Cook Illinois is a leading transportation company based in Illinois that provides school bus services to various school districts. When it comes to acquiring Information Technology (IT) assets, Cook Illinois has established comprehensive guidelines for determining whether to lease or purchase the equipment. These guidelines help the company effectively manage its IT infrastructure while considering various factors such as cost, technology advancements, and operational requirements. The Cook Illinois Guidelines for Lease vs. Purchase of Information Technology are designed to provide a framework for decision-making that ensures optimal utilization of resources. By evaluating the pros and cons of both leasing and purchasing IT equipment, the company can make informed choices that align with its goals and objectives. In the context of Cook Illinois, there are different types of guidelines for lease vs. purchase of Information Technology, which include: 1. Cost Analysis: Cook Illinois carefully assesses the financial implications of leasing versus purchasing IT equipment. This analysis examines upfront costs, monthly payments, depreciation, maintenance fees, and potential resale value. By comparing these costs, the company can determine the most cost-effective option. 2. Technological Advancements: Cook Illinois considers the rapid pace of technological advancements when evaluating lease versus purchase decisions. Leasing provides flexibility to upgrade IT equipment as new technologies emerge, allowing the company to stay competitive in the industry. Purchasing, on the other hand, may require longer-term commitments and can limit the ability to adopt future innovations. 3. Operational Flexibility: Cook Illinois considers the flexibility offered by leasing arrangements in terms of equipment scalability and adaptability. Leasing allows the company to easily adjust its IT infrastructure to meet changing operational needs or fluctuations in demand. Purchasing may bind the company to specific equipment and restrict the ability to adapt to evolving requirements. 4. Asset Ownership: Cook Illinois evaluates the advantages of owning IT assets versus leasing them. Purchasing equipment grants complete ownership, allowing the company to customize and tailor the IT infrastructure to specific needs. Leasing transfers ownership responsibilities to the lessor and provides the benefit of reduced maintenance and upgrade costs. 5. Risk Management: Cook Illinois assesses the risks associated with both leasing and purchasing IT equipment. These risks include technological obsolescence, equipment failure, and potential financial losses. By evaluating these risks, the company can implement risk management strategies to mitigate potential issues. In conclusion, Cook Illinois has established comprehensive guidelines to evaluate whether to lease or purchase Information Technology equipment. These guidelines encompass cost analysis, technological advancements, operational flexibility, asset ownership considerations, and risk management. By adhering to these guidelines, Cook Illinois can make informed decisions that optimize their IT infrastructure while aligning with the company's overall goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Directrices para el arrendamiento frente a la compra de tecnología de la información - Guidelines for Lease vs. Purchase of Information Technology

Description

How to fill out Cook Illinois Directrices Para El Arrendamiento Frente A La Compra De Tecnología De La Información?

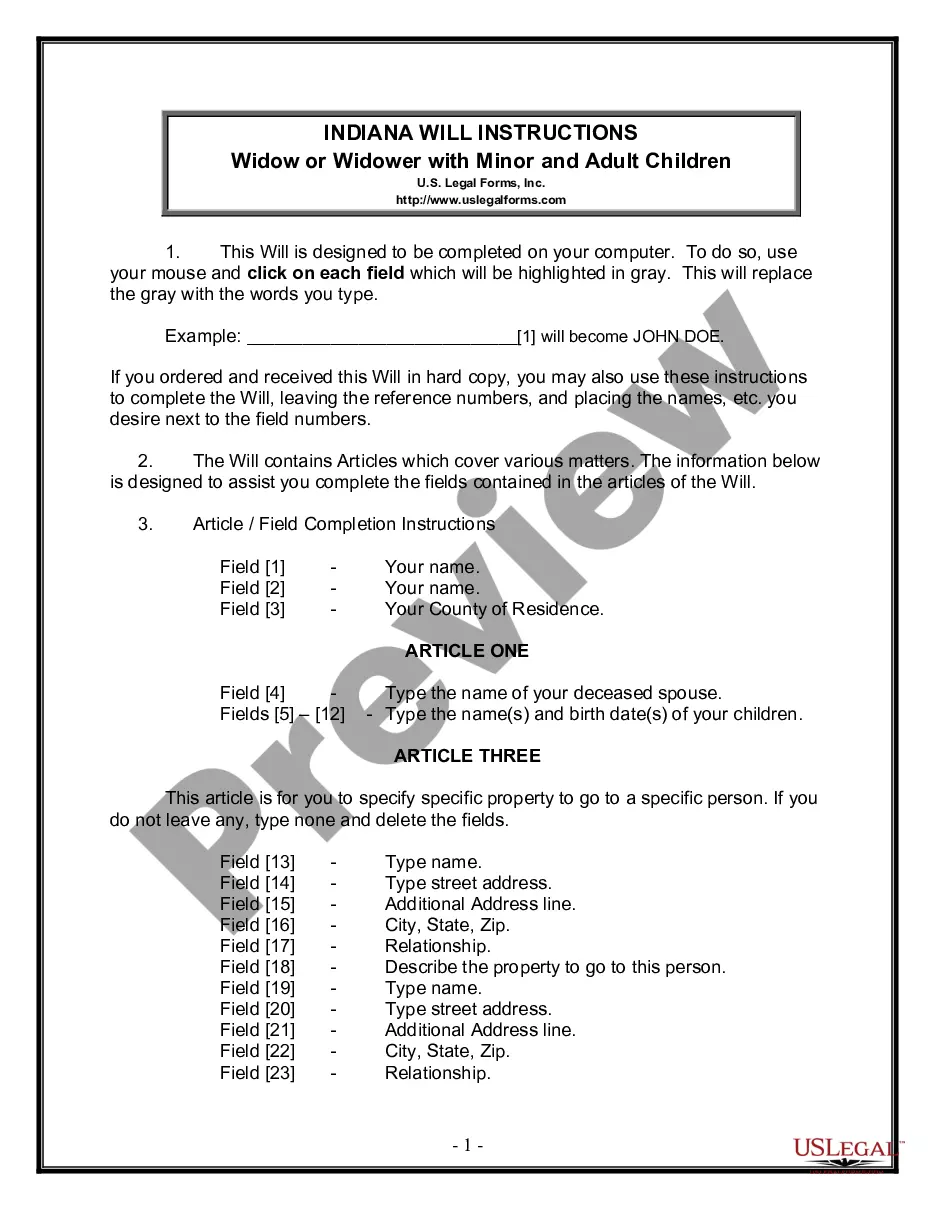

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including Cook Guidelines for Lease vs. Purchase of Information Technology, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any activities related to document completion simple.

Here's how to locate and download Cook Guidelines for Lease vs. Purchase of Information Technology.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the validity of some documents.

- Check the related document templates or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Cook Guidelines for Lease vs. Purchase of Information Technology.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Cook Guidelines for Lease vs. Purchase of Information Technology, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you have to deal with an extremely complicated case, we advise using the services of a lawyer to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-specific documents effortlessly!