Los Angeles, California is a bustling city located in Southern California. It is known for its diverse culture, beautiful beaches, and vibrant entertainment industry. For individuals residing in Los Angeles, having appropriate health and disability insurance coverage is vital. This checklist aims to guide individuals in the city through the process of selecting the right insurance plans for their specific needs. 1. Research: Start by conducting thorough research on various health and disability insurance providers in Los Angeles. Look for reputable companies that offer comprehensive coverage and have a strong presence in the city. 2. Coverage Options: Understand the different types of health and disability insurance available in Los Angeles. Common options include individual health insurance, group insurance, Medicare, Medicaid, and disability insurance. 3. Individual Health Insurance: This type of insurance is designed for individuals and families who are not covered by an employer's insurance plan. It provides coverage for doctor visits, hospital stays, prescription medications, and preventive care. 4. Group Insurance: Many employers in Los Angeles offer group health insurance to their employees. This type of insurance provides coverage for a group of people, usually at lower premium rates compared to individual plans. 5. Medicare: Medicare is a federal health insurance program primarily for individuals aged 65 and older. It includes various parts, such as Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage plans), and Part D (prescription drug coverage). 6. Medicaid: Medicaid is a state and federal program that provides health insurance to low-income individuals and families. Eligibility criteria vary, so it is essential to check if you qualify for Medicaid in Los Angeles. 7. Disability Insurance: Disability insurance protects individuals financially in case they become disabled and are unable to work. It covers a portion of their income and offers financial stability during challenging times. 8. Provider Network: When selecting an insurance plan, consider the provider network offered by the insurance company. Ensure that the doctors, hospitals, and specialists you prefer are in-network, as this will help reduce out-of-pocket expenses. 9. Coverage Limits and Benefits: Carefully review the coverage limits, benefits, and exclusions of each insurance plan. Pay close attention to factors such as deductibles, co-pays, coverage for pre-existing conditions, and prescription drug coverage. 10. Affordability: Assess your budget and determine how much you can afford to spend on health and disability insurance premiums. Consider factors like plan costs, deductibles, and out-of-pocket expenses to find a balance between coverage and affordability. 11. Additional Services: Some insurance plans offer additional services such as telehealth, wellness programs, and mental health coverage. Evaluate these additional services to assess if they align with your healthcare needs. 12. Customer Reviews: Before finalizing an insurance plan, read customer reviews and ratings for the insurance company. This can give you insights into their customer service, claims process, and overall satisfaction levels. Remember that each person's insurance needs are unique, so it is crucial to consider your specific circumstances when choosing health and disability insurance in Los Angeles, California. Take your time, compare different options, and consult with insurance professionals if needed to make an informed decision.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Lista de Verificación - Seguro de Salud y Discapacidad - Checklist - Health and Disability Insurance

Description

How to fill out Los Angeles California Lista De Verificación - Seguro De Salud Y Discapacidad?

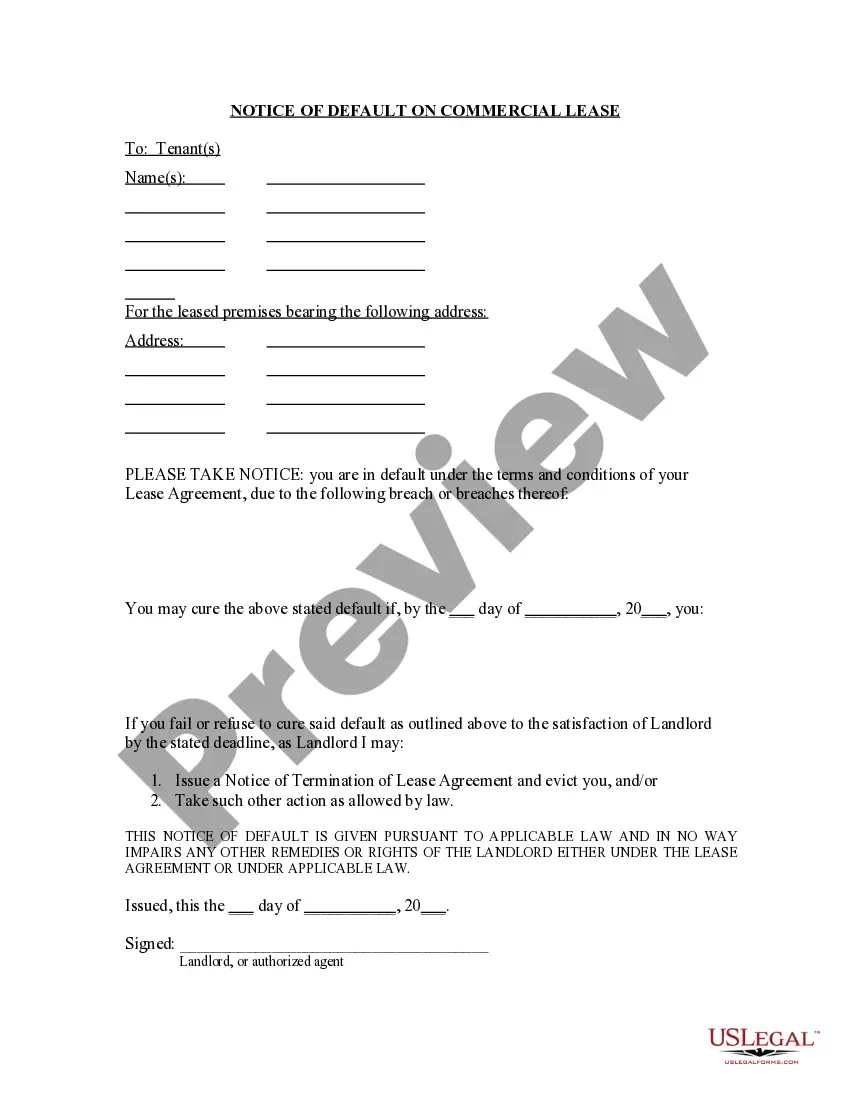

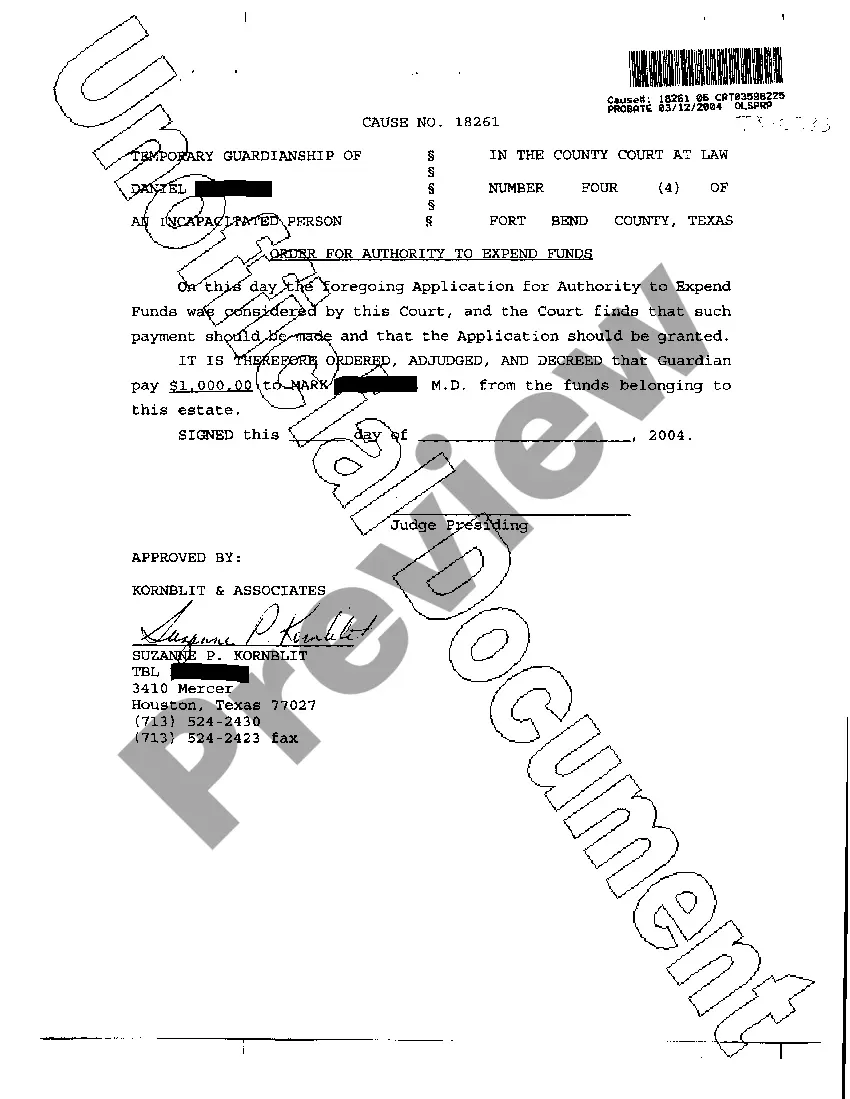

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Los Angeles Checklist - Health and Disability Insurance, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any tasks related to document execution straightforward.

Here's how to purchase and download Los Angeles Checklist - Health and Disability Insurance.

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the related document templates or start the search over to find the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and purchase Los Angeles Checklist - Health and Disability Insurance.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Los Angeles Checklist - Health and Disability Insurance, log in to your account, and download it. Of course, our website can’t replace a lawyer completely. If you have to cope with an exceptionally complicated situation, we recommend getting an attorney to review your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork with ease!