Chicago Illinois Credit Memo is a financial document used in business transactions, specifically in the city of Chicago, Illinois. It serves as a notice or memorandum to acknowledge and record the credit amount owed to a customer or client by a supplier or vendor. This document is crucial for maintaining accurate financial records and ensuring transparency in payment transactions. The Chicago Illinois Credit Memo includes important details such as the name and address of both the supplier/vendor and the customer/client, the date of issuance, a unique identification number for easy reference and tracking, and a comprehensive description of the credit amount. The credit memo is typically generated when there is an overpayment, a return of goods, an adjustment in pricing, or any other situation where the customer is owed money by the supplier/vendor. It helps in rectifying any discrepancies or errors in the billing process promptly. There are several types of Chicago Illinois Credit Memo that may be encountered in business transactions: 1. Overpayment Credit Memo: This type of credit memo is issued when a customer makes an excess payment for goods or services rendered. It ensures that the customer is reimbursed for the overpaid amount. 2. Return Credit Memo: A return credit memo is generated when a customer returns purchased goods to the supplier/vendor. It allows for the adjustment of the customer's account and facilitates the issuing of refunds or credits. 3. Pricing Adjustment Credit Memo: This credit memo is used when there is a need to adjust the pricing of previously sold goods or services. It reflects any changes in the contract terms or agreed-upon prices, ensuring accurate billing. 4. Damage or Defective Goods Credit Memo: In cases where goods are received by the customer in a damaged or defective condition, a credit memo is issued to compensate for the inconvenience or loss. It may include the cost of replacement goods or a monetary refund. 5. Late Delivery Credit Memo: If a supplier/vendor fails to meet the agreed-upon delivery timeline and this delay causes inconvenience or additional costs for the customer, a credit memo may be issued as compensation for the delay. In summary, a Chicago Illinois Credit Memo is a vital financial document used in business transactions within the city. It acknowledges and records the credit amount owed to a customer by a supplier/vendor and possesses different types for various scenarios such as overpayment, returns, pricing adjustments, damaged goods, and late delivery.

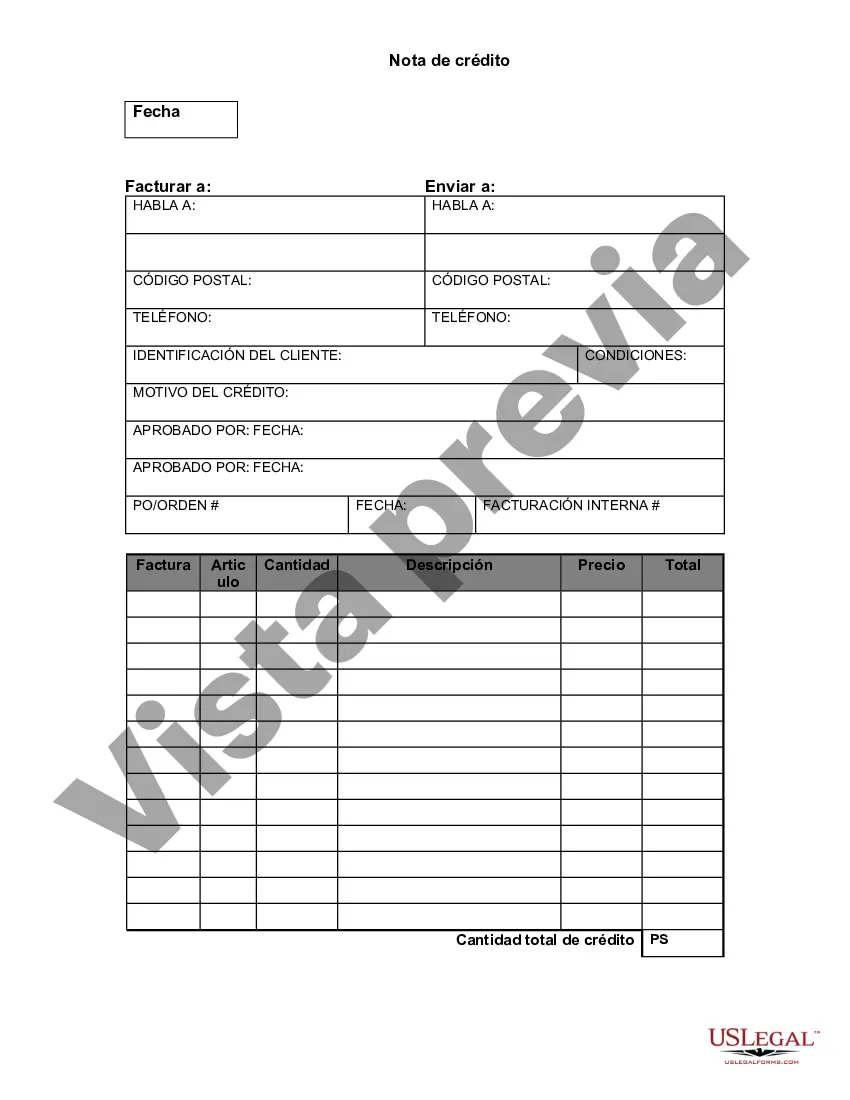

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Nota de crédito - Credit Memo

Description

How to fill out Chicago Illinois Nota De Crédito?

If you need to find a trustworthy legal paperwork supplier to get the Chicago Credit Memo, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to get and execute different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to search or browse Chicago Credit Memo, either by a keyword or by the state/county the document is created for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Chicago Credit Memo template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes these tasks less pricey and more reasonably priced. Set up your first company, organize your advance care planning, draft a real estate contract, or execute the Chicago Credit Memo - all from the convenience of your sofa.

Sign up for US Legal Forms now!