Salt Lake City, Utah is a vibrant and growing city located in the western United States. It is known for its stunning mountain views, outdoor recreational activities, and thriving business scene. When it comes to health and disability insurance, residents of Salt Lake City have several options to consider. Here is a detailed description of Salt Lake Utah Checklist for Health and Disability Insurance: 1. Health Insurance: Health insurance is crucial to ensure that individuals and families have access to quality healthcare services. In Salt Lake City, there are various types of health insurance plans available, including individual and family plans, employer-sponsored plans, Medicare, and Medicaid. These plans typically provide coverage for doctor visits, hospital stays, prescription medications, preventive care, and more. 2. Disability Insurance: Disability insurance safeguards individuals' income in the event of an illness or injury that prevents them from working. Salt Lake City offers disability insurance plans that provide financial protection and peace of mind. There are two main types of disability insurance: — Short-term disability insurance: This type of insurance covers a portion of your income for a relatively short duration, typically up to six months. It provides temporary financial support during recovery from an illness, injury, or childbirth. — Long-term disability insurance: Long-term disability insurance offers coverage for an extended period, sometimes until retirement age if needed. It provides a percentage of your income if you become disabled and cannot work for an extended period. These plans are particularly important for self-employed individuals or those with physically demanding jobs. 3. Supplemental Insurance: In addition to health and disability insurance, Salt Lake City residents may also consider supplemental insurance plans. These plans cover expenses that traditional insurance may not fully address, such as deductibles, co-payments, and out-of-pocket costs. Supplemental insurance can help bridge the financial gap and lessen the burden of medical expenses. 4. Employer-sponsored Insurance: Many employers in Salt Lake City offer group health and disability insurance plans as part of their employee benefits package. These plans provide coverage to employees and their immediate family members, often at a reduced cost compared to individual plans. It is essential for residents to review their employer's insurance options and understand the coverage provided. 5. Utah Health Insurance Marketplace: Salt Lake City residents who do not have employer-sponsored insurance can explore the Utah Health Insurance Marketplace. This marketplace offers a range of health insurance options, including plans that qualify for subsidies based on income and family size. It is important to research and compare different plans to find the one that best fits individual needs. In conclusion, Salt Lake City, Utah offers a diverse range of health and disability insurance options. It is crucial for residents to consider their specific needs, compare available plans, and select the coverage that provides the best protection for their health and financial wellbeing. Whether through individual plans, employer-sponsored insurance, or the Utah Health Insurance Marketplace, individuals in Salt Lake City can find the right insurance solutions to meet their requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Lista de Verificación - Seguro de Salud y Discapacidad - Checklist - Health and Disability Insurance

Description

How to fill out Salt Lake Utah Lista De Verificación - Seguro De Salud Y Discapacidad?

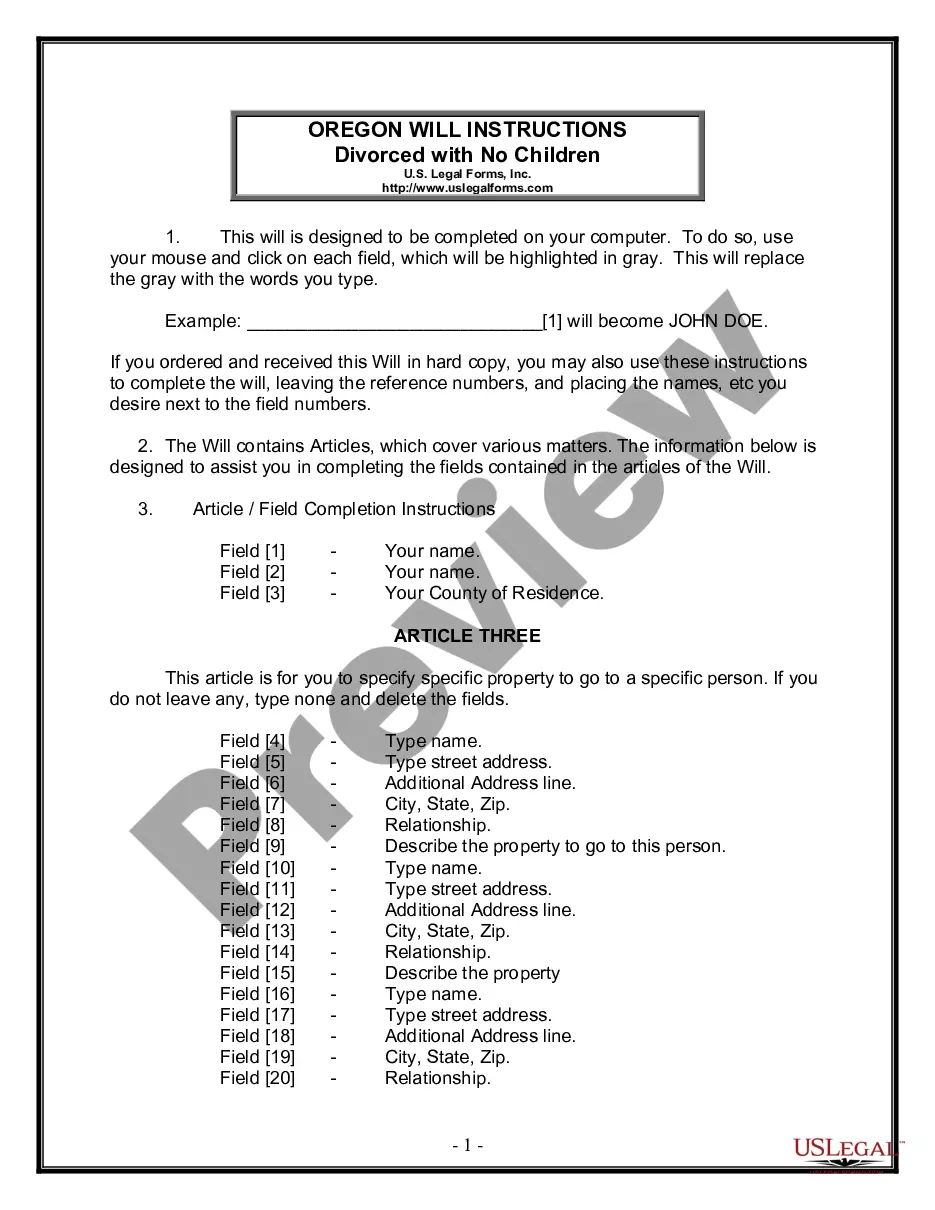

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life scenario, finding a Salt Lake Checklist - Health and Disability Insurance meeting all local requirements can be exhausting, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Apart from the Salt Lake Checklist - Health and Disability Insurance, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Salt Lake Checklist - Health and Disability Insurance:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Salt Lake Checklist - Health and Disability Insurance.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!