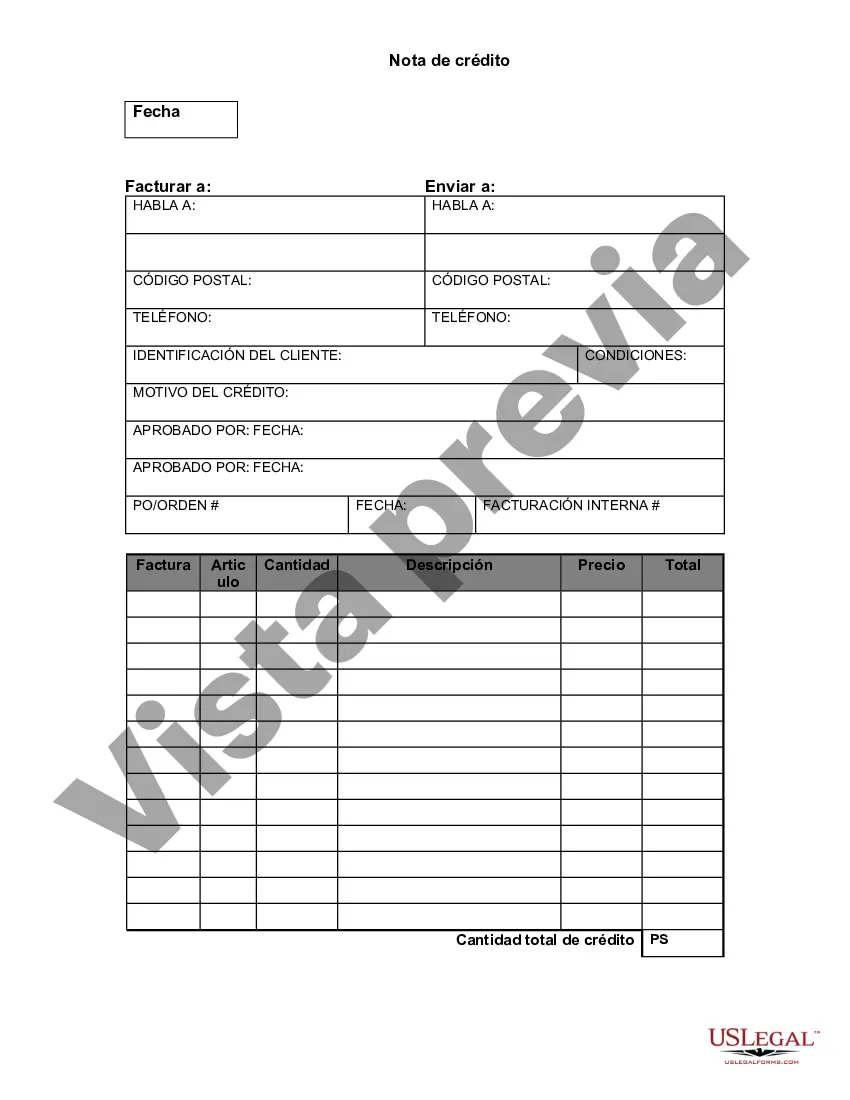

A Wake North Carolina Credit Memo is a detailed document issued by a business or organization in Wake County, North Carolina to acknowledge a credit adjustment made to a customer's account. It serves as a record of the credit applied, providing transparency and ensuring accuracy in financial transactions. The Wake North Carolina Credit Memo is typically created when a customer returns merchandise, cancels a service, or receives a refund for an overpayment. By issuing a credit memo, the business acknowledges the customer's request and facilitates the credit adjustment process, while also maintaining a clear record of the transaction. The content of a Wake North Carolina Credit Memo generally includes the following details: 1. Header: The memo starts with the business's name, address, and contact information. It may also include a unique credit memo number and the memo's creation date. 2. Customer Information: The credit memo will include the customer's name, address, and account number to ensure accurate tracking and identification. 3. Reason for Credit: The memo clearly explains the reason for the credit adjustment, such as returned merchandise, canceled service, or overpayment. This section provides transparency for both the business and the customer. 4. Itemized List: A detailed list of the credited items, including a description, quantity, price, and any applicable taxes or fees, is provided. This allows the customer to easily understand the adjustment made to their account. 5. Total Amount Credited: The credit memo will display the total amount credited to the customer's account. This may include a breakdown of individual items and any additional adjustments like restocking fees or shipping costs. 6. Terms and Conditions: Some Wake North Carolina Credit Memos feature a section outlining the terms and conditions of the credit adjustment. This may include information on return policies, refund methods, or any restrictions on future credit use. Different types of Wake North Carolina Credit Memos may include: 1. Sales Return Credit Memo: This is issued when a customer returns purchased items for a refund or an exchange. It accounts for the sales return and posts the appropriate credit to the customer's account. 2. Service Cancellation Credit Memo: If a customer cancels a service and is entitled to a refund or credit, a service cancellation credit memo is issued to ensure proper documentation and transparency. 3. Billing Adjustment Credit Memo: In cases where a billing error occurs or an overpayment is made, a billing adjustment credit memo is issued to provide the necessary credit adjustment to the customer's account. 4. Vendor Credit Memo: While not directly related to Wake North Carolina customers, vendor credit memos are issued by businesses in Wake County to vendors or suppliers to request credits for returned or damaged goods, invoicing errors, or pricing discrepancies. In summary, a Wake North Carolina Credit Memo is a detailed document created by a business in Wake County to acknowledge a credit adjustment made to a customer's account. It ensures accurate recording of transactions and provides transparency between the business and the customer. Various types of Wake North Carolina Credit Memos include sales return credit memo, service cancellation credit memo, billing adjustment credit memo, and vendor credit memo.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Nota de crédito - Credit Memo

Description

How to fill out Wake North Carolina Nota De Crédito?

Whether you intend to open your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Wake Credit Memo is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the Wake Credit Memo. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Wake Credit Memo in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!