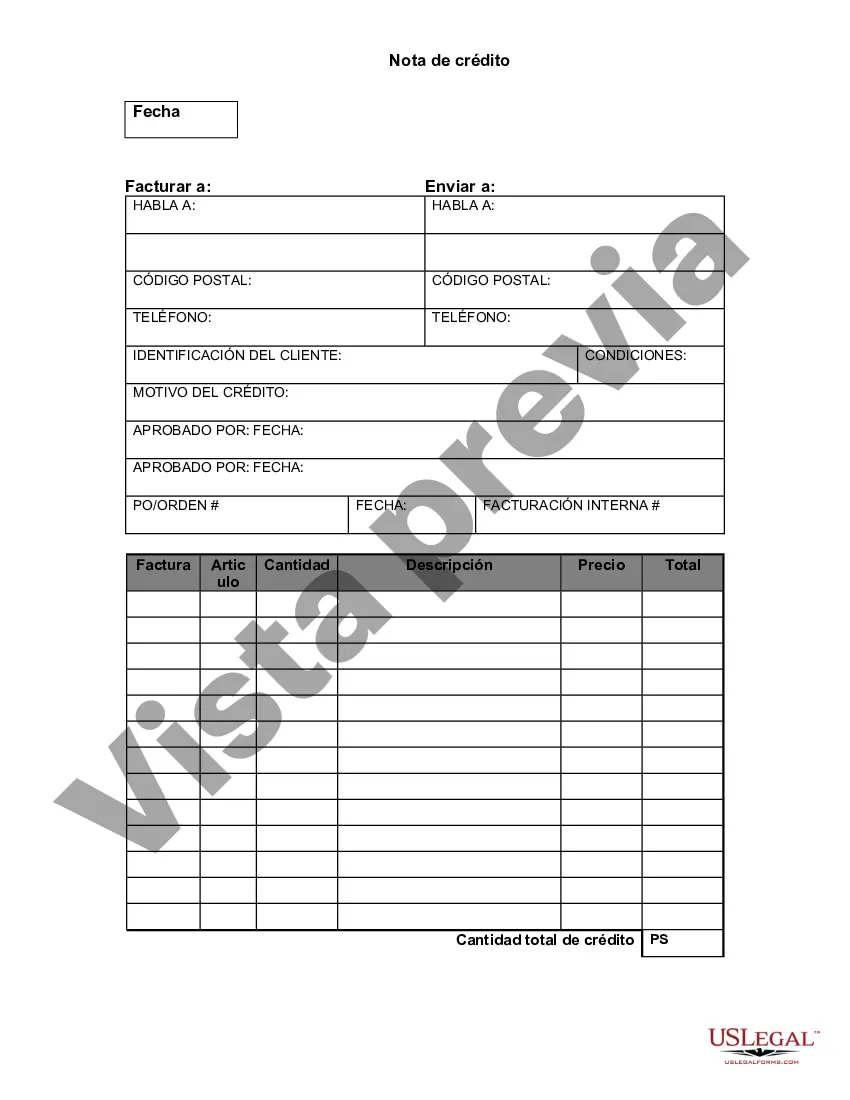

Mecklenburg North Carolina Credit Memo is an essential document used in financial transactions to record a credit issued to a customer's account. It serves as a legally binding record of a company's decision to provide a refund, credit, or adjustment to a customer's outstanding balance due to various reasons. This credit may be in the form of a refund for returned goods, an overpayment made by the customer, a pricing discrepancy, or any other valid basis approved by the company. The Mecklenburg North Carolina Credit Memo includes several key details. Firstly, it typically contains the company's name, address, and contact information at the top, followed by the memo's unique reference number and date of issuance. Each Credit Memo should clearly state the customer's name, address, and contact information as well. Next, the document provides a comprehensive description of the reason for issuing the credit, including any supporting documentation or evidence if applicable. This step ensures that the credit is approved and justified, preventing any disputes or misunderstandings in the future. Additionally, it may specify the specific product or service in question, the quantity or amount involved, and the original price. Furthermore, the Mecklenburg North Carolina Credit Memo outlines the amount of credit being granted to the customer. This may be stated as a specific monetary value or a percentage of the total outstanding balance. In case the customer has multiple outstanding invoices, the memo may also specify which invoice(s) the credit is being applied to. Finally, the document should include the authorized person's name, signature, and title, as well as a line for the customer's acknowledgement or acceptance of the credit. This ensures that both parties are aware of and in agreement with the credit issuance. Types of Mecklenburg North Carolina Credit Memos may include: 1. Product Return Credit Memo: Issued when a customer returns a product and is eligible for a refund or credit on their account. 2. Overpayment Credit Memo: Generated when a customer accidentally makes an excess payment, resulting in a credit being applied to their account. 3. Pricing Adjustment Credit Memo: Issued to rectify any pricing discrepancies, such as incorrect discounts or overcharges, providing a credit to the customer. 4. Shipment Error Credit Memo: Generated when a customer receives incorrect or damaged goods due to a company's shipping errors, resulting in a credit being issued. In conclusion, Mecklenburg North Carolina Credit Memo is a crucial financial document used to record and authorize credits provided to customers for various reasons. It ensures transparency, accuracy, and proper documentation of financial transactions, benefiting both the company and its customers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Nota de crédito - Credit Memo

Description

How to fill out Mecklenburg North Carolina Nota De Crédito?

If you need to get a reliable legal document supplier to find the Mecklenburg Credit Memo, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can search from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of supporting resources, and dedicated support team make it simple to get and complete various documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply select to search or browse Mecklenburg Credit Memo, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Mecklenburg Credit Memo template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately available for download once the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less pricey and more affordable. Create your first business, arrange your advance care planning, create a real estate contract, or execute the Mecklenburg Credit Memo - all from the comfort of your sofa.

Sign up for US Legal Forms now!