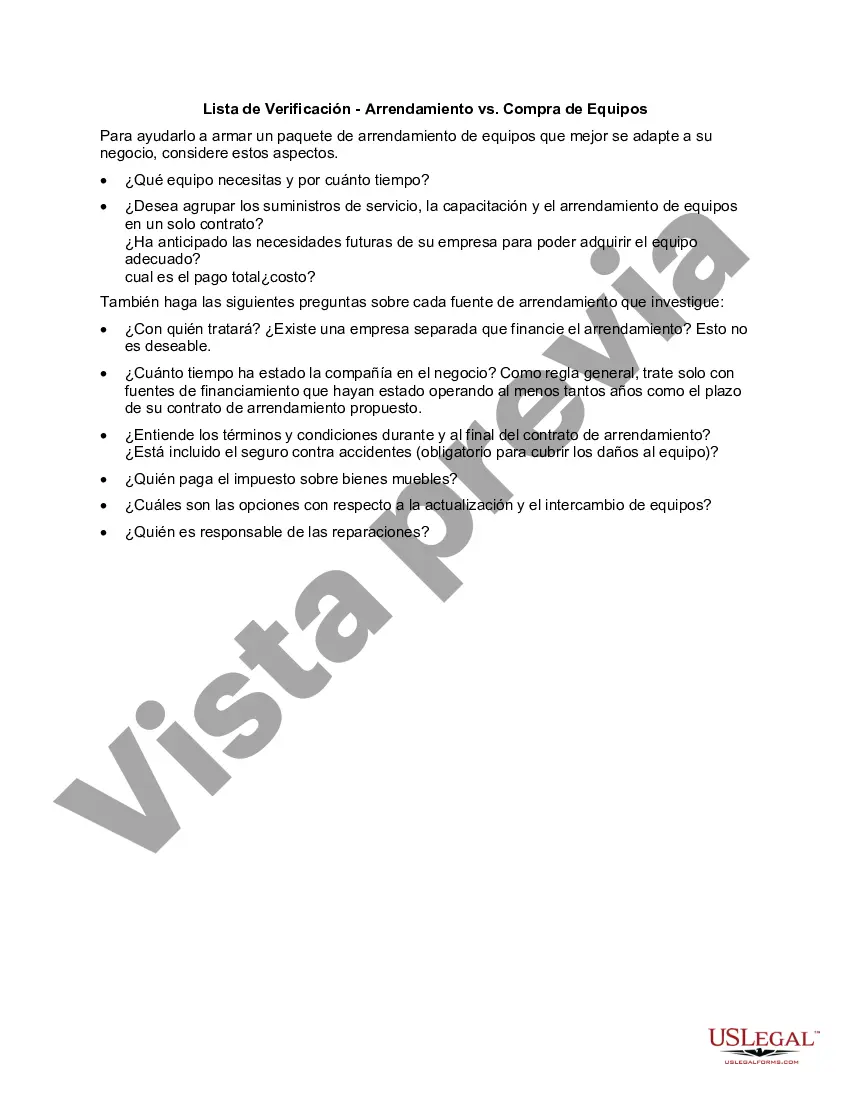

Allegheny, Pennsylvania Checklist — Leasing vs. Purchasing Equipment: A Comprehensive Guide Introduction: In Allegheny, Pennsylvania, businesses often face the dilemma of whether to lease or purchase equipment for their operations. This checklist aims to provide a detailed description of the factors businesses should consider when making this crucial decision. By weighing the pros and cons, analyzing financial implications, and assessing business requirements, companies can make an informed choice that aligns with their goals and budget. Key Factors to Consider: 1. Initial Cost: — Analyze whether your business can afford the upfront expenses associated with purchasing equipment outright. — Consider leasing as a viable option if immediate cash flow is a concern. 2. Long-term Financial Implications: — Leasing offers the advantage of lower monthly payments, allowing businesses to preserve cash flow. — Evaluate the depreciation factor associated with purchasing equipment. Leasing may be more attractive, especially for rapidly evolving technologies. 3. Equipment Usage: — Assess the frequency and duration of equipment use. If the equipment will be used only for specific projects or seasons, leasing may suit your business better. — For long-term, regular use, purchasing equipment might be a more cost-effective option in the long run. 4. Equipment Upgrades: — Consider the pace of technological advancements and industry updates. Leasing enables businesses to upgrade equipment more frequently to remain competitive. — Purchasing equipment requires additional costs for upgrades and may lead to equipment obsolescence. 5. Maintenance and Repairs: — Determine the responsibility for maintenance and repairs based on the leasing or purchasing agreement. — Leasing often includes maintenance as part of the contract, reducing unexpected expenses. Allegheny, Pennsylvania Checklist — Types of Leasing vs. Purchasing Equipment: 1. Financial Lease: — A type of leasing where a business assumes a significant portion of the risks and rewards associated with equipment ownership. — Monthly payments contribute towards the purchase price, offering a potential ownership stake at the end of the lease period. 2. Operating Lease: — Offers businesses the advantages of leasing without long-term commitments. — Ideal for equipment that rapidly depreciates or requires regular upgrades. 3. Capital Lease: — Similar to a financial lease but grants businesses the option to purchase the equipment at the end of the lease. — Monthly payments typically cover the asset's full cost over time. Conclusion: When considering leasing vs. purchasing equipment in Allegheny, Pennsylvania, businesses must carefully evaluate their specific needs, financial situation, and long-term goals. By utilizing this detailed checklist, businesses can navigate the decision-making process and make a choice that best suits their operations. Whether choosing a financial, operating, or capital lease, the ultimate aim is to ensure the efficient utilization of resources and maximize profitability in Allegheny, Pennsylvania.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Lista de Verificación - Arrendamiento vs. Compra de Equipos - Checklist - Leasing vs. Purchasing Equipment

Description

How to fill out Allegheny Pennsylvania Lista De Verificación - Arrendamiento Vs. Compra De Equipos?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business objective utilized in your region, including the Allegheny Checklist - Leasing vs. Purchasing Equipment.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Allegheny Checklist - Leasing vs. Purchasing Equipment will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Allegheny Checklist - Leasing vs. Purchasing Equipment:

- Ensure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Allegheny Checklist - Leasing vs. Purchasing Equipment on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!