Houston, Texas Checklist — Leasing vs. Purchasing Equipment: A Comprehensive Guide Are you a business owner or decision-maker in Houston, Texas, looking to acquire new equipment for your operations? Choosing between leasing and purchasing equipment is a crucial decision that can significantly impact your bottom line. To help you make an informed choice, we have prepared a detailed checklist outlining the key factors to consider when deciding between leasing and purchasing equipment in Houston, Texas. 1. Financial Considerations: — Budget: Evaluate your financial capacity and determine whether purchasing or leasing fits within your budget constraints. — Cash Flow: Consider the impact on your cash flow, as purchasing equipment may require a substantial upfront investment compared to predictable monthly lease payments. — Tax Implications: Consult with a tax professional to understand how leasing or purchasing equipment can affect your annual tax deductions and depreciation costs. — Financing Options: Research different financing options available for purchasing equipment, such as loans or leases with buyout options. 2. Equipment Usage and Flexibility: — Equipment Lifespan: Assess the expected lifespan of the equipment needed for your Houston-based operations. If the equipment becomes outdated quickly, leasing might be a more cost-effective solution. — Technological Advancements: Determine if the equipment rapidly evolves, and if leasing offers the flexibility to upgrade to newer models as they become available. — Industry-specific Considerations: Research industry-specific regulations, standards, and certifications required for equipment usage in Houston, Texas, and evaluate how leasing or purchasing can align with those requirements. — Seasonal Needs: If your business experiences seasonal fluctuations, consider how often the equipment will be utilized throughout the year, as leasing allows for adjustments based on changing demands. 3. Maintenance and Repairs: — Warranty: Review the warranty options provided by equipment suppliers and determine if warranty coverage is more beneficial when leasing or purchasing. — Repair Costs: Evaluate potential repair and maintenance expenses associated with the equipment and weigh whether leasing or purchasing offers better cost control. — Vendor Support: Assess the vendor's reputation, customer support, and availability of spare parts in Houston, Texas, to ensure minimal downtime and optimum operational efficiency. 4. End-of-Term Considerations: — Residual Value: Determine the equipment's projected residual value at the end of the lease term if choosing the leasing option, and weigh it against the potential resale value if purchasing. — Equipment Disposal: Understand the responsibilities and costs associated with disposing of leased equipment at the end of the contract or selling owned equipment when replacing it. — Future Needs: Consider if your business might require different or upgraded equipment in the future. Leasing often provides more flexibility to adapt to changing needs. Types of Houston, Texas Checklist — Leasing vs. Purchasing Equipment— - Construction Equipment: Specifically tailored to contractors and construction companies in Houston, Texas, this checklist highlights considerations unique to the construction industry. — Medical Equipment: Houston's thriving healthcare industry demands specific guidelines for leasing or purchasing medical equipment, ensuring compliance with regulatory standards. — Technology Equipment: For tech-savvy businesses in Houston seeking the latest gadgets, this checklist focuses on leasing vs. purchasing technology equipment such as computers, servers, and software licenses. In summary, whether you're in construction, healthcare, technology, or any other industry in Houston, Texas, making the right choice between leasing and purchasing equipment is key to maximizing your operational efficiency and financial stability. By using this comprehensive checklist, you'll have a solid foundation to evaluate the pros and cons, ultimately helping you make an informed decision aligned with your business goals.

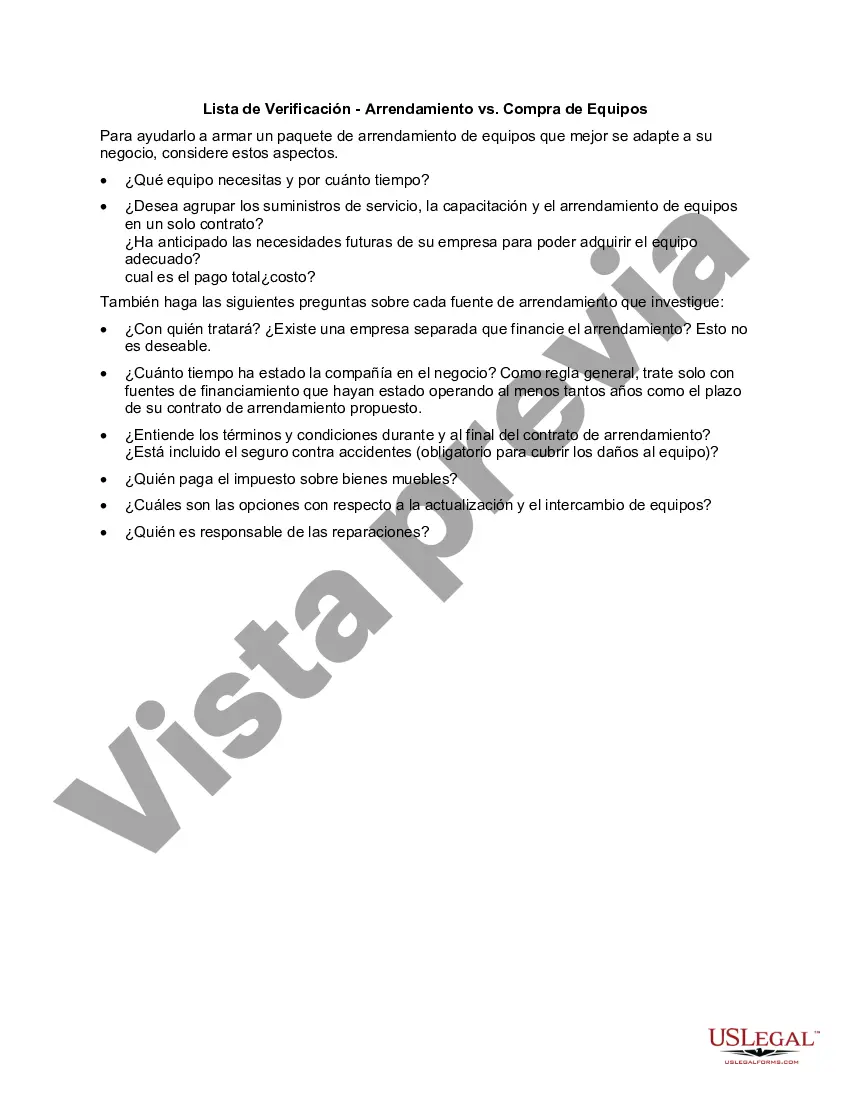

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Lista de Verificación - Arrendamiento vs. Compra de Equipos - Checklist - Leasing vs. Purchasing Equipment

Description

How to fill out Houston Texas Lista De Verificación - Arrendamiento Vs. Compra De Equipos?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Houston Checklist - Leasing vs. Purchasing Equipment, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how you can purchase and download Houston Checklist - Leasing vs. Purchasing Equipment.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the legality of some documents.

- Check the similar document templates or start the search over to locate the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and buy Houston Checklist - Leasing vs. Purchasing Equipment.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Houston Checklist - Leasing vs. Purchasing Equipment, log in to your account, and download it. Needless to say, our website can’t replace a legal professional entirely. If you have to cope with an exceptionally complicated case, we recommend using the services of a lawyer to review your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-compliant documents effortlessly!