements, and credit card statements. — Property records: Keep copies of property deeds, mortgage documents, lease agreements, and insurance policies. — Medical records: Maintain medical history, prescriptions, immunization records, and medical bills for personal healthcare needs. 2. Business Record-Keeping Checklist: — Legal documents: Maintain copies of business licenses, permits, certificates of incorporation, and partnership agreements. — Financial records: Keep track of business bank statements, profit and loss statements, balance sheets, and tax filings. — Employee records: Maintain personnel files, employment contracts, payroll records, and benefits documentation. — Contracts and agreements: Keep records of client contracts, vendor agreements, leases, and any other legally binding agreements. — Intellectual property: Document trademarks, patents, copyrights, and any related legal filings. 3. Non-Profit Organization Record-Keeping Checklist: — Non-profit status and incorporation documents: Maintain copies of articles of incorporation, bylaws, and tax-exempt status documentation. — Financial records: Keep track of donations received, grant applications, expenditure reports, and fundraising event documentation. — Board and governance records: Maintain board meeting minutes, resolutions, conflict-of-interest policies, and organizational policies. — Volunteer and member records: Keep records of volunteer agreements, member databases, and volunteer hour logs. — Program reports and impact assessments: Document program budgets, outcomes, evaluations, and progress reports. Conclusion: Proper record keeping is essential for individuals, businesses, and non-profit organizations in San Jose, California, to ensure smooth operations, legal compliance, and effective decision-making. By following the respective checklists provided above, you can establish a solid foundation for efficient record-keeping practices. Remember, maintaining accurate records not only keeps one organized but also serves as a valuable resource for future reference, budgeting, and analysis.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Lista de verificación: mantenimiento de registros clave - Checklist - Key Record Keeping

Description

How to fill out San Jose California Lista De Verificación: Mantenimiento De Registros Clave?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life sphere, finding a San Jose Checklist - Key Record Keeping suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Aside from the San Jose Checklist - Key Record Keeping, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your San Jose Checklist - Key Record Keeping:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Jose Checklist - Key Record Keeping.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!