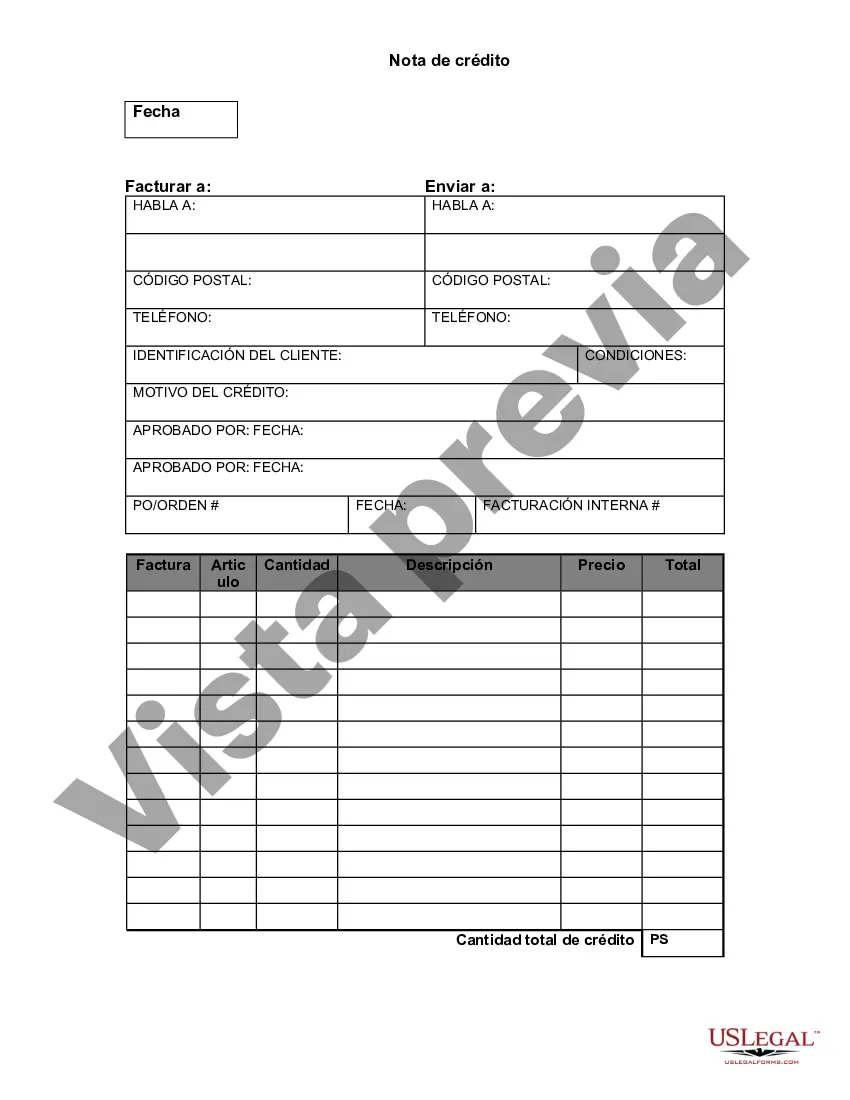

Nassau New York Credit Memo is an important financial document used by businesses to track and manage credit transactions. It serves as a record of credit given to a customer, highlighting the amount owed, the reason for the credit, and any applicable deductions. This document is essential for maintaining accurate financial records and facilitating smooth business operations. Keywords: Nassau New York, credit memo, financial document, credit transactions, track, manage, record, amount owed, reason, deductions, accurate financial records, business operations. There are two main types of Nassau New York Credit Memo: 1. Sales Return Credit Memo: This type of credit memo is issued when a customer returns a purchased item due to various reasons like product defects, dissatisfaction, or error in shipment. The sales return credit memo provides a credit to the customer's account equal to the original purchase amount, which can be applied toward future purchases or refunded. 2. Price Adjustment Credit Memo: This type of credit memo is used when there is a price discrepancy or error in the original invoice. It is issued to correct the billing amount and adjust the customer's account accordingly. Price adjustment credit memos may be initiated if the customer was overcharged, undercharged, or if there were any discounts or promotions that weren't properly applied. In both cases, Nassau New York Credit Memos should include important details such as the customer's name, contact information, credit memo number, date of issue, original invoice number, reason for the credit, and the amount being credited. Additionally, the credit memo should be authorized by the relevant department or individual within the organization and forwarded to the appropriate parties for further action or documentation. By utilizing Nassau New York Credit Memos effectively, businesses can maintain accurate financial records, strengthen customer relationships, and ensure timely resolution of credit-related matters. Proper documentation and tracking of credit transactions are crucial for streamlining accounting processes and fostering transparent financial practices. Keywords: Sales return credit memo, price adjustment credit memo, purchased item, product defects, dissatisfaction, error in shipment, credit to the customer's account, future purchases, refunded, price discrepancy, original invoice, billing amount, adjust customer's account, overcharged, undercharged, discounts, promotions, customer's name, contact information, credit memo number, date of issue, reason, authorized, department, individual, organization, documentation, business, financial records, customer relationships, timely resolution, accounting processes, transparent financial practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Nota de crédito - Credit Memo

Description

How to fill out Nassau New York Nota De Crédito?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Nassau Credit Memo is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Nassau Credit Memo. Follow the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Credit Memo in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!