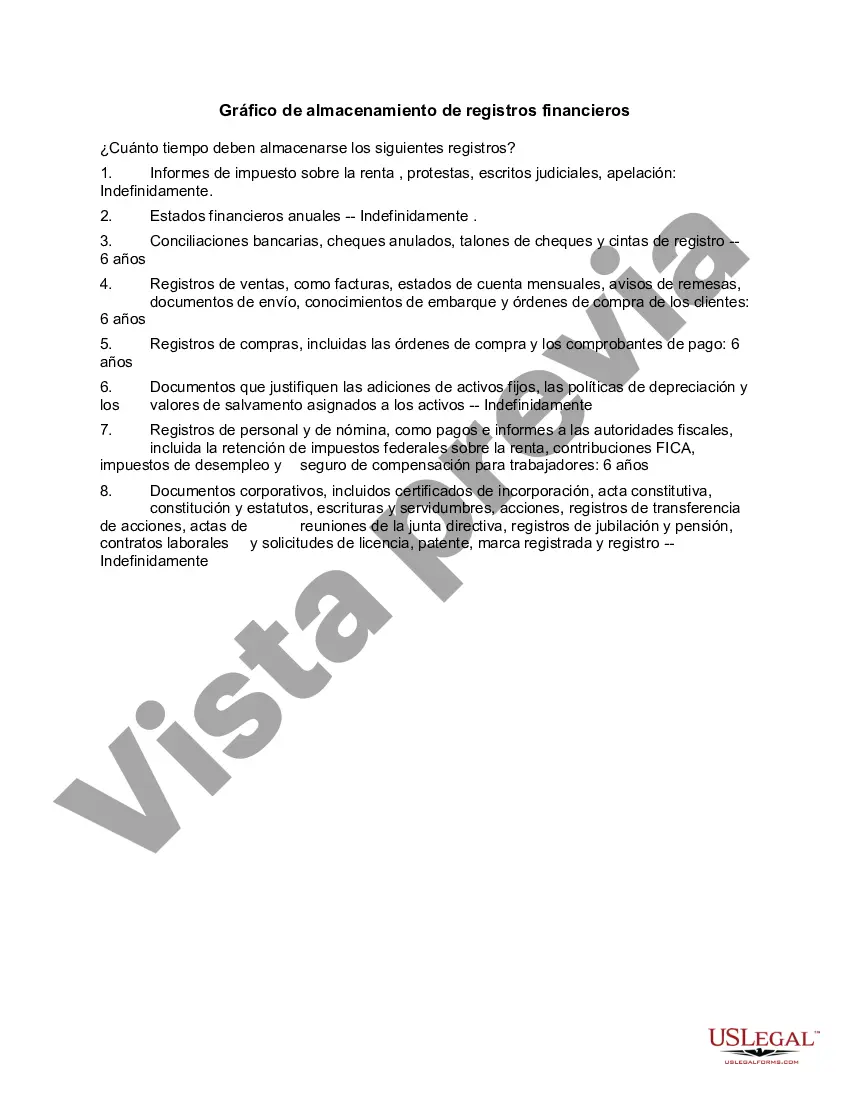

Mecklenburg North Carolina Financial Record Storage Chart: A Comprehensive Overview The Mecklenburg North Carolina Financial Record Storage Chart is a vital tool used by organizations and businesses to effectively manage and store their financial records in Mecklenburg County, North Carolina. This comprehensive chart outlines the specific guidelines and procedures for the proper storage and retention of financial documents, ensuring compliance with both state and federal regulations. The chart serves as a roadmap for businesses and institutions to navigate through the complex process of maintaining financial records, facilitating efficient record-keeping practices, and minimizing the risk of data loss or unauthorized access. It provides detailed instructions on the specific categories of financial documents to be stored, the required storage methods, retention periods, and disposal guidelines. Key elements covered in the Mecklenburg North Carolina Financial Record Storage Chart include: 1. Document categorization: The chart encompasses various financial record categories such as income statements, balance sheets, invoices, receipts, tax filings, contracts, and banking statements. Each category is accompanied by specific instructions on how these records should be organized and stored. 2. Storage methods: The chart outlines the different storage methods available for financial records, including physical storage (physical copies in secure facilities) and digital storage (electronic copies in protected databases or cloud-based storage platforms). It offers recommendations on the most suitable method based on factors such as document sensitivity and accessibility needs. 3. Retention periods: Mecklenburg North Carolina Financial Record Storage Chart lays out the specific retention periods for different financial record types, ensuring compliance with federal and state regulations. It details how long records should be retained before they can be disposed of or securely destroyed to free up storage space. 4. Security measures: The chart emphasizes the importance of implementing robust security measures to protect sensitive financial data from unauthorized access or breaches. It provides guidelines for secure storage facilities, encryption protocols, access controls, and backup procedures. 5. Compliance and audit support: By following the guidelines outlined in the chart, businesses can ensure compliance with legal and regulatory requirements related to financial record storage. It also simplifies the auditing process, as the chart serves as documented proof of adherence to recommended storage practices. Types of Mecklenburg North Carolina Financial Record Storage Chart: 1. Small Business Edition: Designed specifically for small businesses, this version of the financial record storage chart provides simplified instructions and tailored recommendations to accommodate the limited resources and unique needs of smaller organizations. 2. Enterprise Edition: The enterprise edition of the chart caters to larger corporations and institutions with significant financial record-keeping requirements. It includes additional guidance on managing complex financial structures, multiple locations, and integrating advanced technology solutions. In conclusion, the Mecklenburg North Carolina Financial Record Storage Chart is an indispensable tool for businesses and organizations operating in Mecklenburg County. Its structured guidelines and instructions ensure proper management, storage, and retention of financial records, reducing risks, improving compliance, and facilitating efficient auditing processes. Whether it's the small business edition or the enterprise edition, following this chart enables organizations to streamline their financial record-keeping practices and safeguard sensitive financial information.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Gráfico de almacenamiento de registros financieros - Financial Record Storage Chart

Description

How to fill out Mecklenburg North Carolina Gráfico De Almacenamiento De Registros Financieros?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Mecklenburg Financial Record Storage Chart, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different categories ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any tasks associated with document completion straightforward.

Here's how to purchase and download Mecklenburg Financial Record Storage Chart.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Check the related document templates or start the search over to locate the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Mecklenburg Financial Record Storage Chart.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Mecklenburg Financial Record Storage Chart, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer entirely. If you have to deal with an extremely challenging case, we advise getting a lawyer to check your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-compliant paperwork with ease!