Travis Texas Compensate Work Chart is a vital tool used to determine the payment and classification of employees' work hours in accordance with Texas state laws. The chart outlines the various tasks and activities that are considered compensate under the Texas pay regulations. It helps employers maintain compliance with the Fair Labor Standards Act (FLEA) and ensures that employees are fairly compensated for their time and efforts. The Travis Texas Compensate Work Chart consists of different categories that encompass a wide range of job duties, including: 1. Regular work hours: This category includes all hours employees spend on their primary job tasks, such as performing job-specific duties and responsibilities. 2. Overtime work: This section covers any additional time worked by employees beyond the standard 40 hours per week, which must be compensated at a rate of one and a half times the regular pay rate. 3. Breaks and meal periods: This category addresses the duration and compensation for rest breaks and meal periods provided to employees during their work shift. Texas laws require employers to provide rest breaks but do not mandate meal breaks, except for certain industries like healthcare. 4. Travel time: The chart clarifies the compensability of travel time between job sites or locations and whether it should be considered as payable work hours. Factors such as the mode of transportation, distance, and purpose of travel are considered. 5. Training and meetings: This section outlines whether attendance at training sessions, meetings, or seminars is compensated, distinguishing between mandatory and voluntary sessions. 6. On-call and standby time: The chart addresses whether being on-call or standby requires compensation for employees, based on the level of restrictions or limitations imposed on their personal activities during this period. 7. PRE- and post-shift activities: This section focuses on tasks that employees must perform before or after their scheduled work shift, such as logging in to computer systems or changing into work-specific attire, and whether they should be compensated for these activities. 8. Waiting time: The chart explains whether time spent waiting, such as for equipment setup or customer service, is considered compensate or non-compensable depending on the degree of employee control over their time during the wait. It is crucial for employers in Travis County, Texas, to familiarize themselves with the Travis Texas Compensate Work Chart to accurately determine which hours are compensated and calculate proper wages and overtime pay for their employees. Adhering to these guidelines ensures compliance with state regulations and helps maintain a fair working environment for all employees.

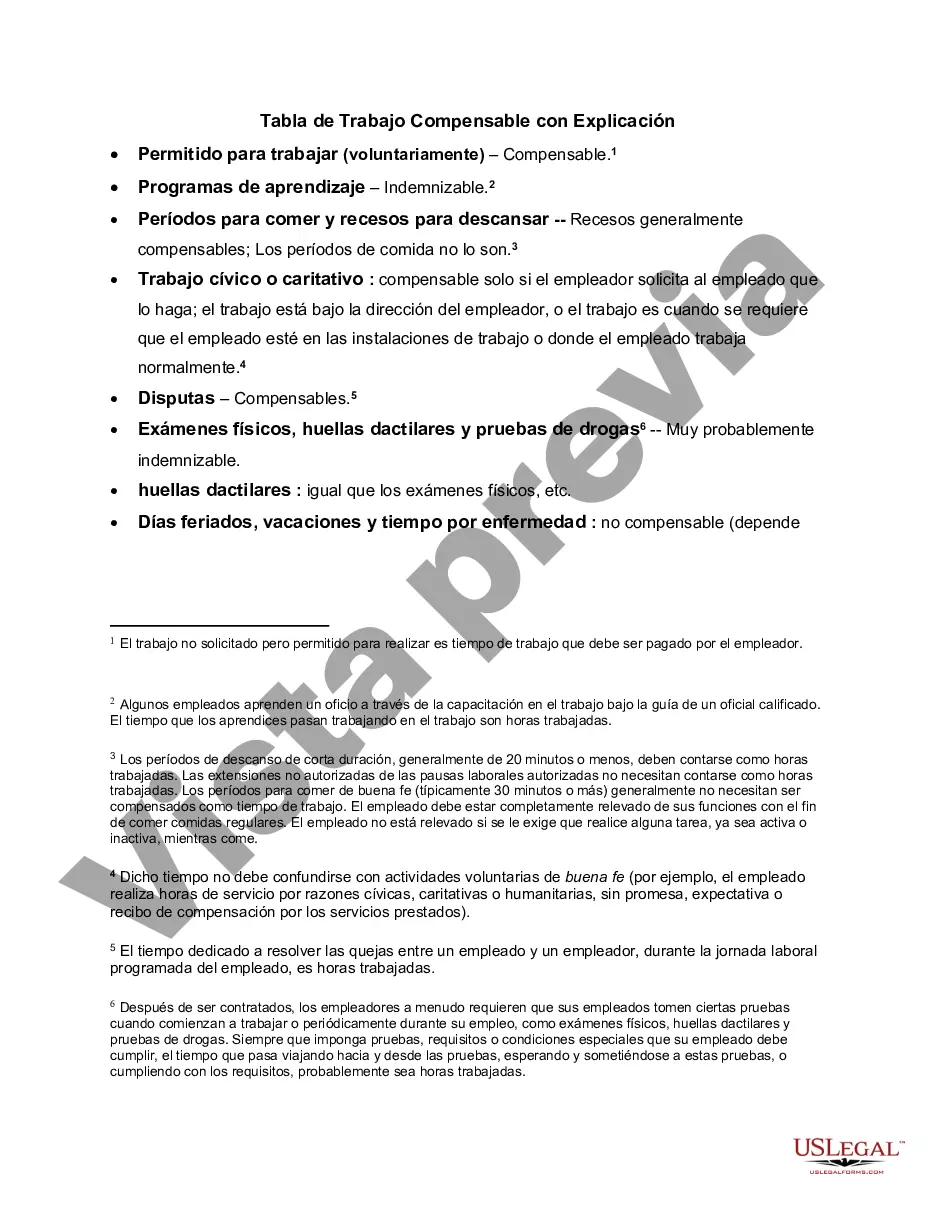

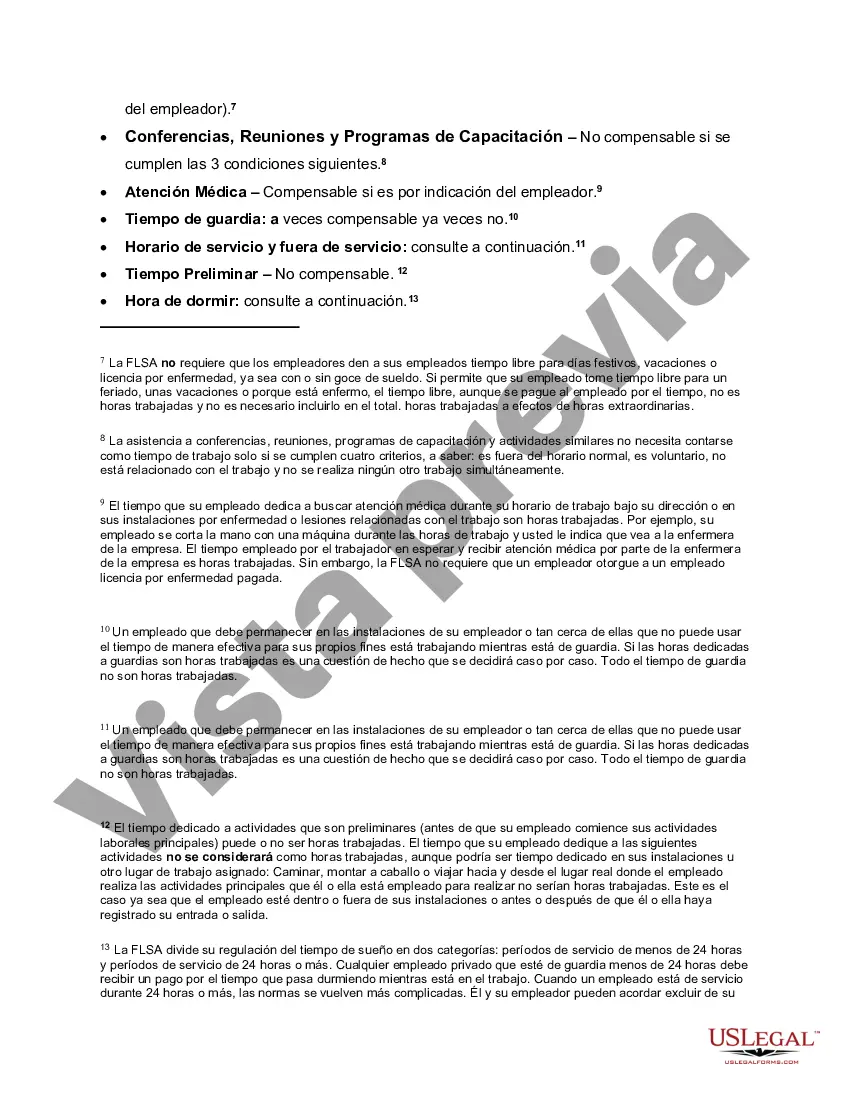

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tabla De Compensación Al Trabajador - Compensable Work Chart with Explanation

Description

How to fill out Travis Texas Tabla De Trabajo Compensable Con Explicación?

Preparing documents for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate Travis Compensable Work Chart with Explanation without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Travis Compensable Work Chart with Explanation by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Travis Compensable Work Chart with Explanation:

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!