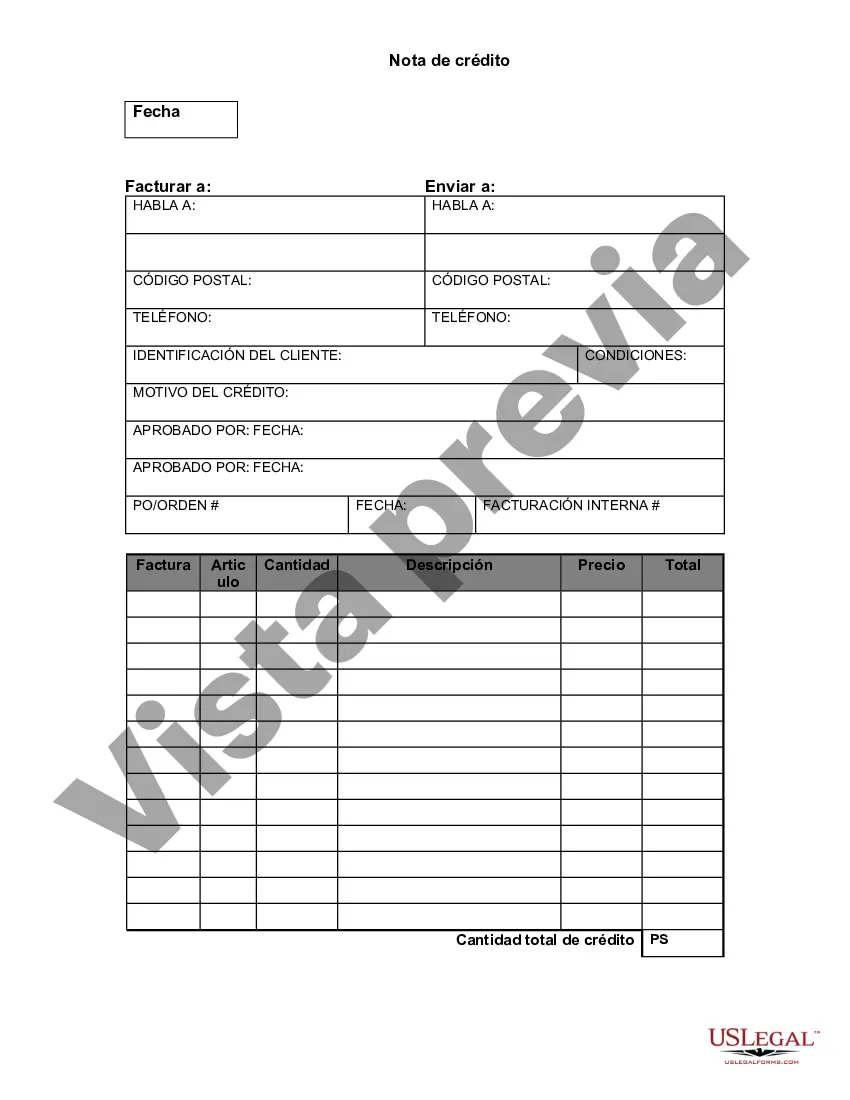

Fairfax Virginia Credit Memo is a financial document used to record and issue credit adjustments or refunds to customers in Fairfax, Virginia. This memo is typically issued by businesses or organizations in response to customer overpayment, returned merchandise, error correction, or any other circumstances where the customer is entitled to a credit. A Fairfax Virginia Credit Memo includes various key details and components to accurately document the transaction. These details are: 1. Customer Information: The credit memo starts by specifying the customer's name, address, contact information, and any other relevant identification details. 2. Memo Number: Each credit memo is assigned a unique identification number for easy reference and tracking purposes. 3. Date: The date when the credit memo is prepared and issued is mentioned to establish the timeline of the transaction. 4. Description of Goods or Services: A detailed description of the goods or services for which the credit is being issued is included, ensuring transparency and clarity. 5. Quantity and Unit Price: The credit memo specifies the quantity of goods or services to be credited and the original unit price. 6. Total Credit Amount: The total credit amount is calculated by multiplying the quantity with the unit price and subtracting any applicable discounts or fees. 7. Reason for Credit: A comprehensive explanation of the reason for issuing the credit memo is provided. This could be due to a billing error, returned merchandise, or any other valid reason. 8. Supporting Documentation: If applicable, any supporting documents such as receipts, invoices, or return authorization forms are attached to the credit memo. 9. Terms and Conditions: Any specific terms and conditions related to the credit, such as its validity period or limitations, are mentioned for the customer's awareness. Different types of Fairfax Virginia Credit Memos include: 1. Sales Credit Memo: Issued when a customer returns or cancels a purchase, resulting in a credit due to them. 2. Pricing Error Credit Memo: Generated when an incorrect price was charged, leading to an overpayment by the customer. This type of credit memo corrects the billing discrepancy. 3. Damaged Goods Credit Memo: Created when a customer receives damaged or defective products and is entitled to a credit or refund. 4. Adjustment Credit Memo: This credit memo type allows businesses to make adjustments or corrections to a customer's account balance due to any errors or discrepancies. In summary, a Fairfax Virginia Credit Memo is a detailed financial document that acknowledges the issuance of credits or refunds to customers in Fairfax, Virginia. It ensures accuracy and transparency in recording and resolving customer-related financial transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Nota de crédito - Credit Memo

Description

How to fill out Fairfax Virginia Nota De Crédito?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, locating a Fairfax Credit Memo meeting all local requirements can be exhausting, and ordering it from a professional attorney is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. Apart from the Fairfax Credit Memo, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Fairfax Credit Memo:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Fairfax Credit Memo.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!