Travis Texas Credit Memo is a significant document used in financial transactions to rectify errors or make adjustments in a customer's account. It essentially serves as a form of credit issued by the company to refund customers for overpayment, returns, or to resolve pricing or billing discrepancies. A Travis Texas Credit Memo ensures accurate accounting and maintains a good customer-business relationship by effectively resolving financial disputes. The Travis Texas Credit Memo follows a standardized format that includes vital information such as the company name, contact details, customer name, transaction date, credit/adjustment amount, and a brief description of the reason for issuing the credit. It is typically issued by the company's accounting or accounts receivable department following an inquiry or complaint from the customer. The credit memo can be divided into different types based on their purposes and nature: 1. Return Credit Memo: This type of credit memo is issued when a customer returns a product due to dissatisfaction, defects, or simply changing their mind about the purchase. The seller refunds the customer's payment and creates a return credit memo to record the transaction accurately. 2. Billing Discrepancy Credit Memo: Sometimes, errors occur in the billing process, such as incorrect pricing, incorrect quantity charged, or unauthorized fees. In such cases, a credit memo is generated to correct the mistake and provide the customer with the necessary adjustment. 3. Overpayment Credit Memo: If a customer accidentally overpays or pays twice for a product or service, the company issues an overpayment credit memo to refund the excess amount and reconcile the customer's account balance. 4. Promotional Credit Memo: Companies may also provide promotional discounts or credits to customers as a gesture of goodwill or to encourage future purchases. These credits are recorded using promotional credit memos to track their usage and impact on the customer's account. 5. General Adjustment Credit Memo: This category encompasses various credit memos that deal with miscellaneous adjustments or credits outside the scope of the aforementioned types. These can include adjustments for shipping delays, damaged goods, or any other unique circumstances requiring monetary compensation to the customer. In conclusion, Travis Texas Credit Memos play a crucial role in ensuring accurate financial records and resolving customer disputes efficiently. They assist businesses in maintaining satisfactory customer relationships and help in maintaining accurate accounting practices by providing systematic documentation of adjustments and credits.

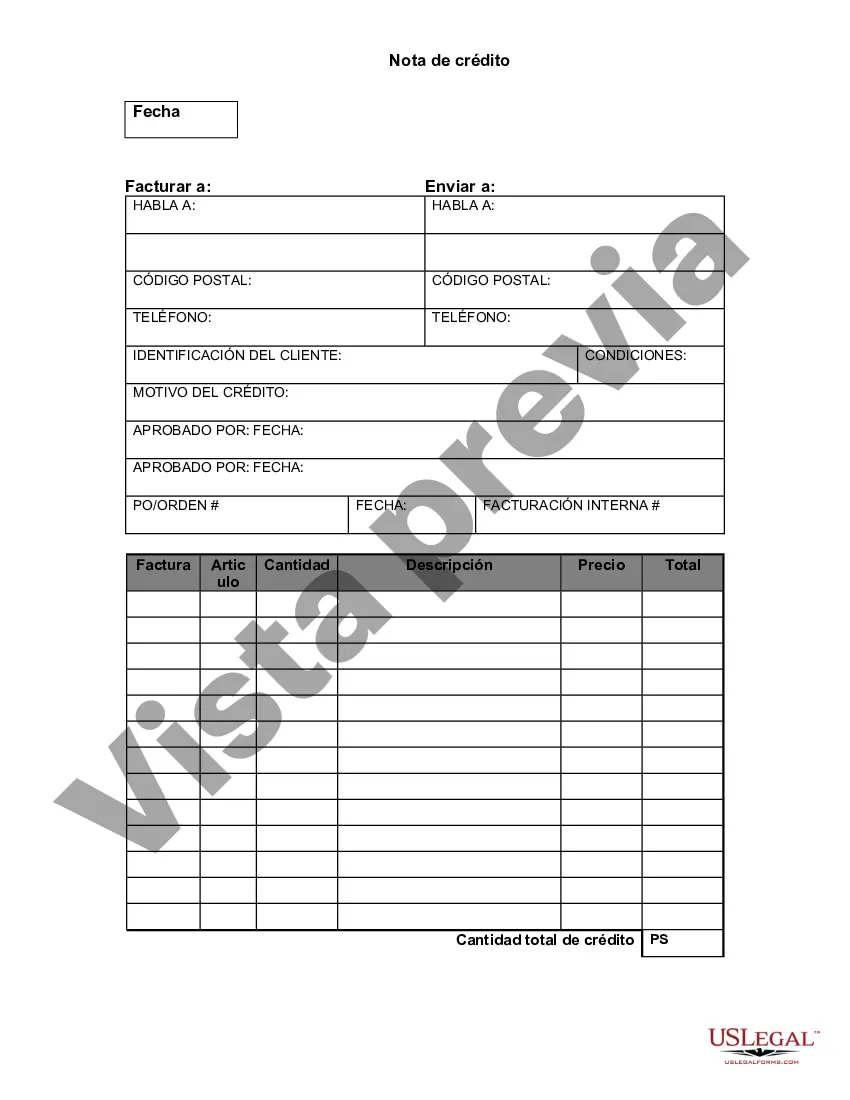

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Nota de crédito - Credit Memo

Description

How to fill out Travis Texas Nota De Crédito?

Whether you plan to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Travis Credit Memo is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Travis Credit Memo. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Travis Credit Memo in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!