Chicago, Illinois, is a bustling city known for its rich history, breathtaking architecture, and vibrant culture. When it comes to leasing vs. purchasing equipment in Chicago, there are several factors to consider. This checklist will help you navigate through the decision-making process by providing an in-depth analysis of the pros and cons of both options. 1. Cost-effectiveness: Leasing equipment in Chicago allows businesses to access top-quality machinery without making a significant upfront investment. On the other hand, purchasing equipment can be more cost-effective in the long run if it is expected to be used for an extended period. 2. Flexibility: Leasing equipment in Chicago provides businesses with the flexibility to upgrade or replace machinery easily as technology evolves. Purchasing equipment, however, may restrict flexibility as businesses would have to sell existing equipment before purchasing new models. 3. Maintenance and Repairs: When leasing equipment in Chicago, maintenance and repairs are often covered by the leasing company, reducing financial burdens for businesses. Conversely, purchasing equipment means taking responsibility for maintenance and repair costs, which can add up over time. 4. Tax Benefits: Leasing equipment in Chicago may offer potential tax benefits as the monthly lease payments are usually tax-deductible. On the other hand, purchasing equipment provides businesses with depreciating tax benefits over the equipment's useful life. 5. Cash Flow: Leasing equipment can help businesses in Chicago preserve cash flow as it requires lower upfront costs and allows businesses to allocate the saved capital towards other vital areas. Purchasing equipment can lead to a significant initial cash outflow, affecting business liquidity. Types of Chicago Illinois Checklist — Leasing vs. Purchasing Equipment: 1. Office Equipment: Businesses in Chicago may require various office equipment such as printers, scanners, and computers. The checklist for leasing vs. purchasing office equipment would encompass factors like cost, longevity, technological advancements, and maintenance requirements. 2. Construction Equipment: Companies in the construction industry in Chicago may need to decide whether to lease or purchase heavy machinery like excavators, bulldozers, and cranes. The checklist here would involve considerations such as project durations, utilization rates, maintenance costs, and resale value. 3. Medical Equipment: Healthcare facilities in Chicago may need to choose between leasing or purchasing medical equipment like MRI machines, X-ray equipment, and ultrasound devices. The checklist for this type would focus on factors such as equipment obsolescence, maintenance support, and compliance with regulatory standards. 4. Restaurant Equipment: Establishments in the food industry in Chicago might need to assess whether leasing or purchasing commercial kitchen equipment like ovens, refrigerators, and dishwashers is more beneficial. The checklist for this type would evaluate factors like menu offerings, growth projections, maintenance availability, and overall budget. By considering these factors and utilizing the appropriate checklist, businesses in Chicago can make informed decisions regarding leasing vs. purchasing equipment, ensuring optimal operational efficiency and financial stability.

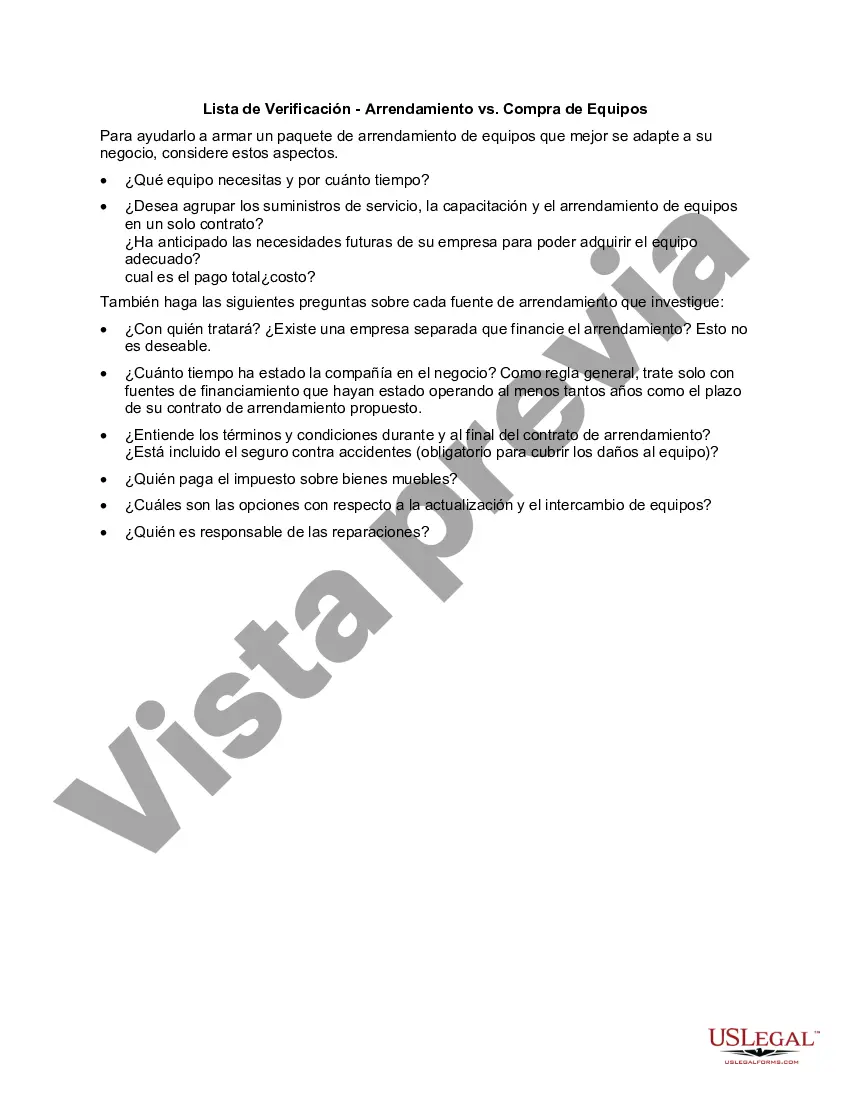

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Lista de Verificación - Arrendamiento vs. Compra de Equipos - Checklist - Leasing vs. Purchasing Equipment

Description

How to fill out Chicago Illinois Lista De Verificación - Arrendamiento Vs. Compra De Equipos?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Chicago Checklist - Leasing vs. Purchasing Equipment is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Chicago Checklist - Leasing vs. Purchasing Equipment. Adhere to the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Checklist - Leasing vs. Purchasing Equipment in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!