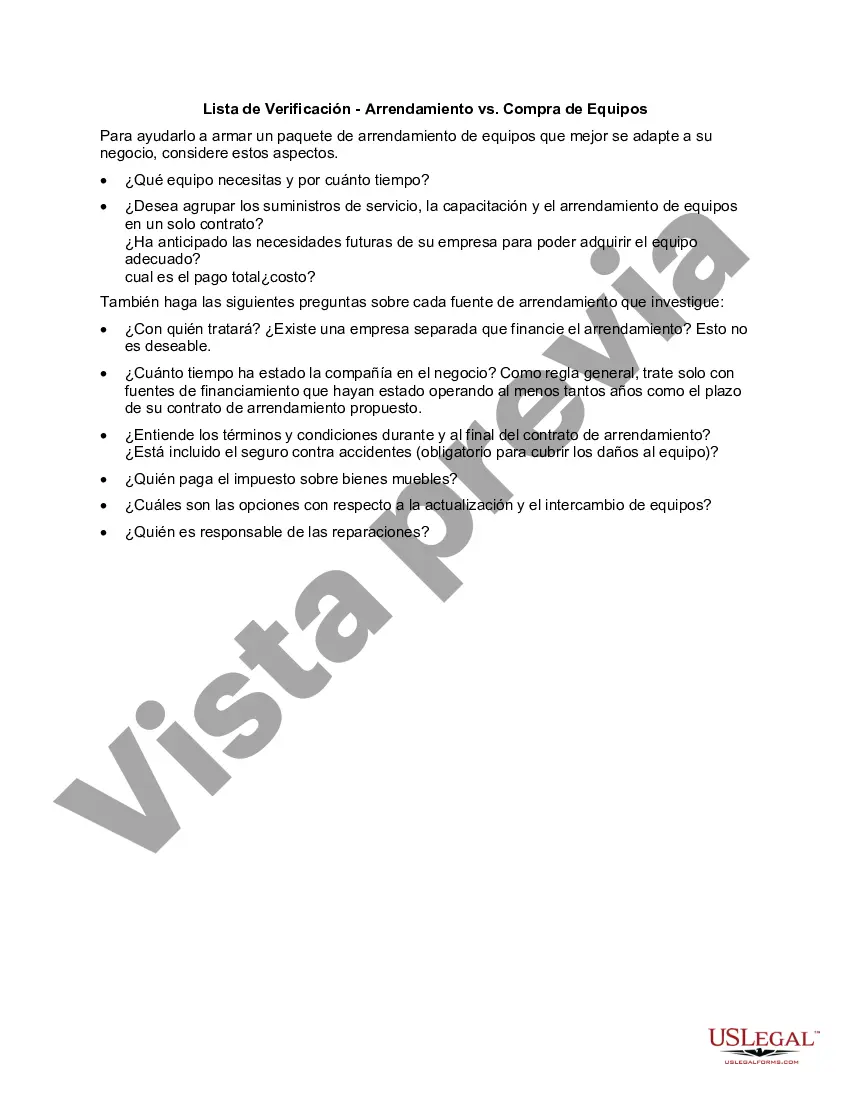

When it comes to making a decision between leasing and purchasing equipment in Cuyahoga, Ohio, there are several factors to consider. This checklist aims to provide a detailed description of what Cuyahoga County businesses should keep in mind when choosing between leasing and purchasing equipment, ensuring a well-informed decision. Relevant keywords for this topic include Cuyahoga Ohio, leasing vs. purchasing equipment, decision-making, Cuyahoga County businesses, factors to consider, and checklist. 1. Identify Your Business Needs: — Analyze your current and future equipment requirements. — Assess the frequency of equipment upgrades or replacements. — Consider the technology advancements and industry-specific equipment demands. — Determine the duration for which the equipment will be needed. 2. Evaluate Financial Considerations: — Review your available budget and cash flow. — Compare the costs of leasing vs. purchasing equipment. — Consider potential tax advantages or incentives associated with each option. — Explore financing options available for purchasing equipment. 3. Assess Equipment Usage: — Evaluate the expected lifespan of the equipment. — Determine the expected usage level (e.g., heavy or occasional use). — Consider whether the equipment will become obsolete or outdated quickly. — Assess the potential maintenance and repair costs for the equipment. 4. Examine Flexibility and Future Needs: — Determine if your business requires flexibility to upgrade or change equipment frequently. — Evaluate the impact of technological advancements on the equipment's usefulness. — Consider any changing business strategies or expansion plans. 5. Understand Potential Risks: — Identify the risk of equipment value depreciation over time. — Consider the risk of obsolescence or technological redundancy. — Evaluate the potential impact on liquidity and balance sheet ratios. In Cuyahoga, Ohio, businesses can choose between various types of equipment leasing or purchasing alternatives, depending on their needs. These can include: 1. Capital Lease: — Offers the lessee an option to purchase the equipment at the end of the lease term. — Provides the benefits of ownership, such as potential tax advantages. — Transfers risks and rewards of ownership to the lessee. 2. Operating Lease: — Usually involves shorter lease terms— - Provides flexibility to upgrade or replace equipment easily. — Often preferred for rapidly changing technology industries. 3. Finance Lease: — Provides long-term financing options for equipment. — Transfers many of the risks and rewards of ownership to the lessee. — Offers flexibility in structuring lease terms and payments. By considering the factors mentioned above and evaluating the available types of leases, Cuyahoga, Ohio businesses can make an informed decision about whether leasing or purchasing equipment will best suit their needs and financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Lista de Verificación - Arrendamiento vs. Compra de Equipos - Checklist - Leasing vs. Purchasing Equipment

Description

How to fill out Cuyahoga Ohio Lista De Verificación - Arrendamiento Vs. Compra De Equipos?

Creating forms, like Cuyahoga Checklist - Leasing vs. Purchasing Equipment, to manage your legal affairs is a challenging and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can get your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms created for different scenarios and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Cuyahoga Checklist - Leasing vs. Purchasing Equipment template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly simple! Here’s what you need to do before downloading Cuyahoga Checklist - Leasing vs. Purchasing Equipment:

- Ensure that your form is specific to your state/county since the regulations for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Cuyahoga Checklist - Leasing vs. Purchasing Equipment isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our website and get the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!