Lima Arizona Compensate Work Chart with Explanation: Understanding the Basics of Employee Compensation in Lima, Arizona In Lima, Arizona, employers and employees alike rely on the Lima Arizona Compensate Work Chart to determine proper compensation for work performed. This detailed chart provides a comprehensive breakdown of various types of work and their corresponding compensation rates, ensuring fairness and compliance with labor laws in Lima, Arizona. Let's delve deeper into the different types of Compensate Work Charts available in Lima and understand their significance. 1. Lima Arizona Compensate Work Chart for Hourly Employees: This chart outlines compensation guidelines for hourly employees in Lima, Arizona. It features salary ranges, overtime rates, and additional compensation such as commissions or bonuses. Designed to protect workers' rights, this chart ensures employers comply with state laws regarding minimum wages and overtime pay. 2. Lima Arizona Compensate Work Chart for Salaried Employees: Salaried employees often have different compensation structures compared to hourly employees. This chart provides information on salary levels, deductions, and benefits available to employees in Lima, Arizona. It ensures that salaried workers receive fair and equitable compensation for their contributions. 3. Lima Arizona Compensate Work Chart for Tipped Employees: Tipped employees, such as servers or bartenders, have unique compensation requirements. This chart outlines the minimum wage standards for tipped employees in Lima, Arizona, including tip credits and how they affect overall compensation. It aims to establish clear guidelines and prevent employers from exploiting tipped workers. 4. Lima Arizona Compensate Work Chart for Independent Contractors: Independent contractors often fall under different compensation rules than traditional employees. This chart provides information on payment structures, contract terms, and any additional compensation benefits applicable to independent contractors. It helps ensure transparency and fair compensation arrangements between contractors and the hiring organizations. 5. Lima Arizona Compensate Work Chart for Piece-Rate Work: Certain industries, like agriculture or manufacturing, rely on piece-rate compensation models. This chart offers guidelines on how to calculate wages for piece-rate work in Lima, Arizona. It details the rate per piece or unit produced, ensuring workers receive appropriate compensation based on their productivity. Understanding the Lima Arizona Compensate Work Chart is crucial for both employers and employees in Lima, Arizona. Adherence to these compensation guidelines helps maintain a fair and harmonious work environment, while protecting the rights and interests of all parties involved. Employers should regularly review and update compensation policies based on these charts to ensure compliance with current labor laws in Lima, Arizona.

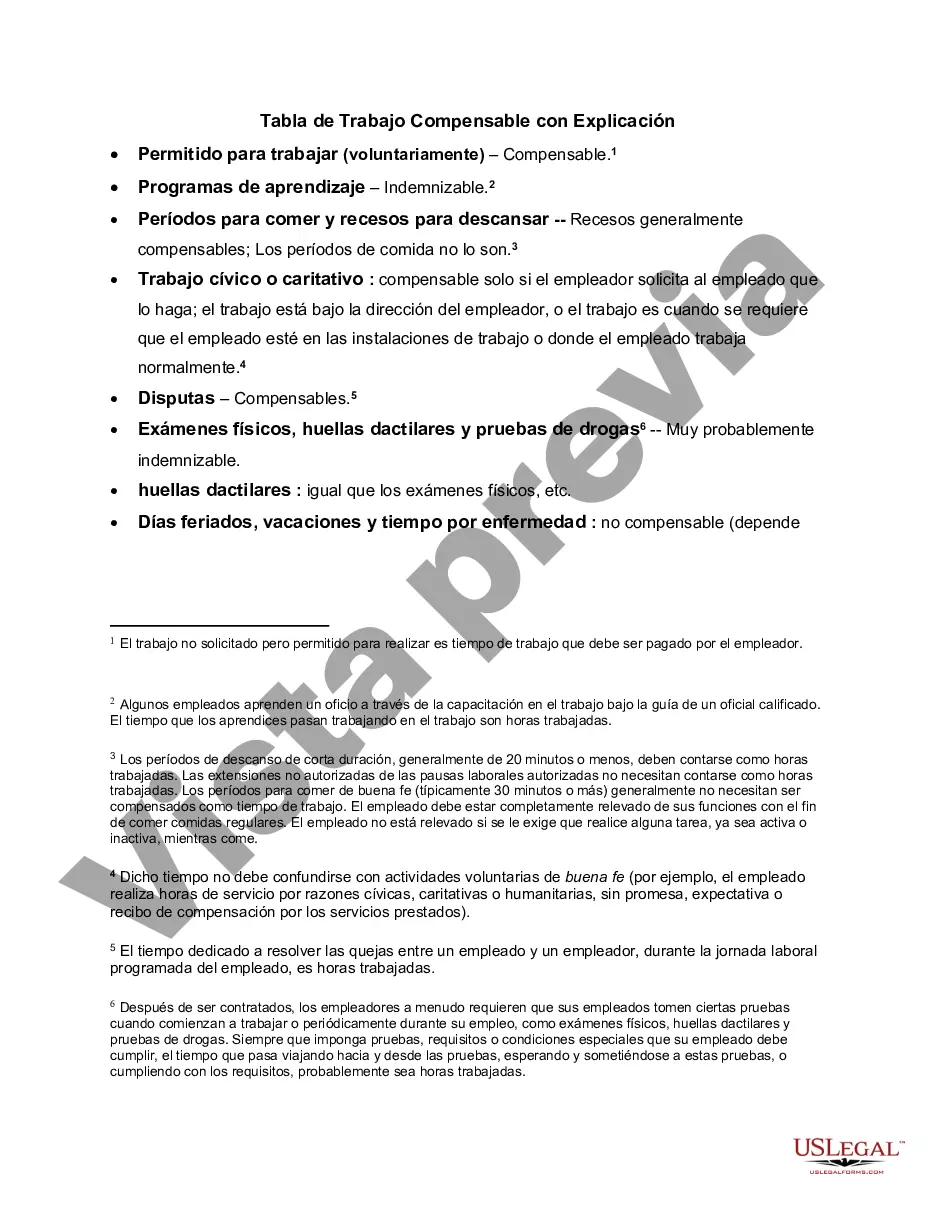

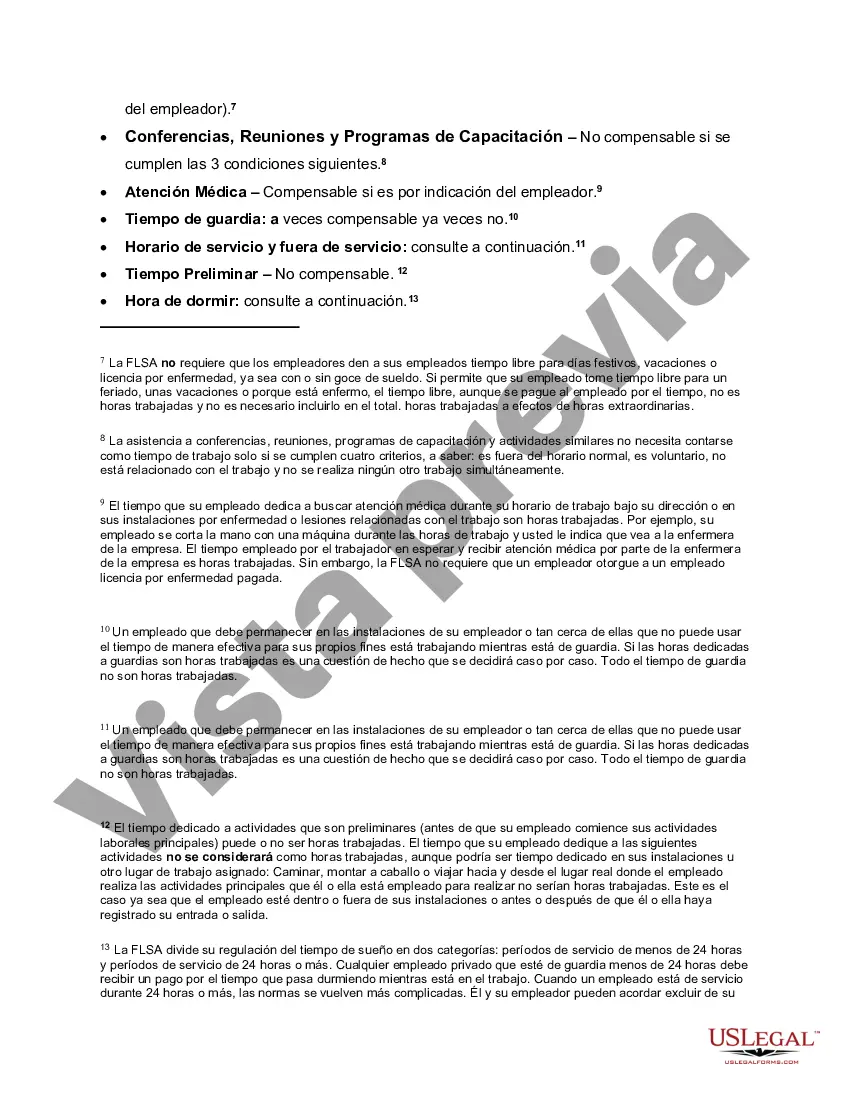

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tabla De Compensación Al Trabajador - Compensable Work Chart with Explanation

Description

How to fill out Pima Arizona Tabla De Trabajo Compensable Con Explicación?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Pima Compensable Work Chart with Explanation, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Pima Compensable Work Chart with Explanation from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Pima Compensable Work Chart with Explanation:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!