Harris Texas Credit Memo is a document issued by the Harris County government or Harris County Financial Services department located in the state of Texas. It serves as a record and acknowledgement of a credit owed by the county to an individual or organization. A credit memo is typically produced when an overpayment has been made or when a refund is due to a taxpayer, vendor, or any entity that has transacted with the county. The Harris Texas Credit Memo is an essential tool in maintaining accurate financial records and ensures that all transactions are accounted for correctly. It contains important information such as the date of issuance, credit amount, recipient's name, payment reference, and details explaining the reason for the credit. This document allows the county to rectify any errors or discrepancies and provides transparency in its financial operations. Different types of Harris Texas Credit Memos may include: 1. Tax Overpayment Credit Memo: This type of credit memo is issued when an individual or business overpays their taxes to the Harris County government. It reflects the excess amount paid and provides a credit for future tax payments or requests a refund. 2. Vendor Overpayment Credit Memo: If a vendor providing goods or services to the county is mistakenly overpaid, a credit memo is generated indicating the extra amount paid. The credit can be applied to future payments or a refund can be requested. 3. Fee Recovery Credit Memo: In case of an overpayment of fees or charges by an entity conducting business with the county, a credit memo is issued to rectify the excess payment. The credit can be used towards future fees or a refund can be requested. 4. Property Tax Refund Credit Memo: When a property owner overpays their property taxes, such as due to an error in assessment or payment calculation, a credit memo is issued indicating the amount to be credited or refunded. 5. Court Fees Credit Memo: If an individual or an organization overpays court fees or other legal costs, a credit memo is provided to maintain accurate accounting and ensure that correct balances are maintained. Overall, the Harris Texas Credit Memo is an integral part of the financial system in Harris County, Texas. It enables the county government to rectify payment errors, maintain accurate financial records, and provide a transparent and efficient process for issuing credits and refunds to individuals, businesses, or organizations.

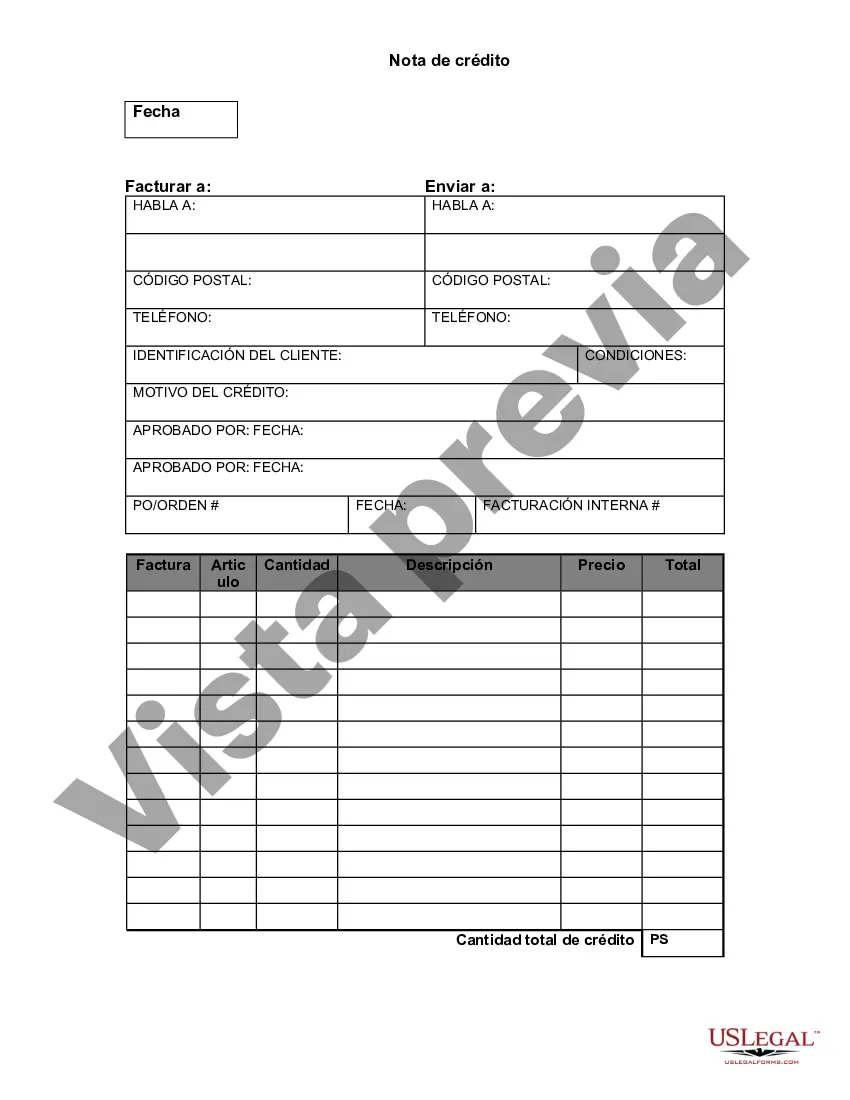

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Nota de crédito - Credit Memo

Description

How to fill out Harris Texas Nota De Crédito?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business objective utilized in your county, including the Harris Credit Memo.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Harris Credit Memo will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Harris Credit Memo:

- Ensure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Harris Credit Memo on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!